Fun Tips About Relationship Of Income Statement And Balance Sheet Net Profit Is Calculated In Which Account

However, it is important to note that the two are distinctly different.

Relationship of income statement and balance sheet. In this section, we will discuss five financial ratios which use an amount from the balance sheet and an amount from the income statement. Its main aim is to calculate how much cash flow your business generated or losses within a given period. View gryphon digital mining's (nasdaq:gryp) latest financials, balance sheet, income statement, cash flow statement, and 10k report at marketbeat.

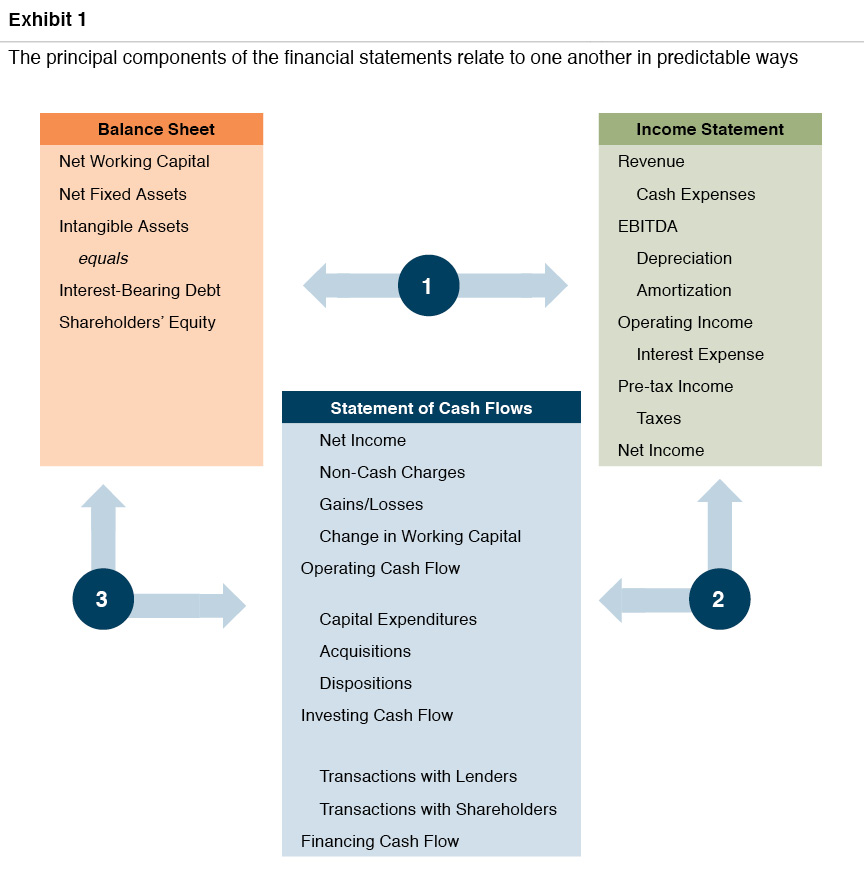

