Fun Tips About Accounting For Advertising Expenses Drawings Debit Or Credit In Trial Balance

Advertising is any communications with a target audience that is designed to persuade that audience to take some type of.

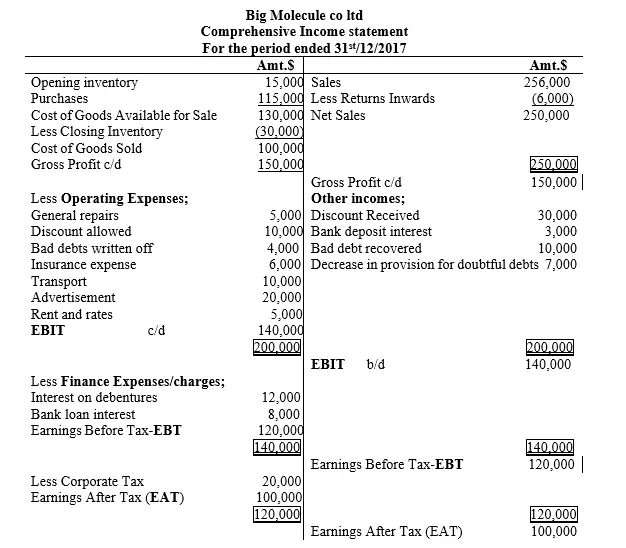

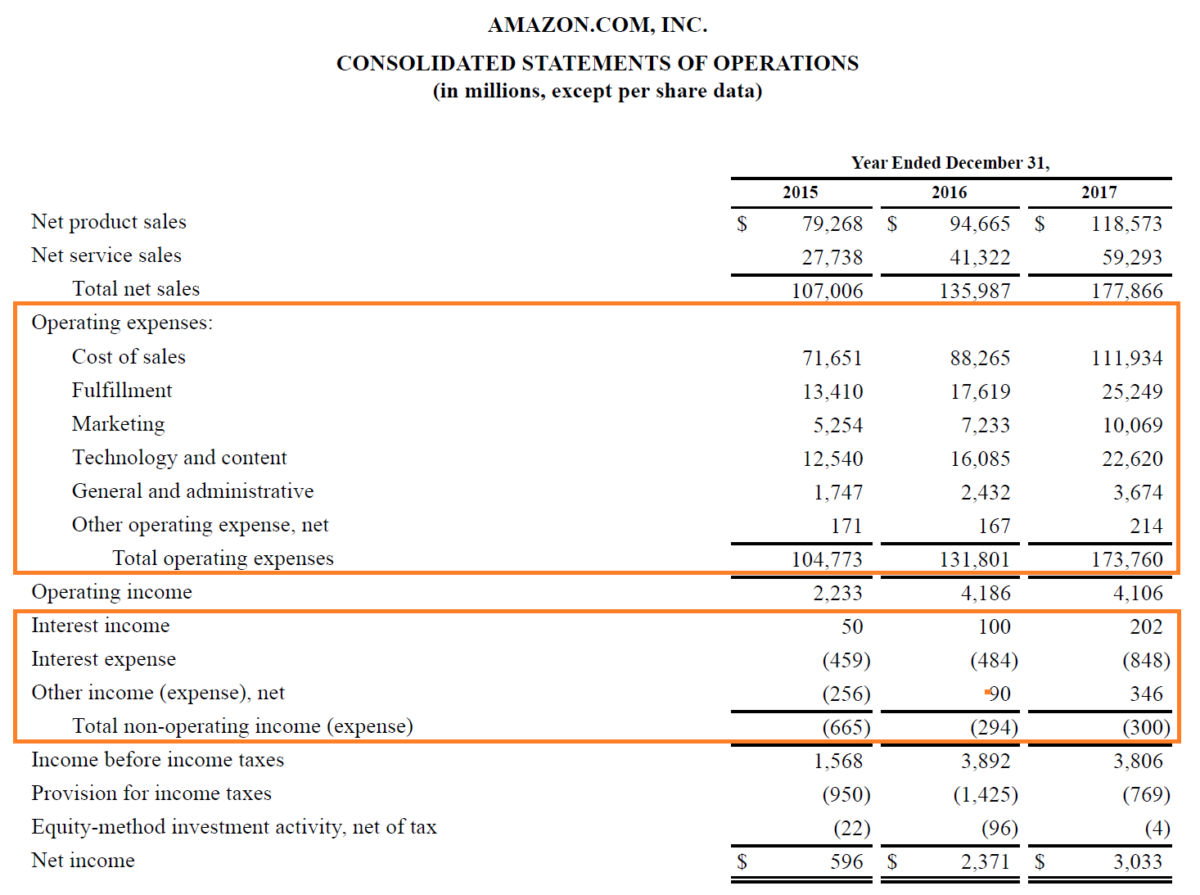

