Best Info About Restricted Funds On Balance Sheet Statement Of Cash Flows Ey

Compensating balances are a type of restricted cash reported on financial statements.

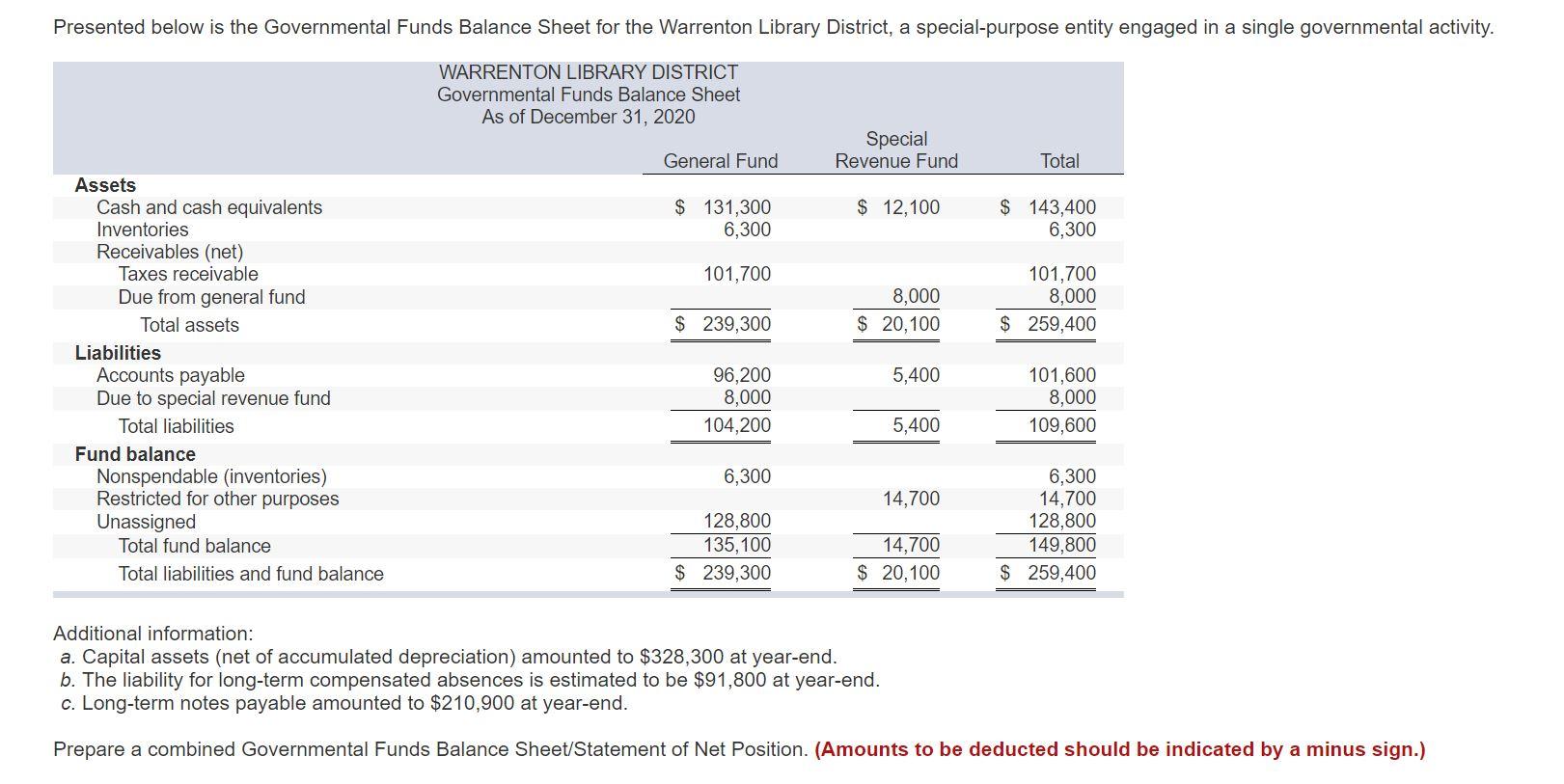

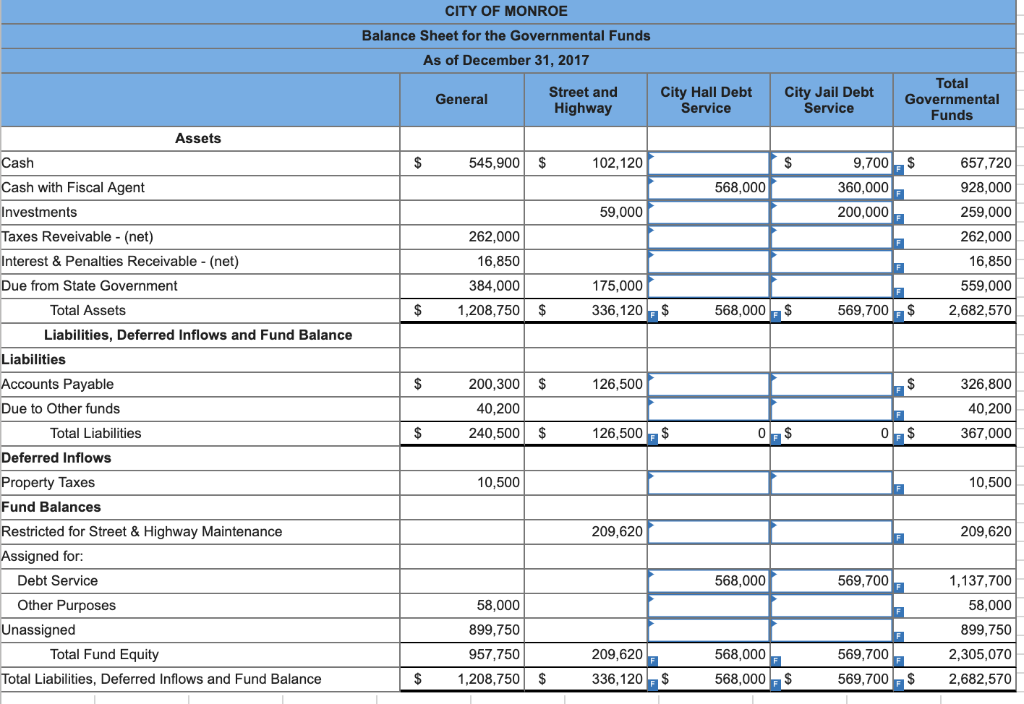