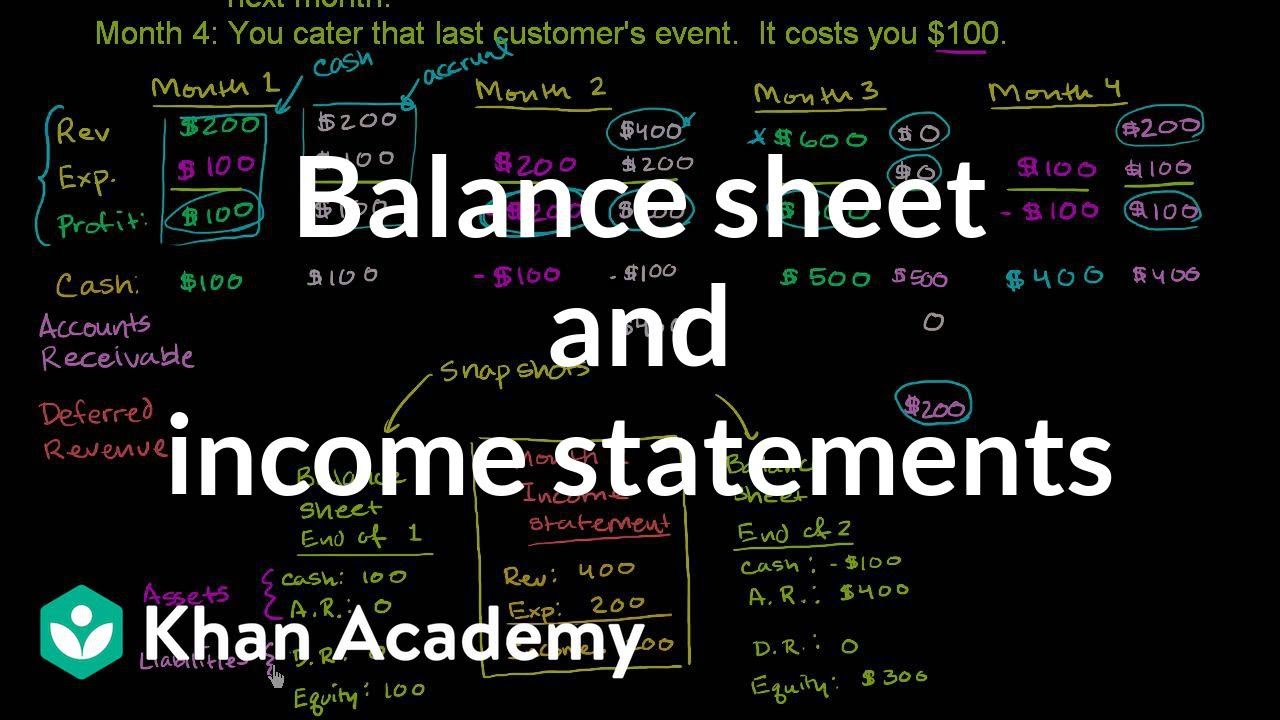

The cash flow statement shows you how to tie the changes in balance sheet together to the income statement for a particular period. At a high level, a balance sheet gives you a snapshot of your business’s financial position, including its value. Balance sheet vs.

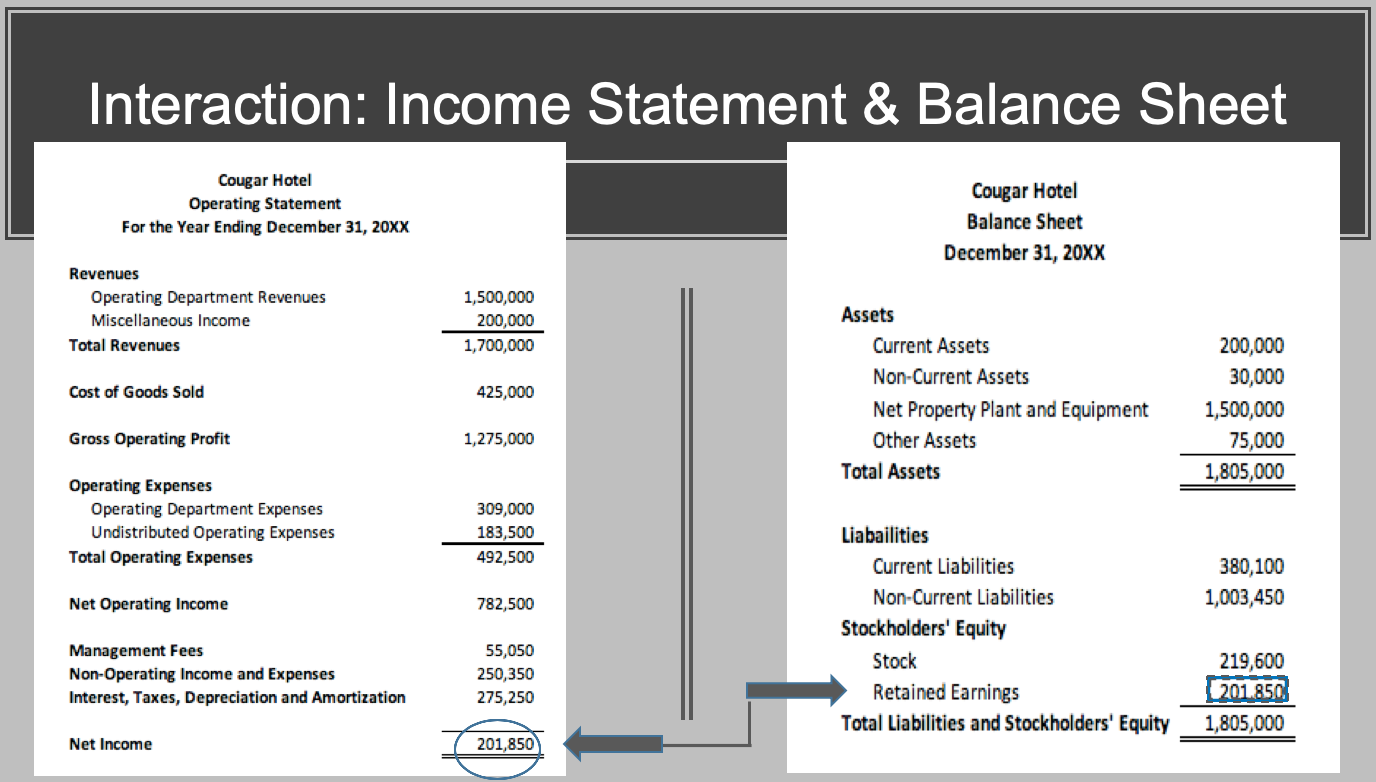

View chromocell therapeutics' (nyse:chro) latest financials, balance sheet, income statement, cash flow statement, and 10k report at marketbeat. Financial ratios using amounts from the balance sheet and income statement. Net income from the bottom of the income statement links to the balance sheet and cash flow statement.