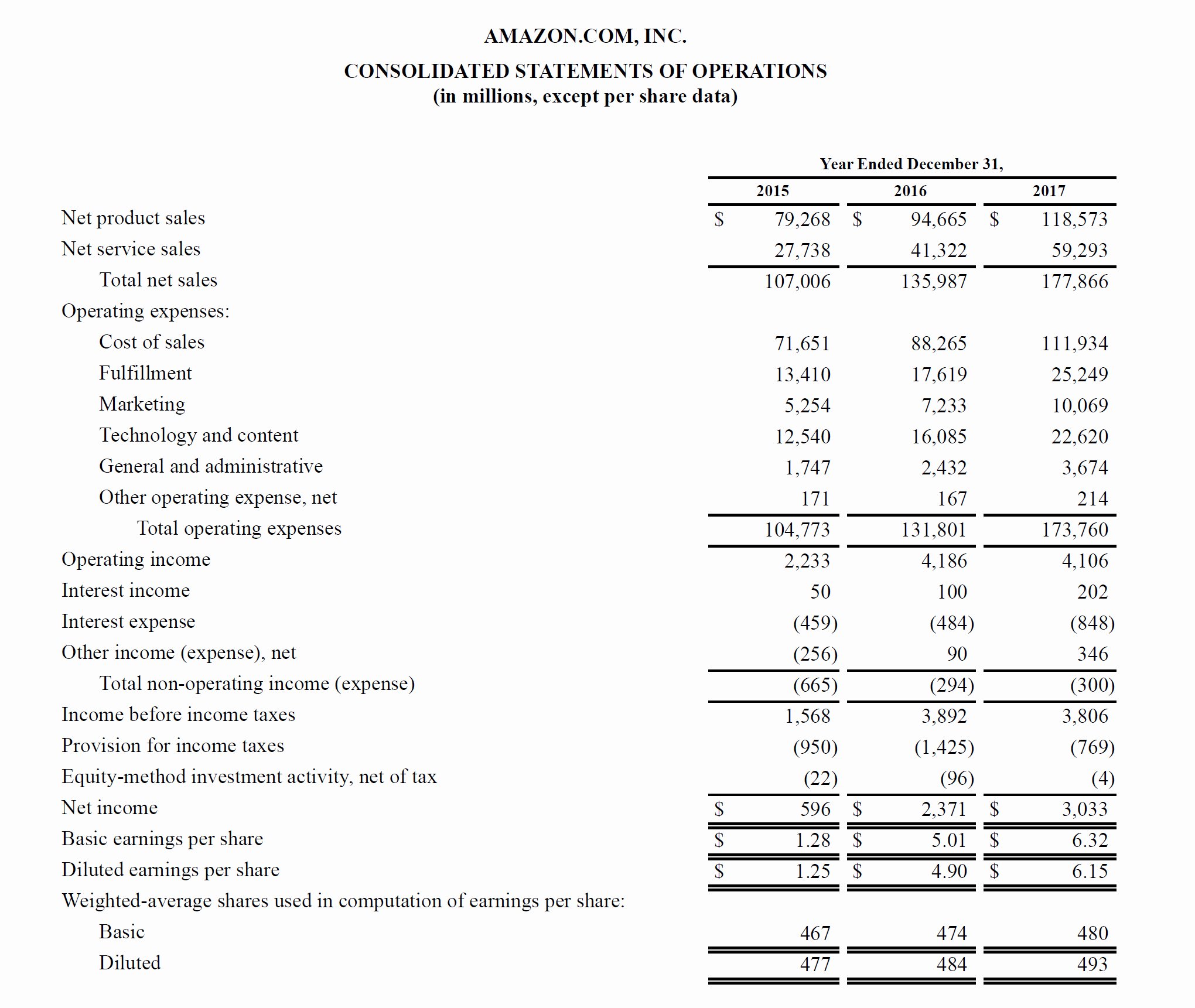

Accounting for advertising expenses. Mar 10, 2023 | thomson reuters. Advertising expense is the income statement account which reports the dollar amount of ads run during the period shown in the income statement. Accounting for advertising expenses.