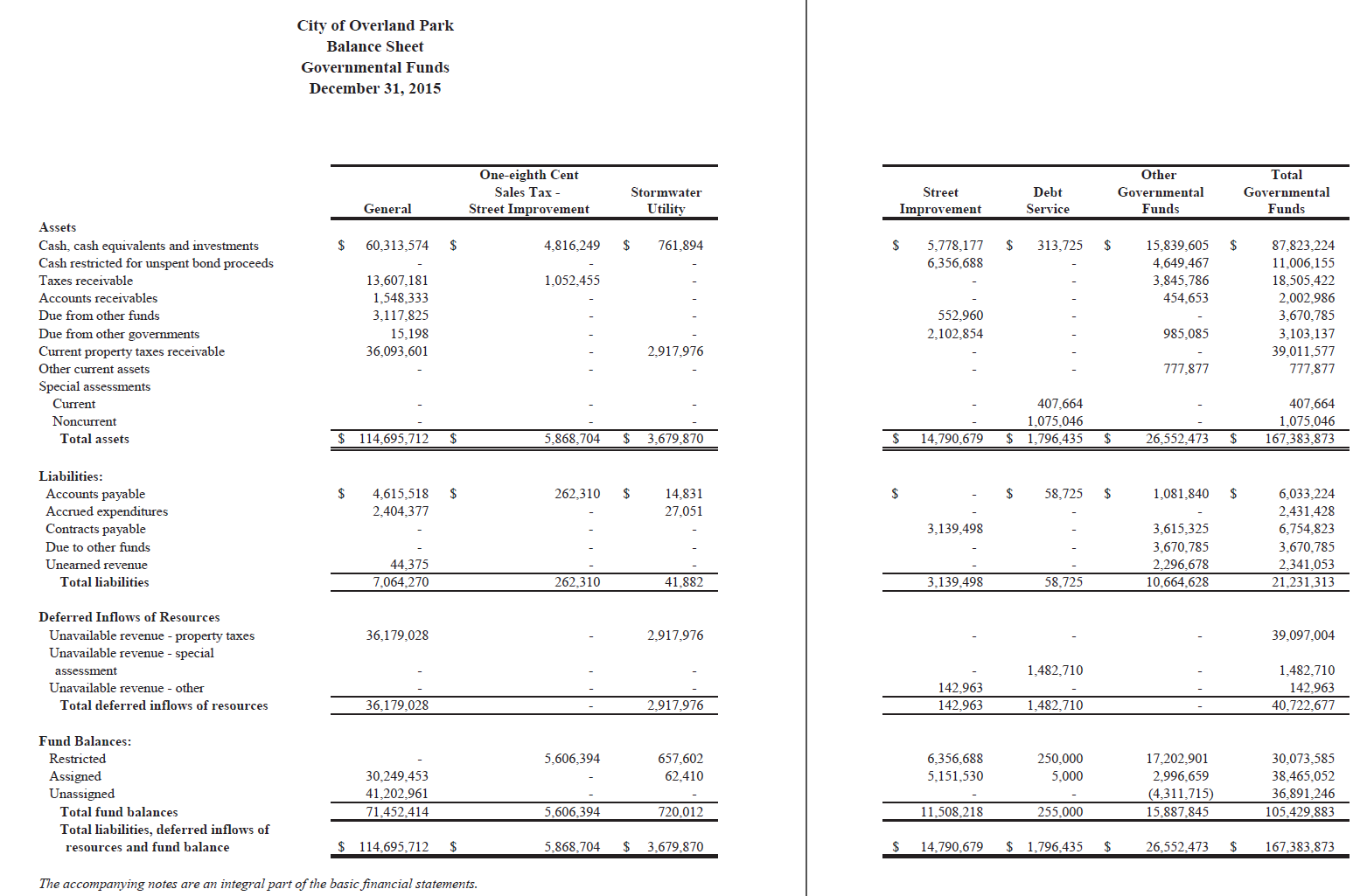

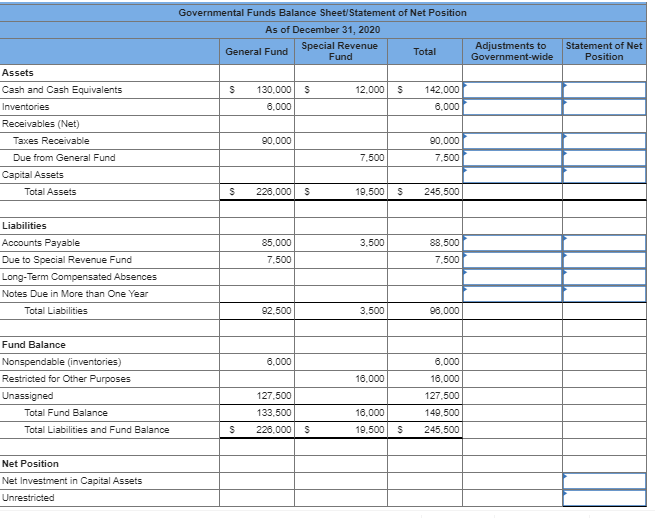

Restricted funds on balance sheet. Restricted cash is recorded separately from cash and cash equivalents on a company’s balance sheet, and the reason for the restriction is often disclosed in the accompanying notes to the financial statement. In other words, amounts generally described as restricted cash will be included with cash and cash equivalents on the statement of cash flows. The balance sheet of a business must cover all assets and liabilities, including cash.