Export data to excel for your own analysis. An expense versus a payable. The two are often assumed to be the same thing.

By understanding the relationship between the two. During the period close process, all temporary accounts are closed to the income summary account, which is then closed to. Net income & retained earnings.

Let’s look at an example to outline the key differences. What is the relationship between financial statements? The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement.

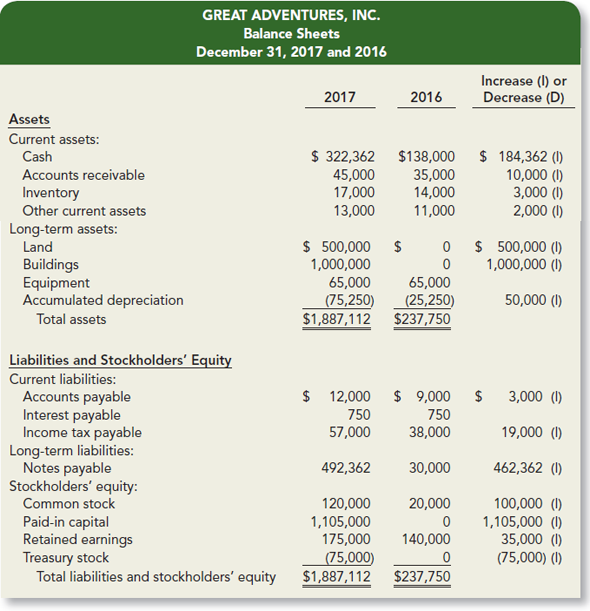

Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for. A balance sheet lists assets and liabilities of the organization as of a specific moment in time, i.e. Purpose balance sheets are used to analyze the current financial position of a business.

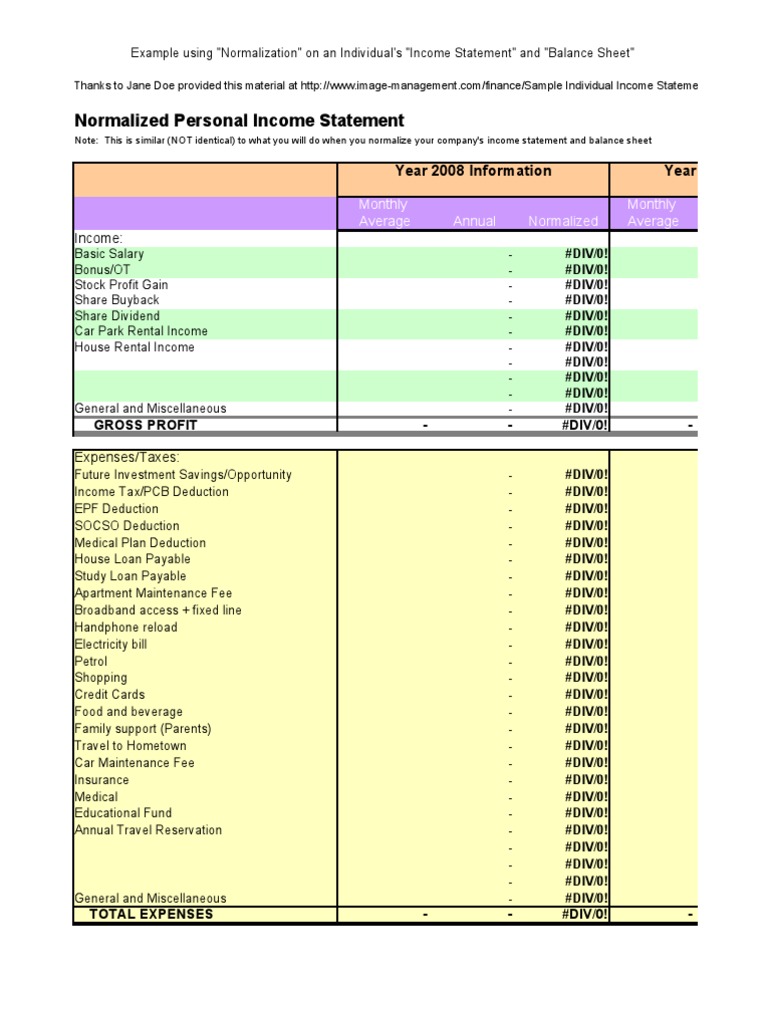

A comparative balance sheet and income statement is shown for cruz, incorporated. The balance sheet provides information on a company’s assets and liabilities, while the income statement provides information on a company’s income and expenses. In financial accounting, the balance sheet and income statement are the two most important types of financial statements (others being cash flow statement, and the statement of retained earnings).

Whatever the business earns during an accounting period is accumulated as retained earnings in the balance sheet’s equity section. These three financial statements are intricately linked to one another. By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports.

Connection between balance sheet and income statement. The income statement shows all your business’s expenses and incomes over a period of time. 3.1 describe principles, assumptions, and concepts of accounting and their relationship to financial statements;