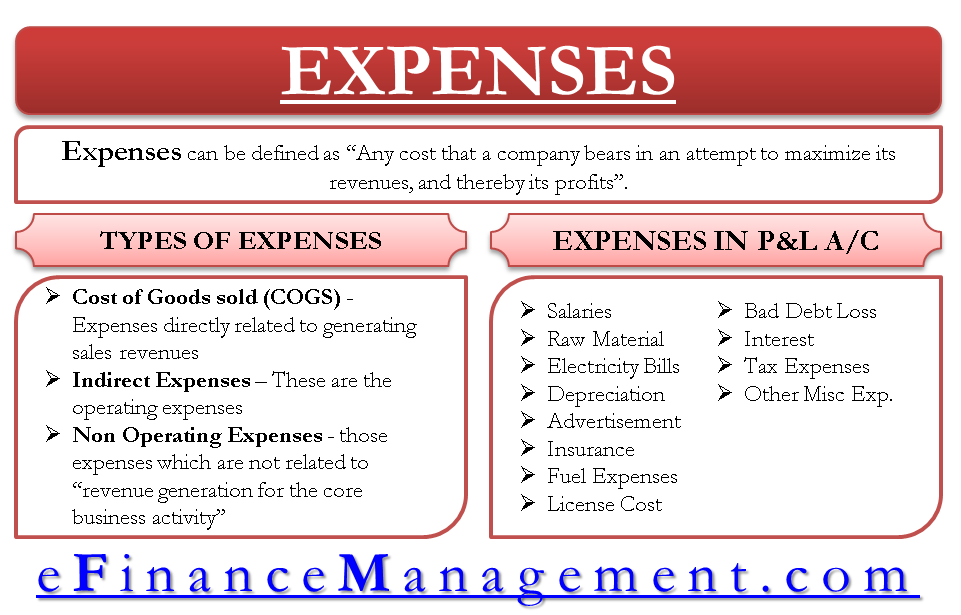

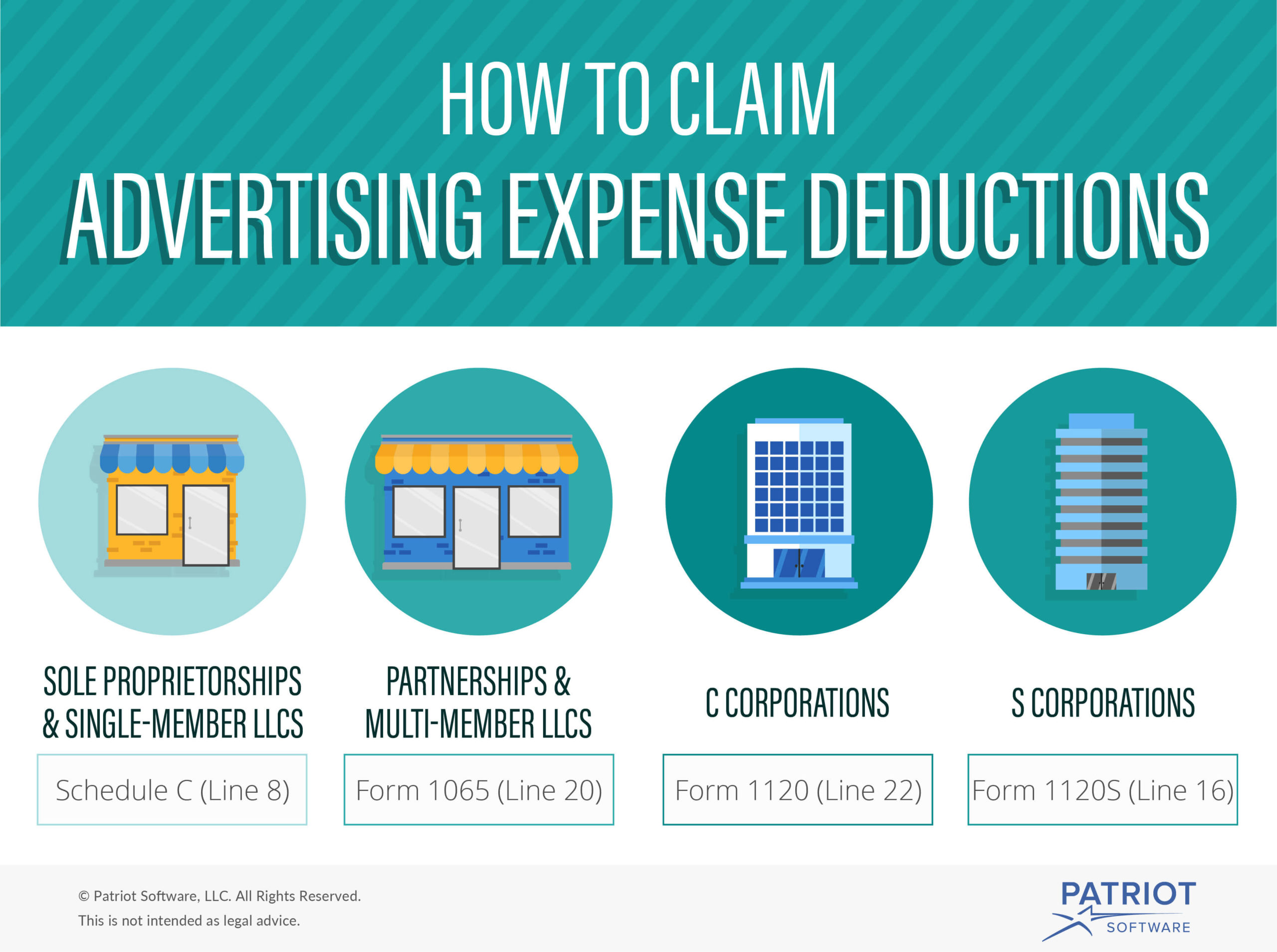

The best answer to this is under generally accepted accounting principles, in an area called other expenses in the. What are expenses in accounting? To record this claim, the marketing agency debits the.

December 02, 2023 what is advertising expense? The balance in this account is reset to zero at. Let ramp automate your expense categorizations.

Us gaap the costs of other than direct response advertising should. Under ifrs, advertising costs may need to be expensed sooner. When it comes to accounting for advertising expenses, there are a few different methods that businesses can use.

