One Of The Best Tips About Bonds Payable Financing Activity Vertical Analysis In Financial Statement

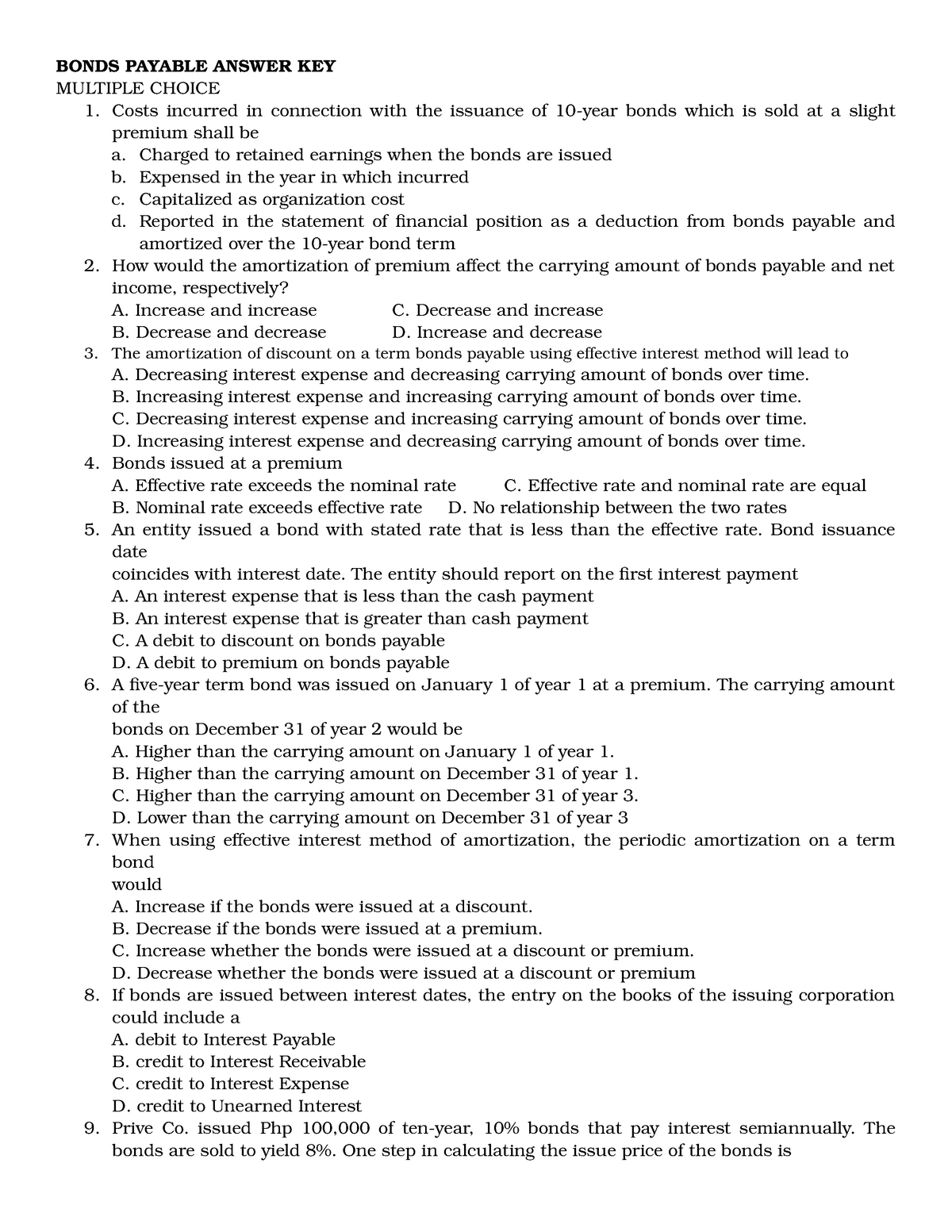

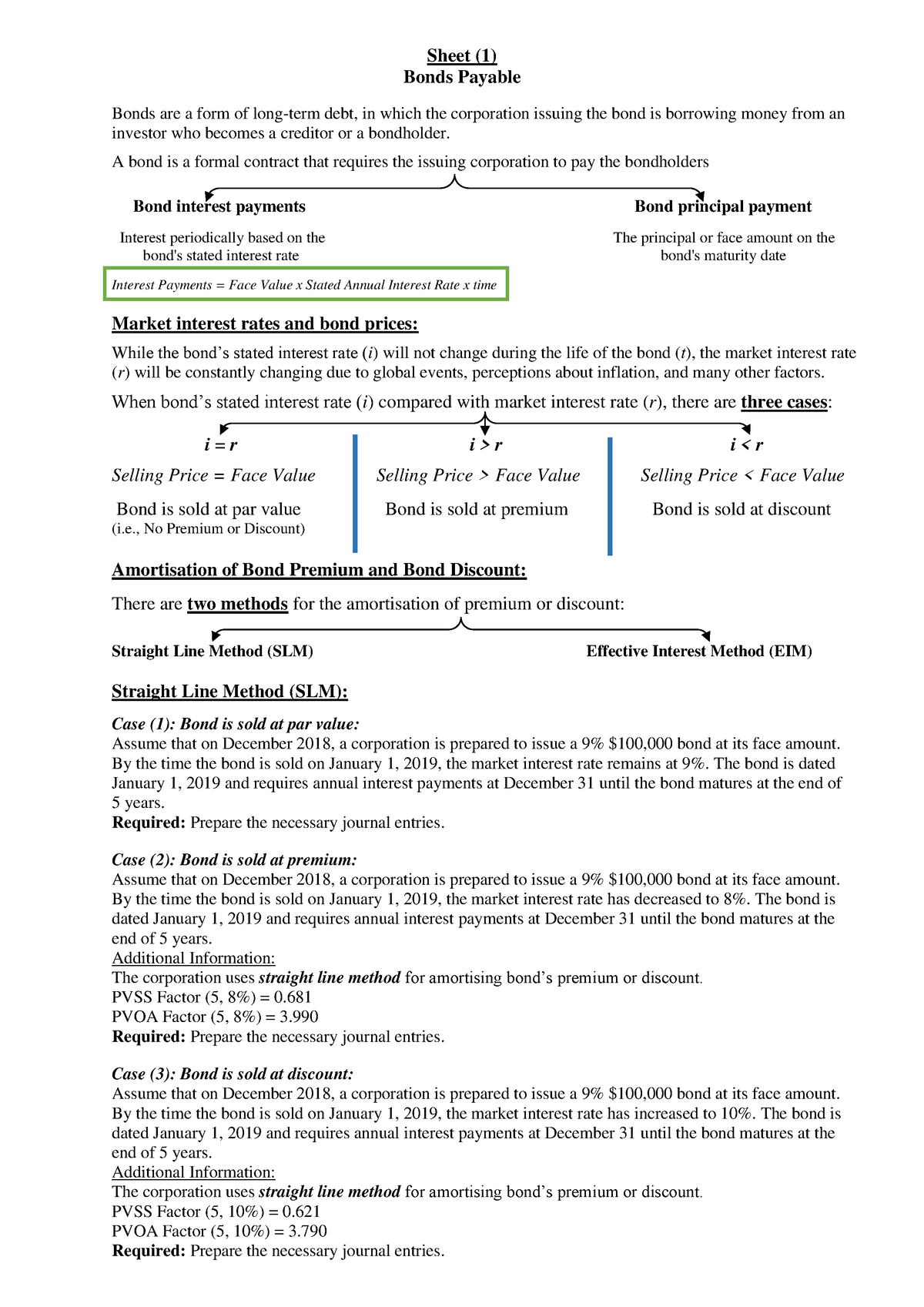

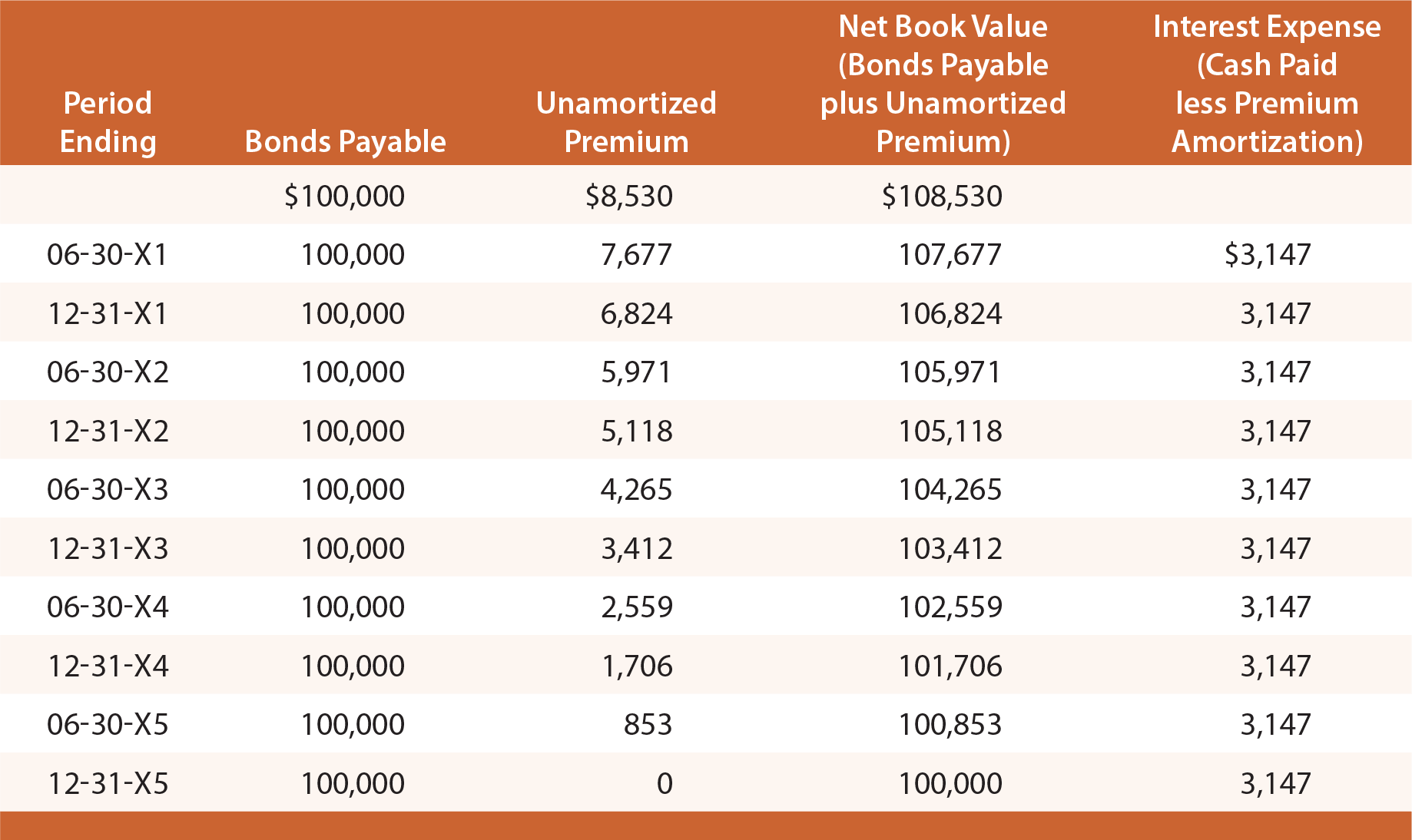

Bonds represent an obligation to repay a principal amount at a future date and pay interest, usually on a semi‐annual basis.