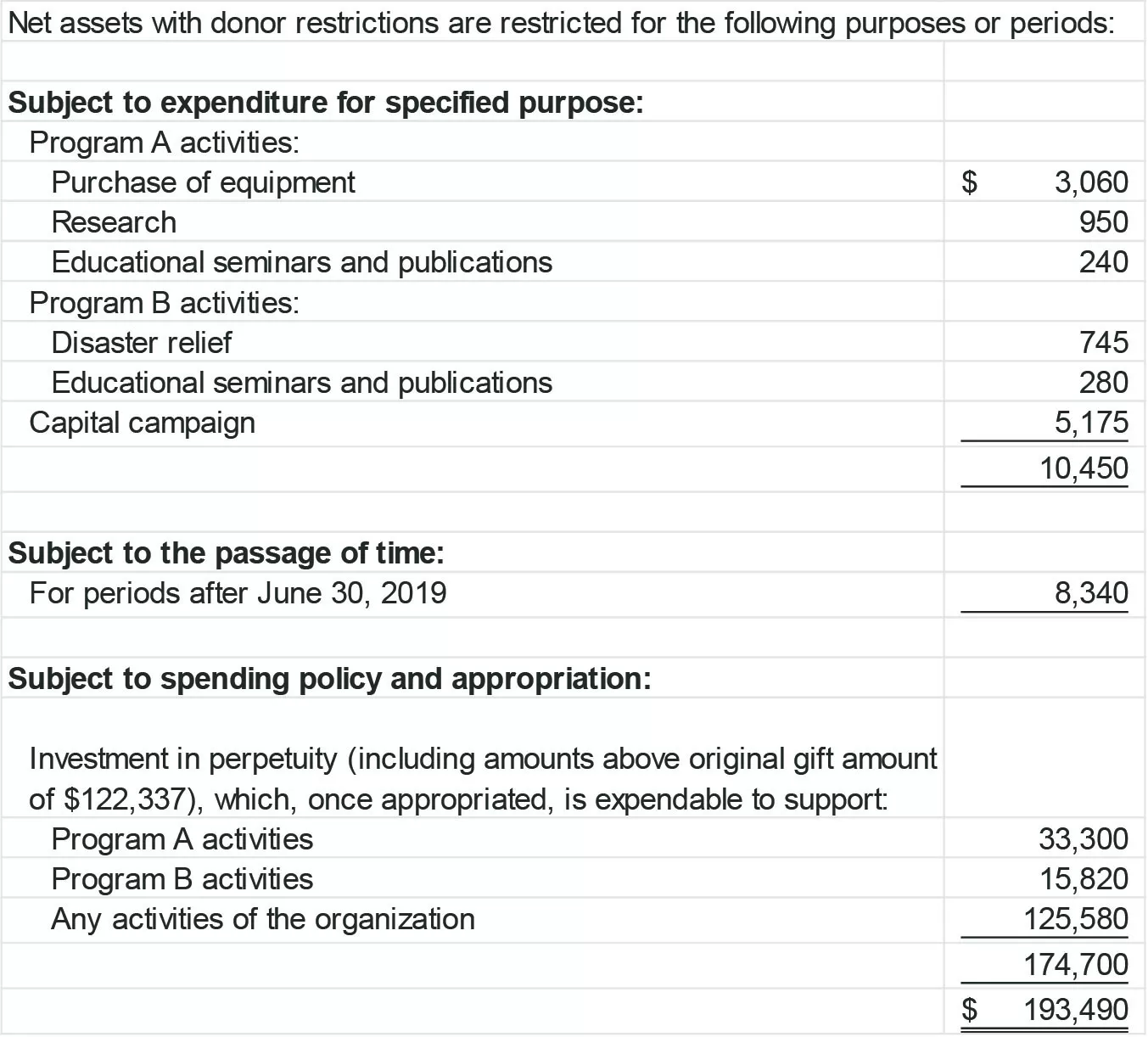

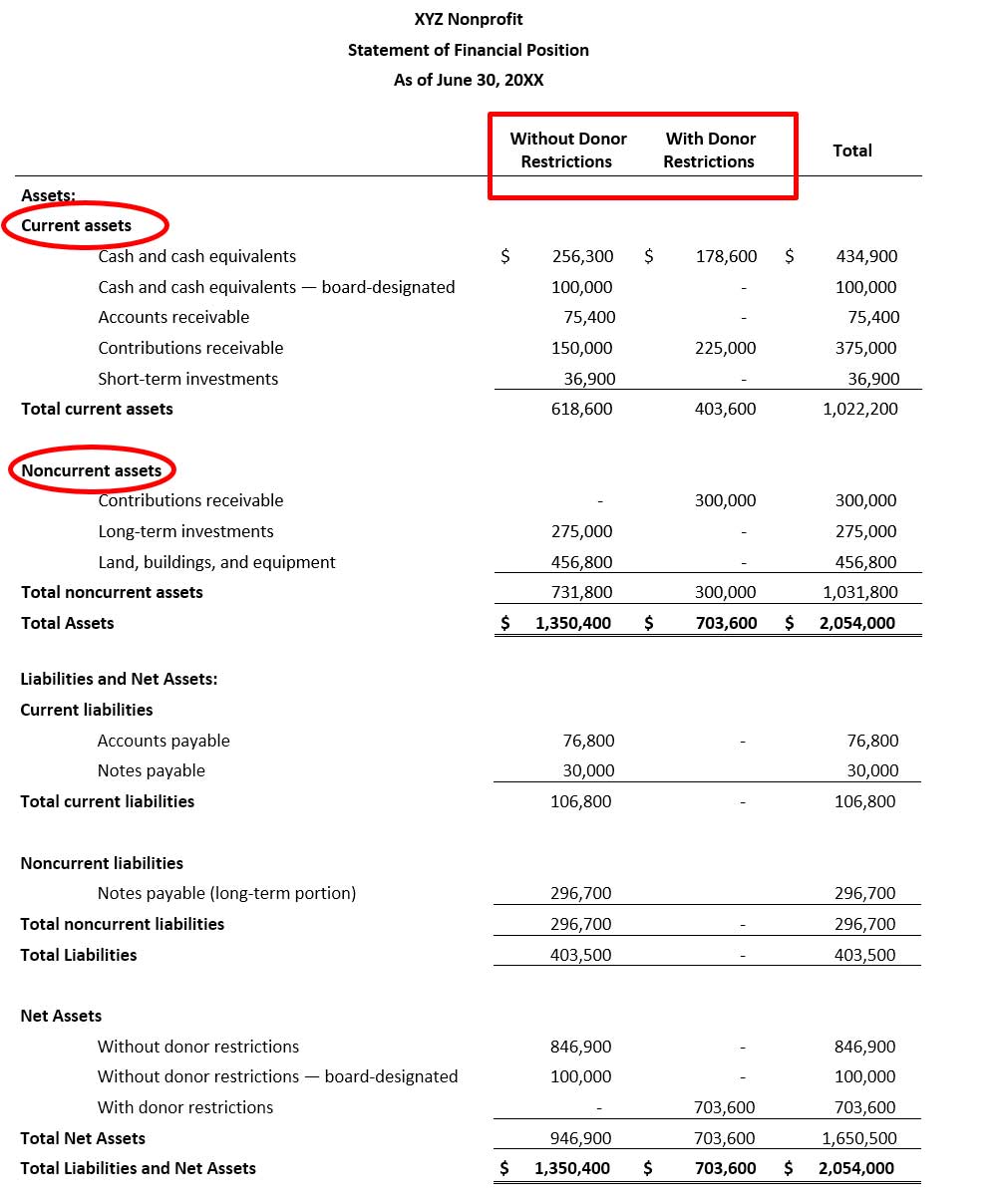

These limitations might apply to money saved in escrow accounts, which can only be used for a specific function. Nonprofits that regularly receive substantial funds with donor restrictions (restricted funding), find themselves in a precarious position. These funds are included in the total net assets on the balance sheet, but they are not actually available to the organization to use in any way except according to restriction.

When there is substantial accumulated restricted funding in place and held on the balance sheet, most nonprofit organizations find themselves at great risk of inadvertently using restricted funds for. Private credit funds for professional investors are facing their first set of stricter rules under a european union proposal slated for approval this week, as their growth has fueled. A restricted fund is any cash balance that has been earmarked for specific or limited use.