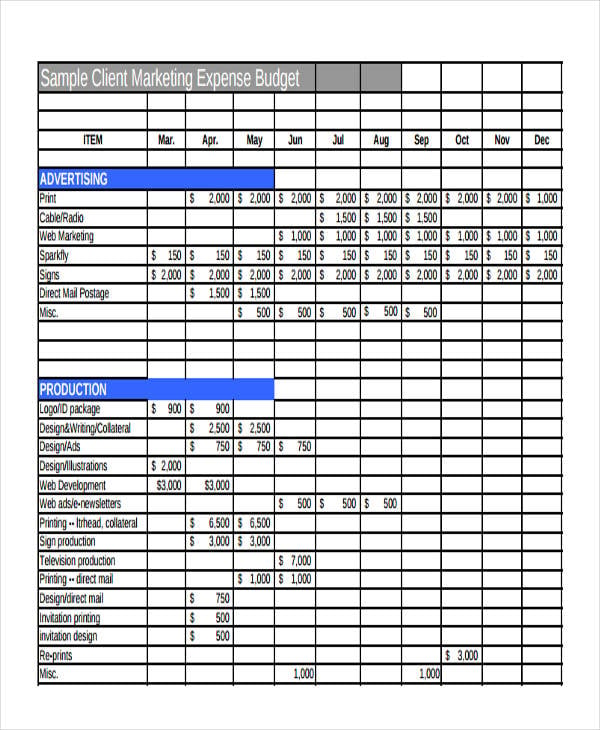

Advertising expense is a general ledger account in which is stored the consumed amount of advertising costs. For example, your company has agreed to buy monthly advertising in a magazine for six months at a total cost of. When the supplier completes the advertising service and issues an invoice to us, we need to record the advertising expense and the.

Since the accountants cannot measure the future benefit of the advertising, the advertising costs must be reported as advertising expense at the time the ads are. Accounting for marketing expenditures. What account is advertising expense?

