First Class Tips About Pre Acquisition Retained Earnings Audit Result Report

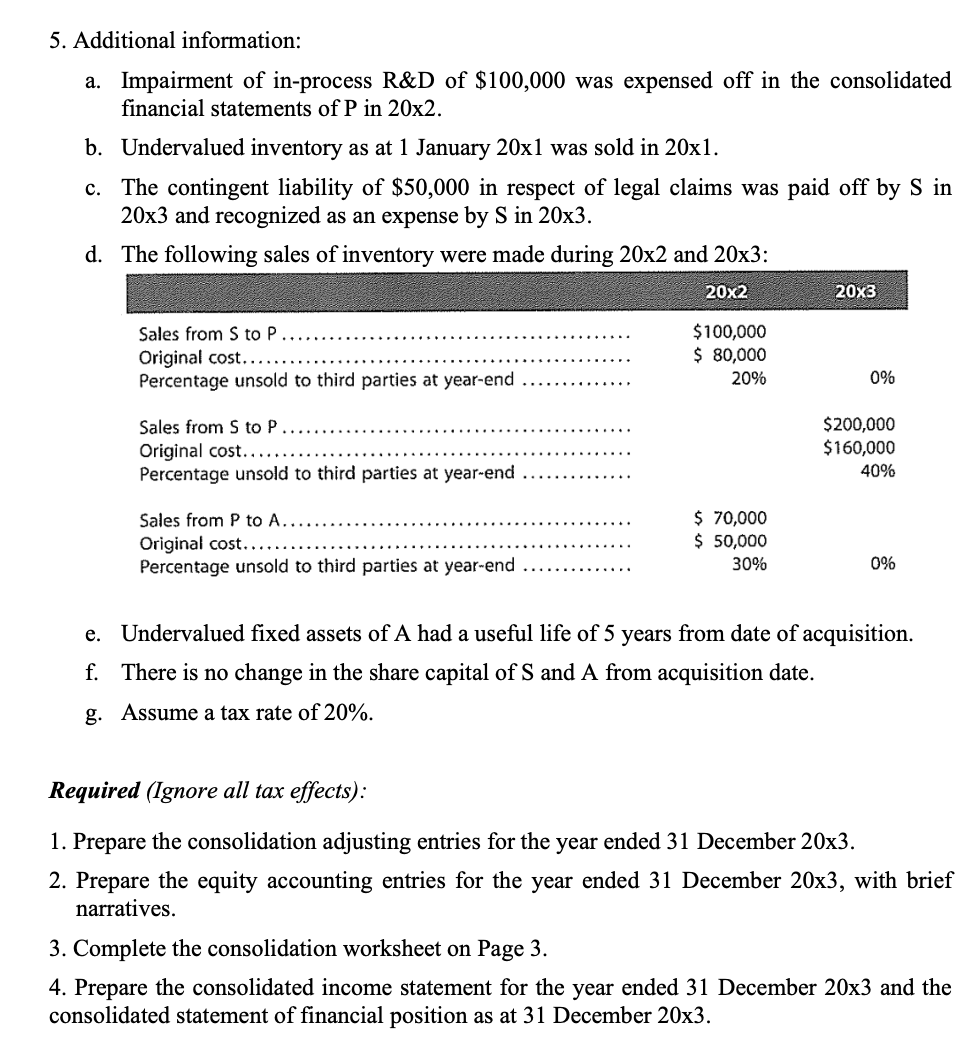