Restricted cash is typically balance sheet as a separate line item, reports the corporate finance institute. The restriction may exist for a specific period or until a certain event occurs. Restricted cash refers to cash that is held by a company for specific reasons and not available for immediate business use.

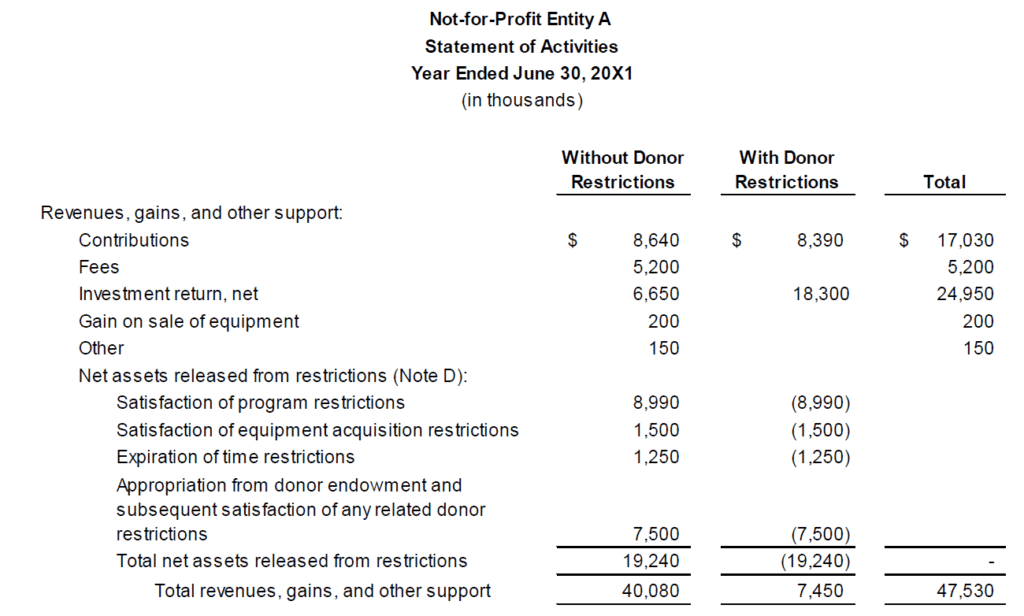

When the purpose for which it was intended is completed, or the time allowed has ended, the money becomes unrestricted or. Accounting requirements once a contribution or grant is identified as restricted, the accounting and recordkeeping requirements are of paramount importance. Reporting restricted funds on financial statements.

Put simply, restricted funds have been given to a charity for a particular reason and can only be spent in accordance with the requests of the donor. Two principles are at the core of the accounting requirements. By focusing on net assets without restrictions, organizations are given the most accurate and relevant picture of the net assets available for use.

By referring to restricted cash more broadly, the fasb intended it to encompass all restricted cash accounts, regardless of their classification on the balance sheet. So your company's balance sheet will report a cash balance that reflects the. Permanent), and whether the restrictions have been imposed externally by donors or internally for the.

In such cases sorp 2005 requires that positive and negative funds are presented separately on the balance sheet. Because of that, they should be used sparingly and only for uses that are not already covered under the general fund. Since funds are separated on the balance sheet/income statement, restricted cash typically appears on a company's balance sheet as either other restricted cash or as other assets..

Restricted funds can be split further into two categories: Why do companies use restricted cash? If an entity has assets who’s use is restricted by donors, separate disclosure on the face of the balance sheets and in the footnotes should be provided.

First, restrictions are imposed by the donor when they make the gift or grant. Each restricted fund is typically treated separately. Often associated with funds held by donations to nonprofit organizations or endowments, restricted.

:max_bytes(150000):strip_icc()/Restricted-Fund-3-2-20c16aeec9274070bac757711f6b4ba0.jpg)

:max_bytes(150000):strip_icc()/Restricted-cash_final-aa54f0ce0256464d966180c8245909d2.png)