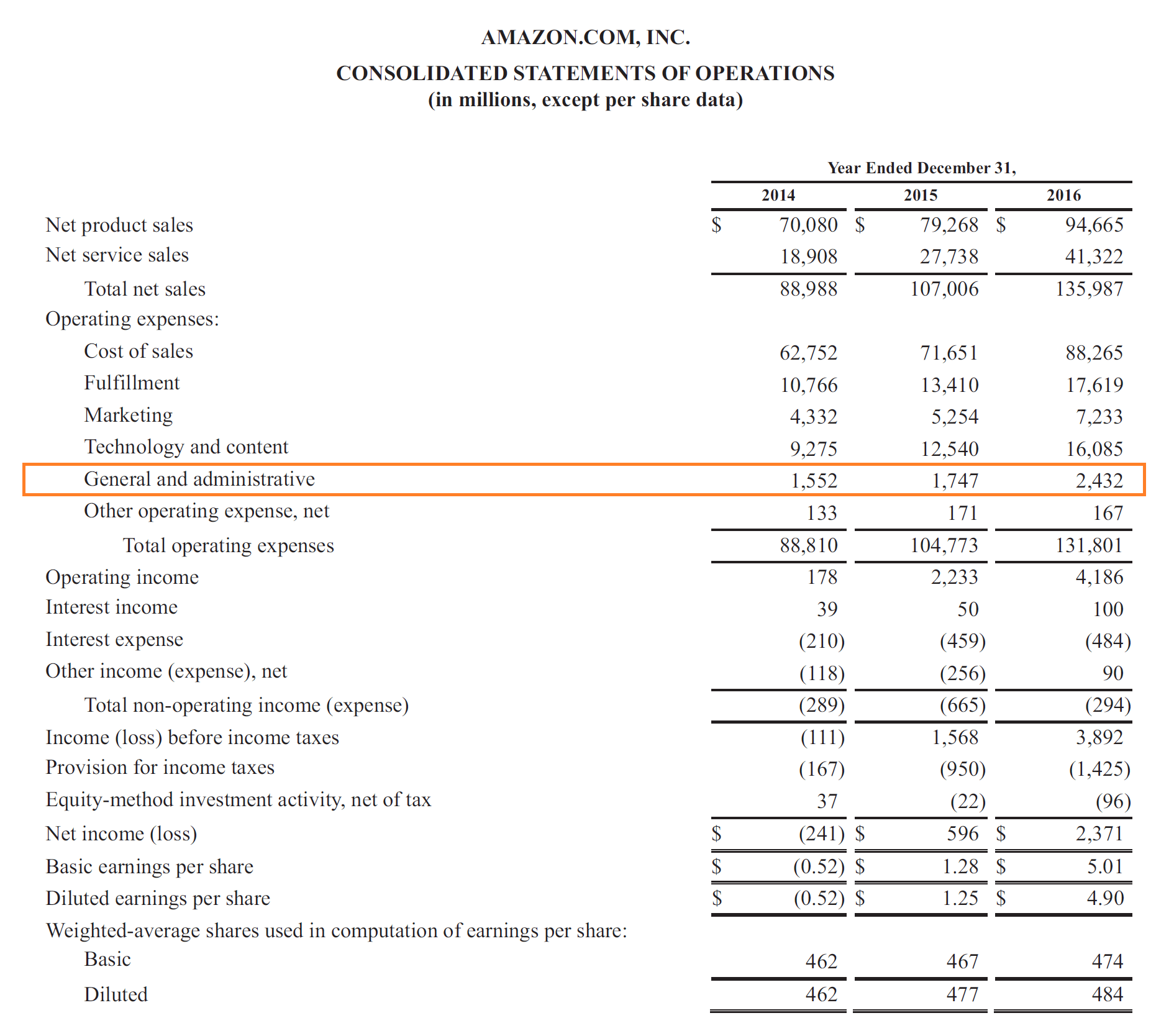

Is advertising a liability or equity? Advertising costs of the marketing agency flow into the income statement as operating costs. There is no definitive answer to this question, as the expense category for advertising can vary.

Traditionally, this meant printing and production of physical. Expenses in accounting are the money spent or costs incurred by a business in an effort to generate revenue. For any given expenditure on advertising, a company should aim to maximize the npv of advertising expenditure.

30 nov 2020 us ifrs & us gaap guide under ifrs, advertising costs may need to be expensed sooner. Post the invoice for the full amount as a prepaid expense. Advertising costs are typically categorized as sg&a expenses on the income statement and may also be recorded as prepaid expenses on the balance sheet.

May 18, 2022 blogger, business accounting, business taxes, creative, photographer you’re probably spending a fair amount of money on advertising your small business to. Present tax laws that allow expenditure of advertising costs result in substantial tax subsidies. Most marketing expenses are charged to expense in the period incurred, though some printed materials and.