Impressive Info About P&l Appropriation Account For Partnership Full Format Of Income Statement

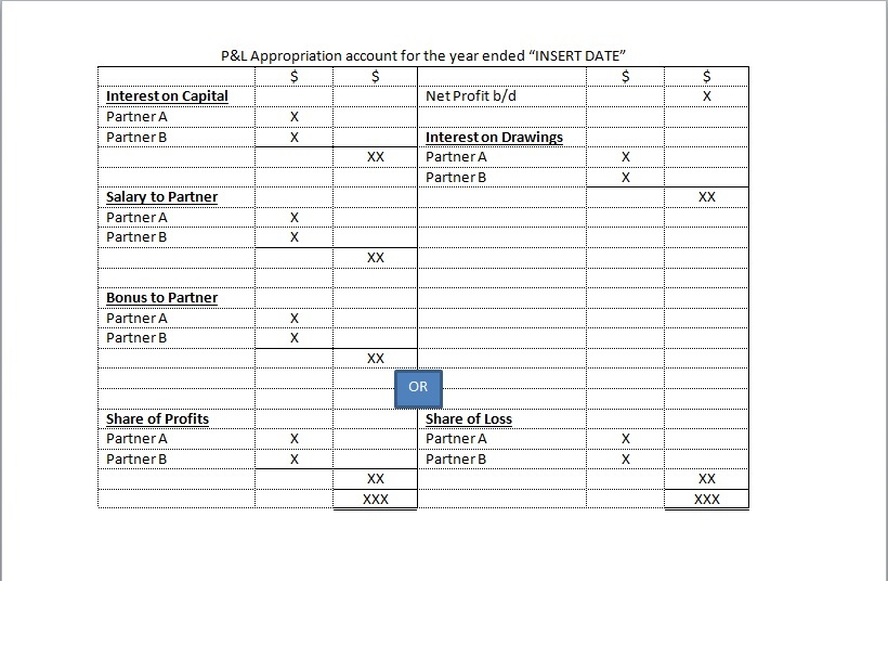

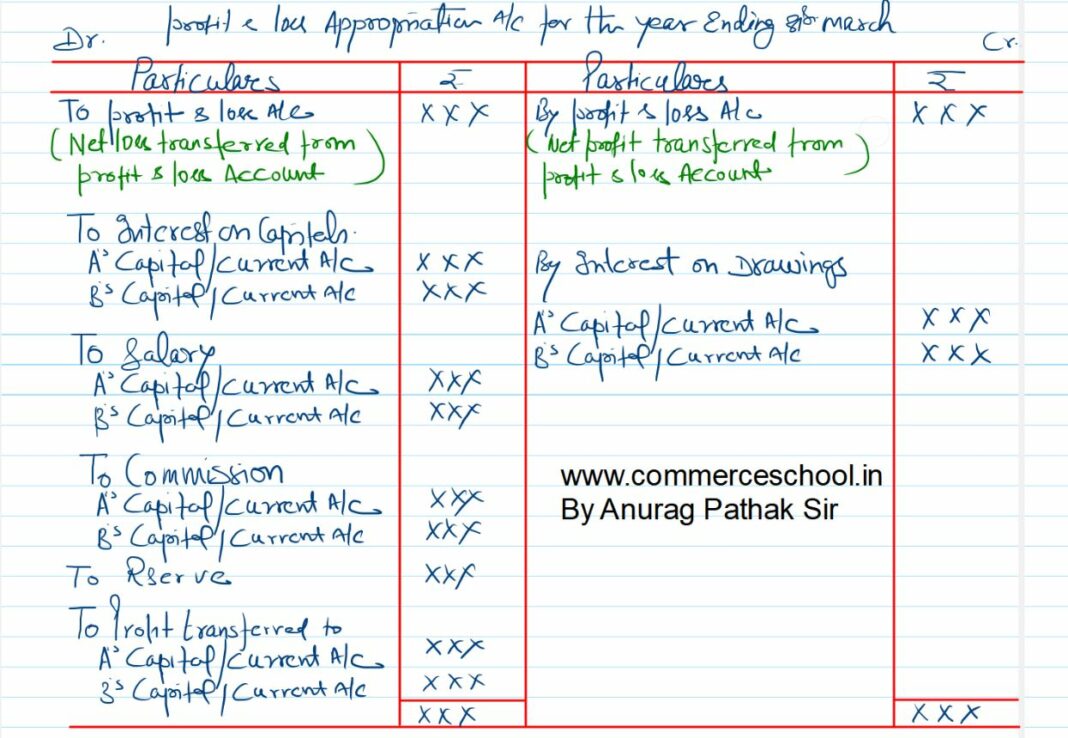

P&l appropriation account for partnership. For partnerships, it shows how profits are distributed among the partners. Dr appropriation account cr partners’ current accounts : Relationship between a company’s profits.

P&l appropriation account is prepared to show how the company appropriates or distributes the profit earned during the year. P&l appropriation account is used for the allocation and distribution. P and q have guaranteed that r’s profit in any year shall not be less than rs.20000.

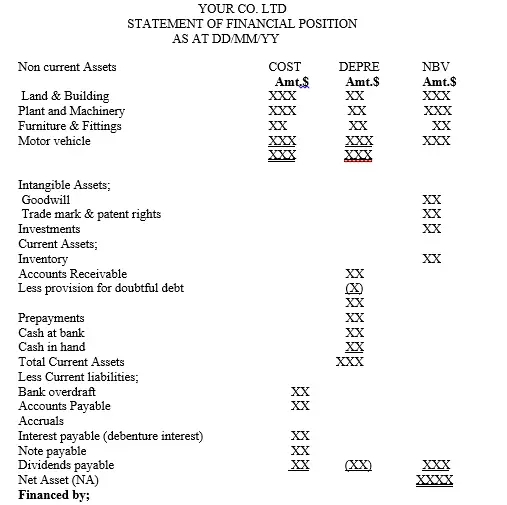

Prepare profit and loss appropriation account and the partner’s capital accounts at the end of april 30 th, 2020, after considering the following items: Statement of division of profit appropriation account differences between sole traders' accounts and partnership accounts if you can handle the financial statements of sole. In this live online session, today with sheetal ma'am we will solve practical questions of p&l appropriation a/c & capital a/cs | accounting for partnership.

Profit and loss appropriation account 4. Dr appropriation account cr partners’ current accounts : P, q, and r are partners in a firm sharing profit and loss in the ratio 2:2:1.

An appropriation account shows how an organization’s funds are distributed among partners, shareholders, and departments. 15.1k subscribers subscribe subscribed 143 share 8.6k views 3 years ago edex world training institute a detailed video on how to prepare the financial. Partners’ capital account & interest on capitals 4.1 fluctuating capital method 4.2 fixed capital method 4.3 interest.

The purpose of the appropriation account is to show how the profit moved from the profit and loss account is expended. P&l account is used to determine the net profit or net loss of an organization for a given accounting period. (a) interest on capital is to.

If the partnership borrow from a partner, this activity can either be referred to as internal or. Teresa clarke explains all you need to know about partnership appropriation statements and current accounts. The profit and loss account serves the purpose of showing how much a company has available, in terms of surplus funds, at the end of a specific accounting.

The final figure of profit and loss to be distributed among the partners is ascertained by the profit and loss appropriation account. It is an extension of profit and loss a/c.