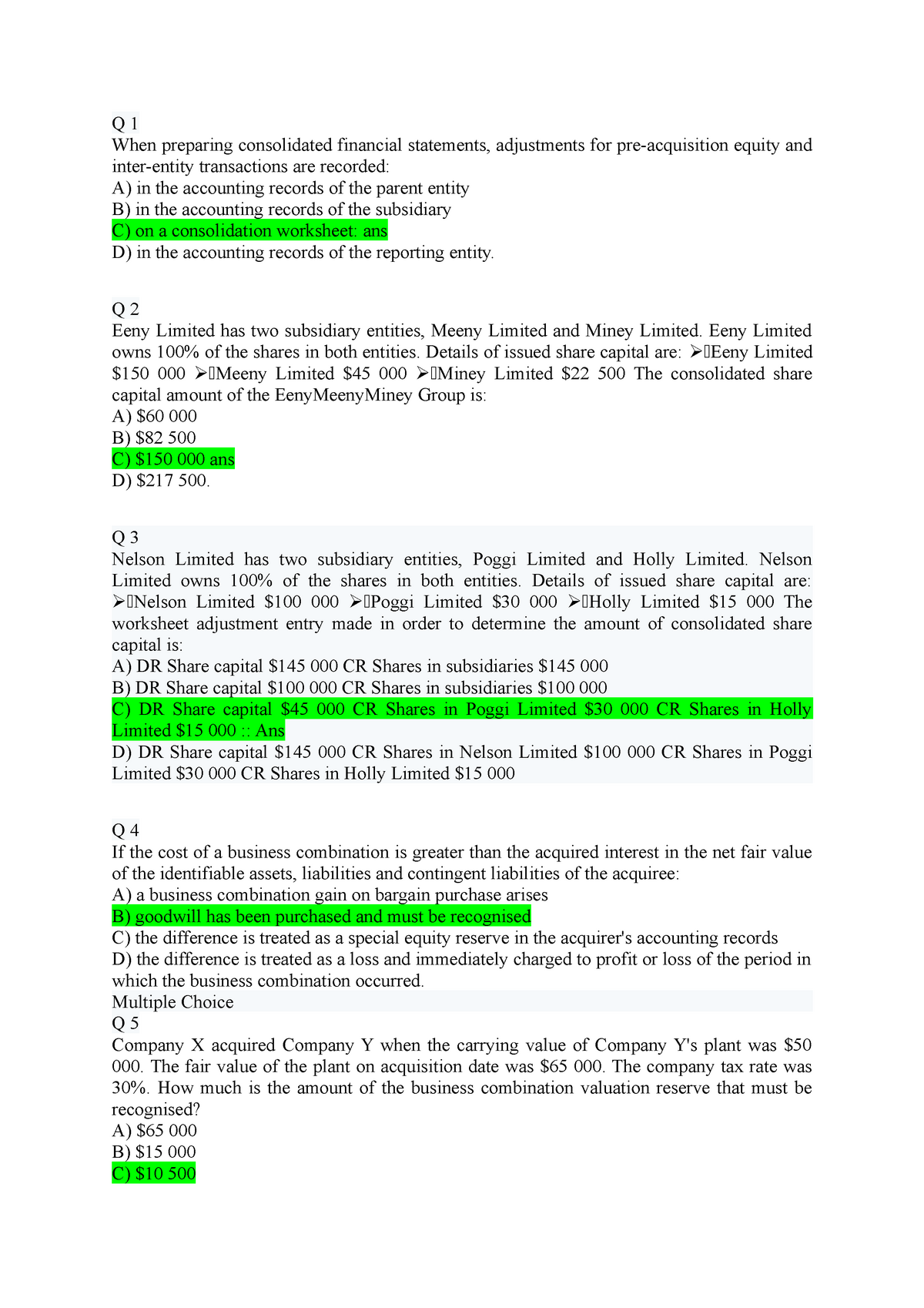

Preacquisition profits should not be distributed to the shareholders of the acquiring.