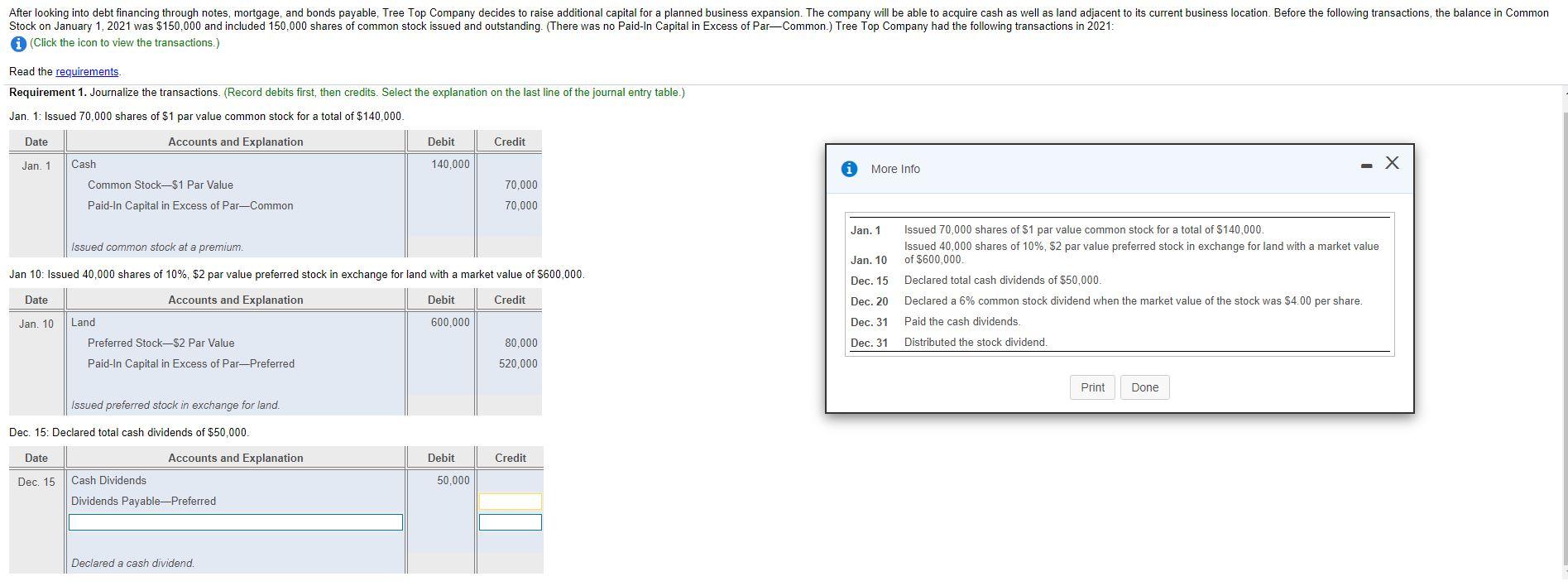

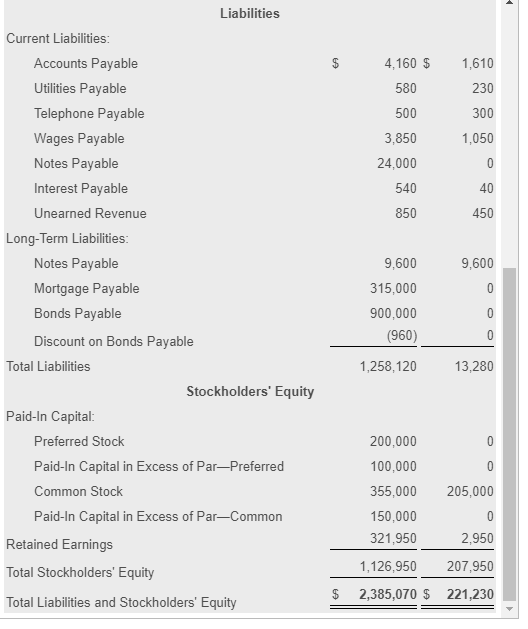

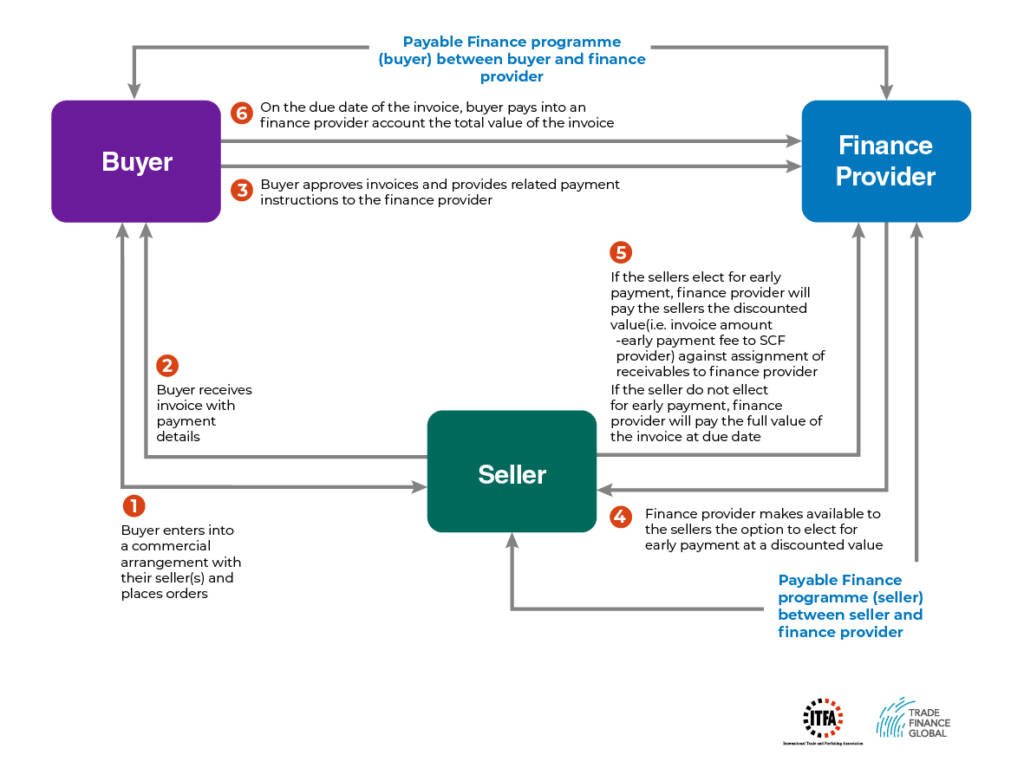

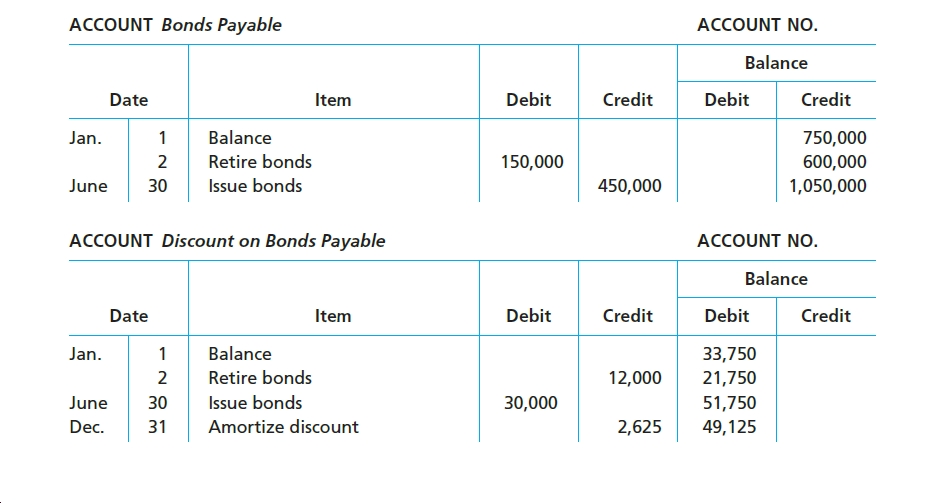

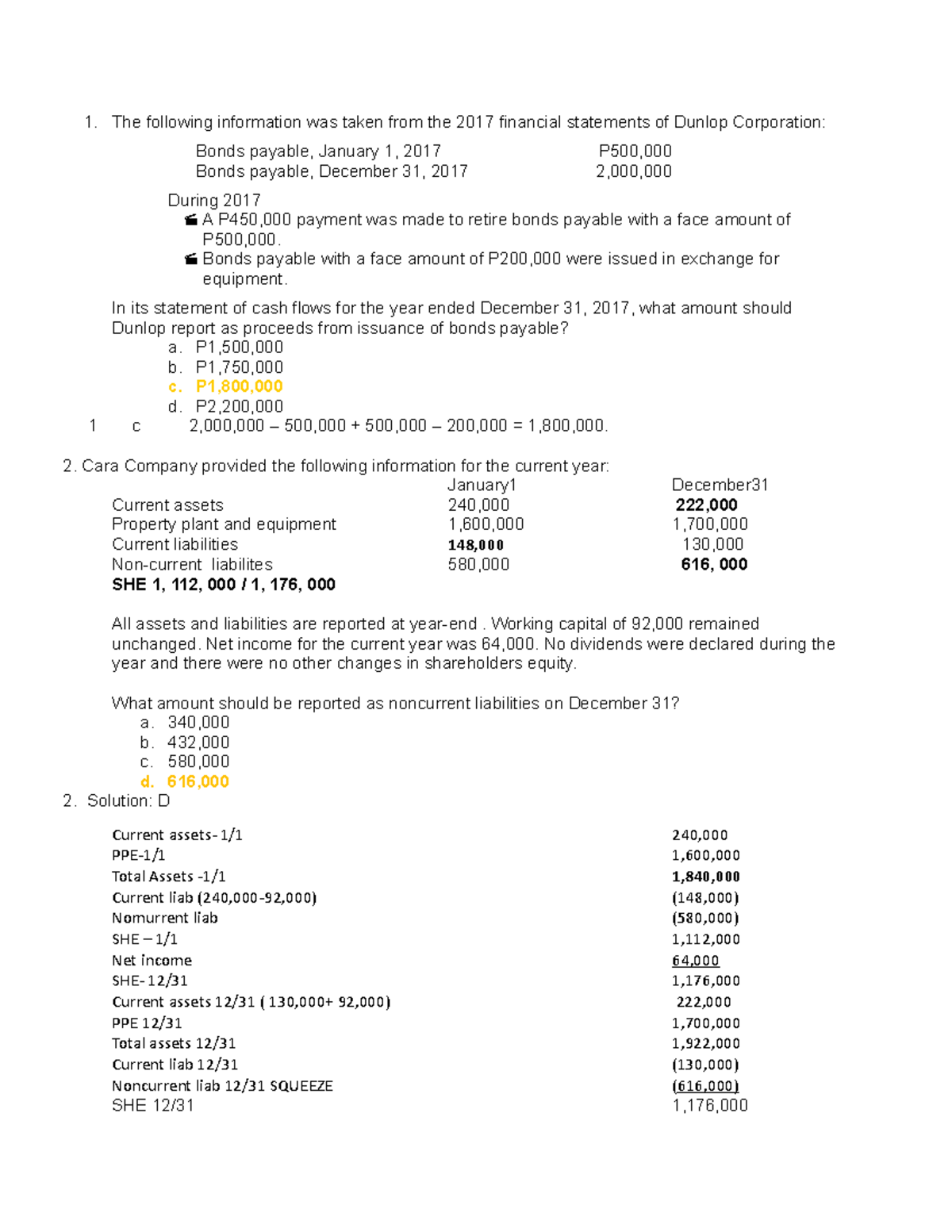

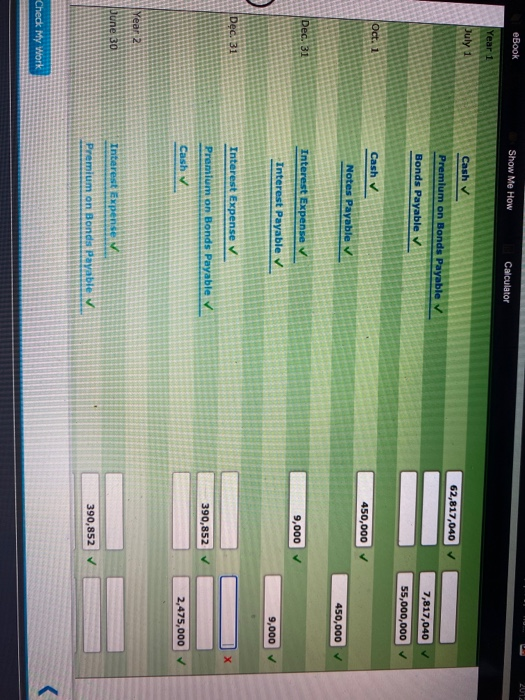

Bonds payable financing activity. Cash flow from financing activities. Bonds payable represent a contractual obligation between a bond issuer and a bond purchaser. Financing activities include all the cash paid and generate from the funding of the company.

The company can raise money by issuing bonds, share capital, and loans. Bond issuers will report the related activity in the financing section of the cash flow statement. Bondholders will report all related cash transactions in the investment section.

Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable, cash proceeds from issuance of capital stock, cash. Bonds payable are recorded when a company issues bonds to generate cash. It is not a part of financing activities.

The cash flow from financing activities is the net amount. Financing activities leading to a decrease in cash. Cash flow from financing activities is the net amount of funding a company generates in a given time period.

Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable, cash proceeds from issuance of capital stock, cash. Cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, reconciling the increase in cash from the scf with the. As retained earnings are linked to the net income from the income statement.

Bonds are an agreement in which the issuer obtains financing. As a bond issuer, the company is a borrower. Unlike notes payable, which normally represent an.