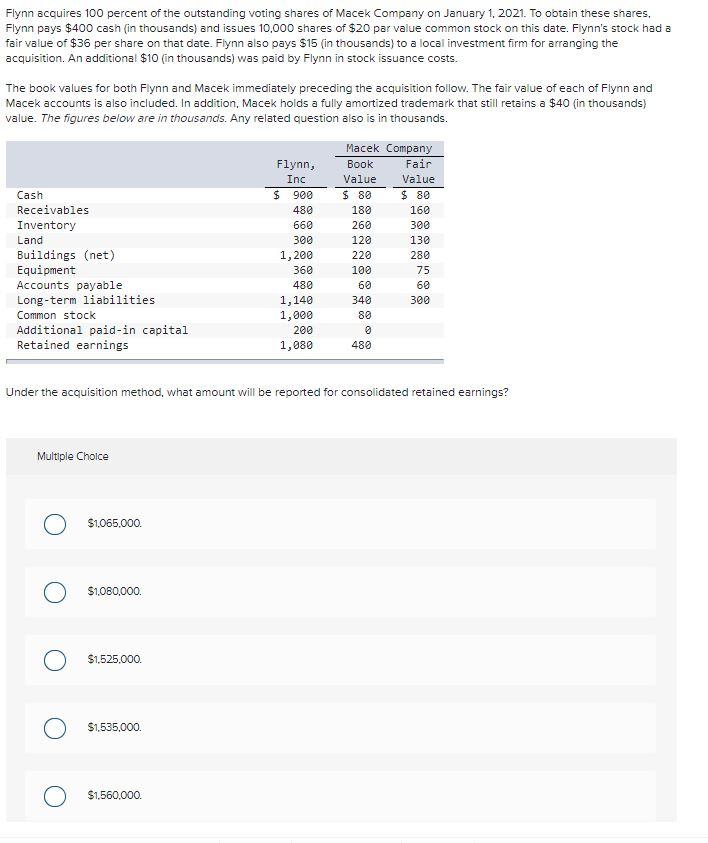

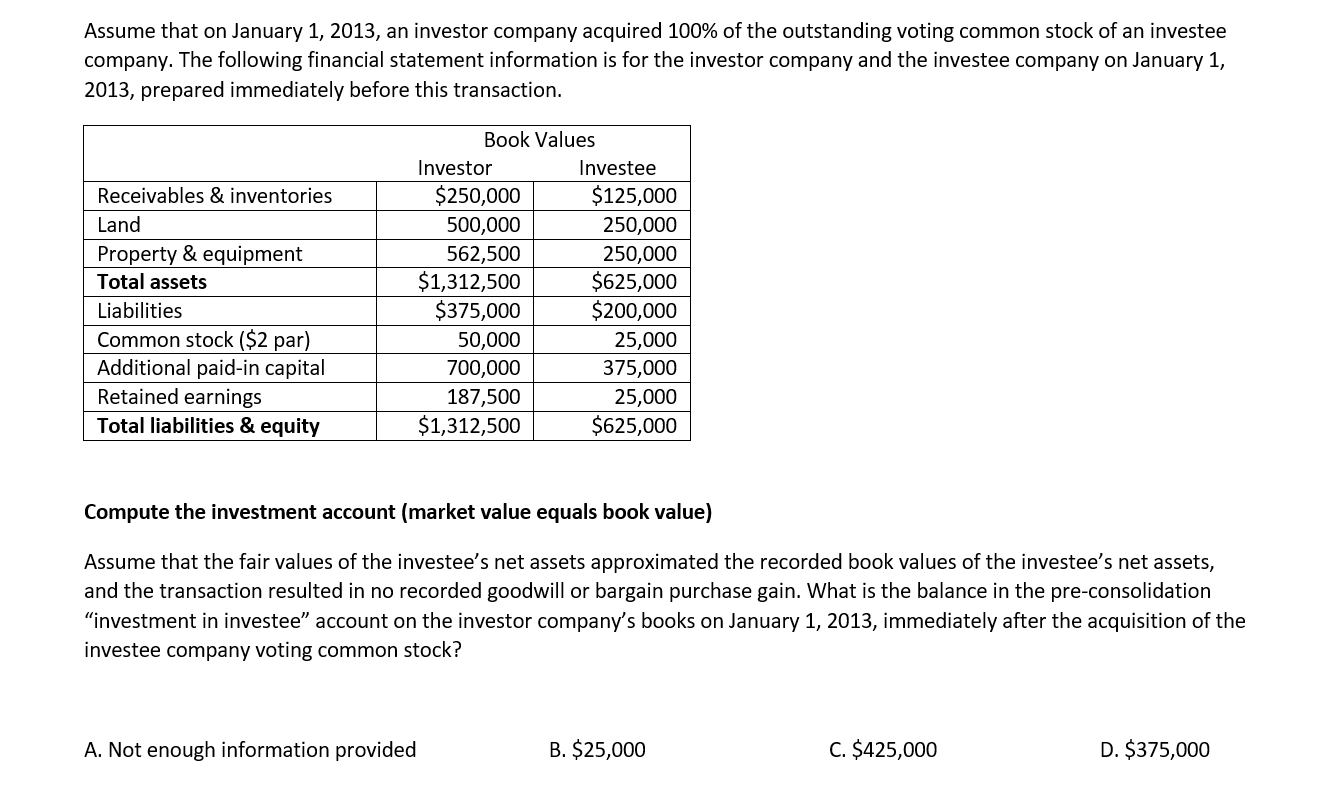

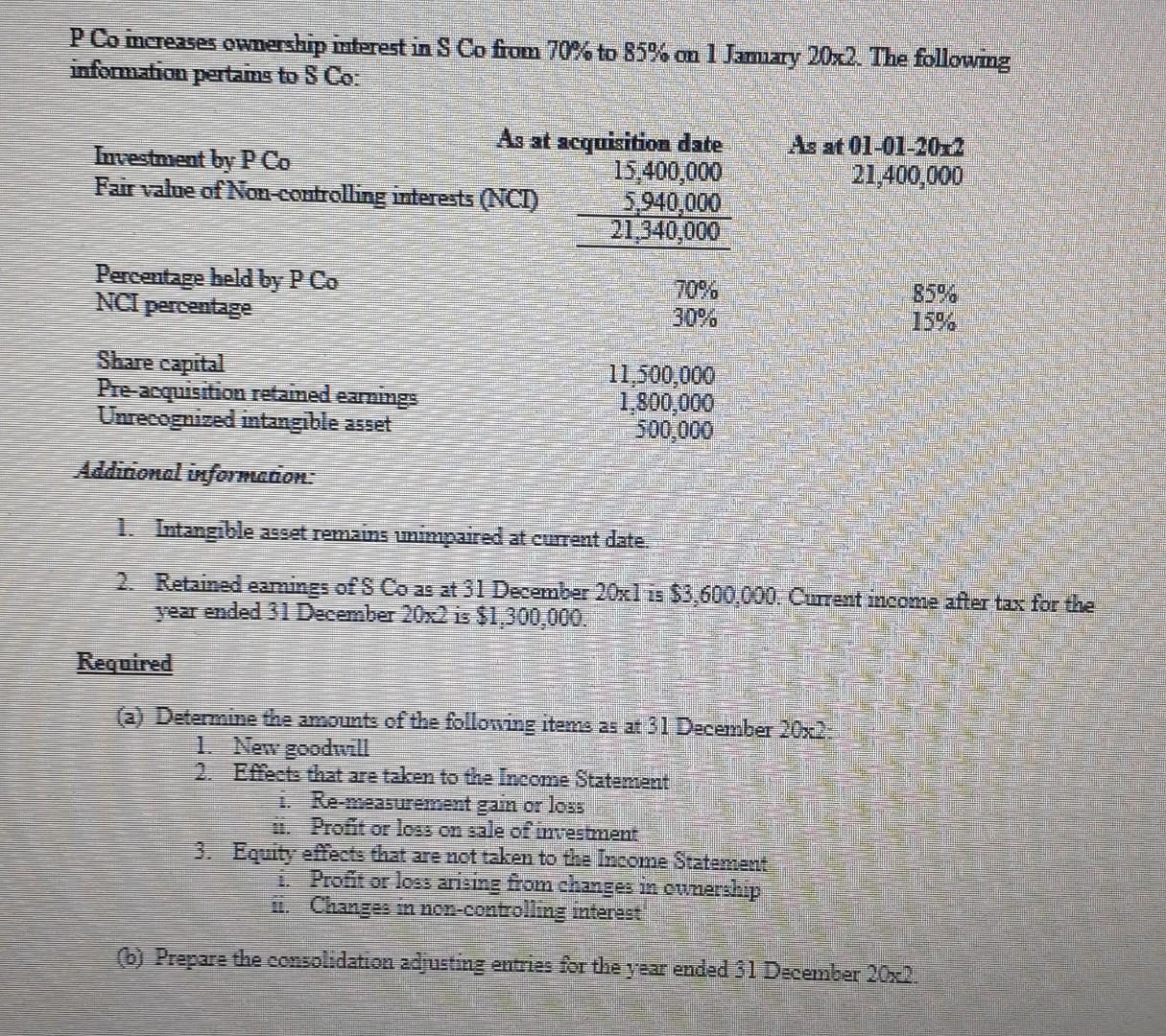

Pre acquisition retained earnings. Company p has opening retained earnings of $100 million including $20 million accumulated since it acquired 80% stake in company s two years back. It is important to consider all aspects of control.

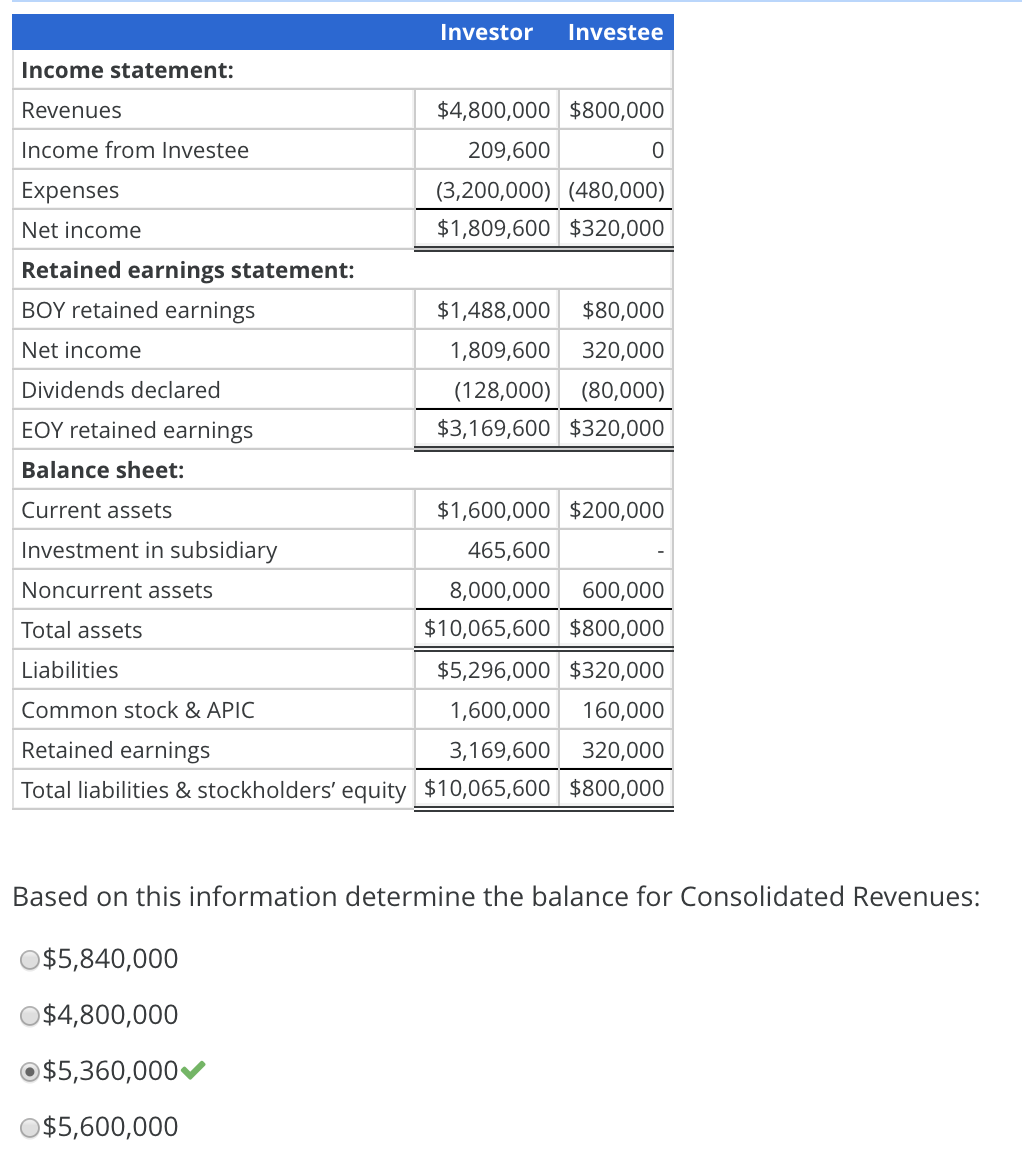

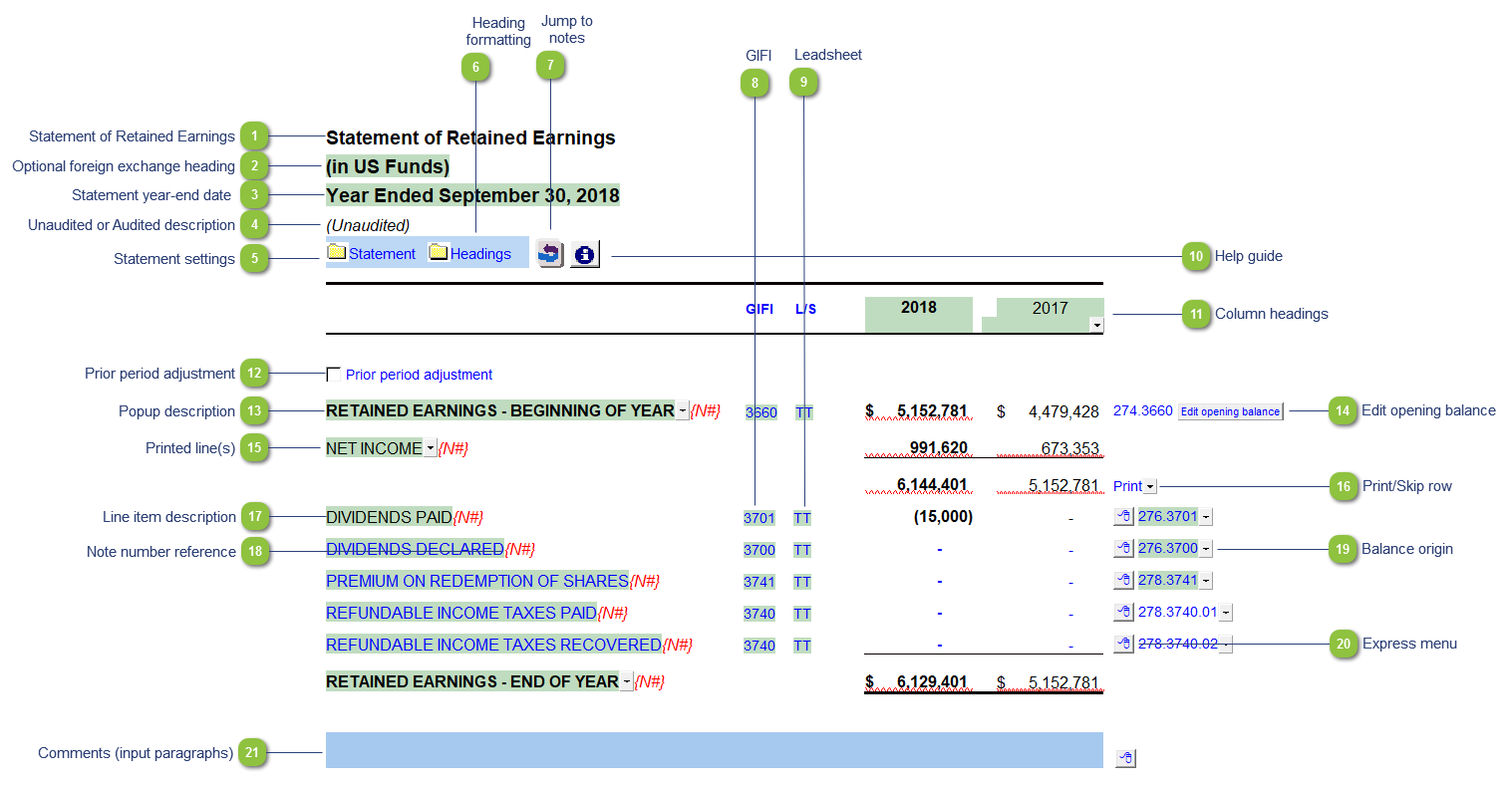

What’s the situation? Retained earnings (re) are the amount of net income left over for the business after it has paid out dividends to its shareholders. It points out that the requirements of ias 27 (which requires investors to recognise income from a subsidiary only to the extent that the investor receives.

Revaluations contain the badwill amount and increases contain the. The retained earnings of one company before it is taken over by another company. Retained earnings (re) are the accumulated portion of a business’s profits that are not distributed as dividends to shareholders but instead are reserved for reinvestment back.

Does the parent have control?). Without looking at the question (it’s not readily available) in the goodwill calculation we need to include as retained earnings the brought forward figure of 20,000 + the pre. For purposes of presenting consolidated financial statements, the reporting entity should reflect its retained earnings balance, which includes its proportionate share of the.

Mommy corp has owned 80% shares of baby ltd since baby’s incorporation. Below there are statements of financial.