Brilliant Strategies Of Info About Form 26as Sbi Frs 102 1a Illustrative Financial Statements 2019

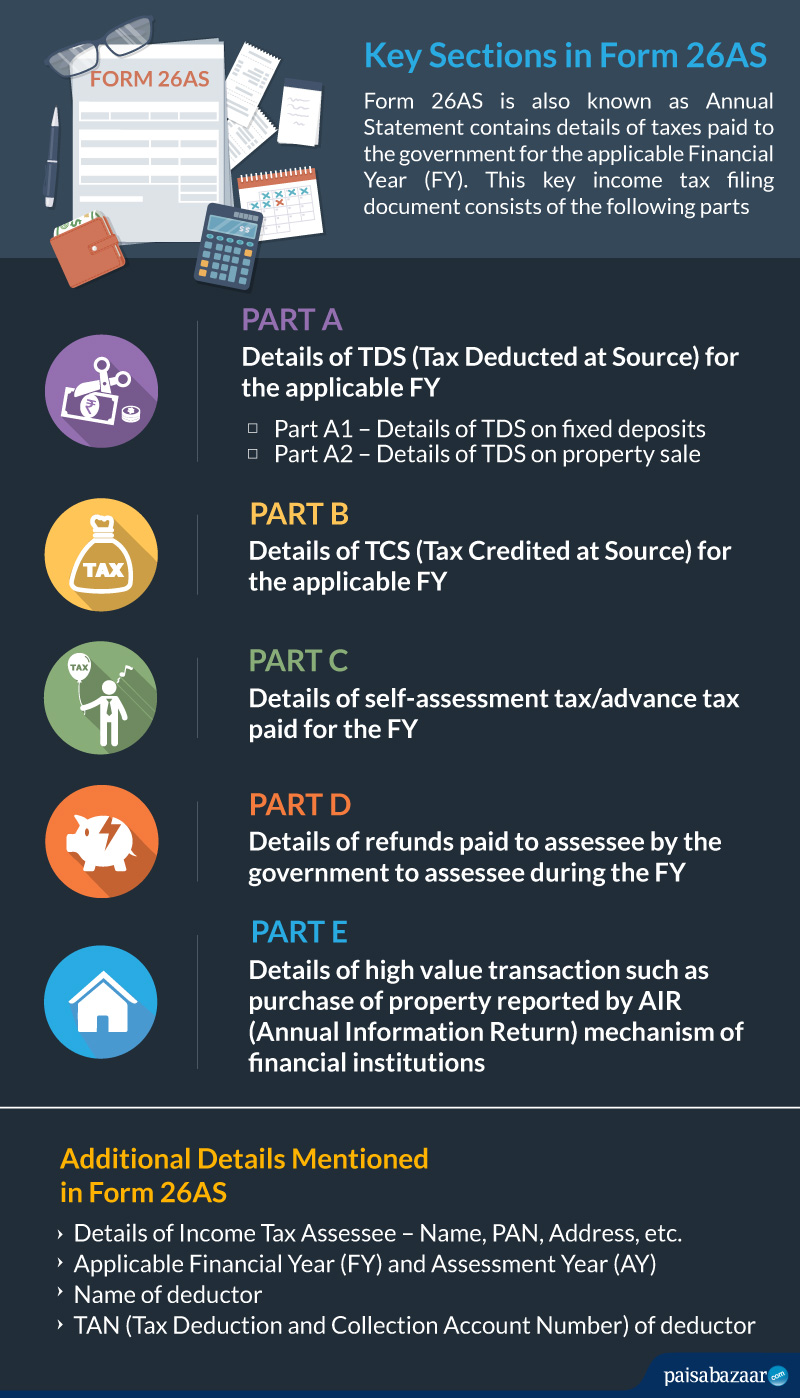

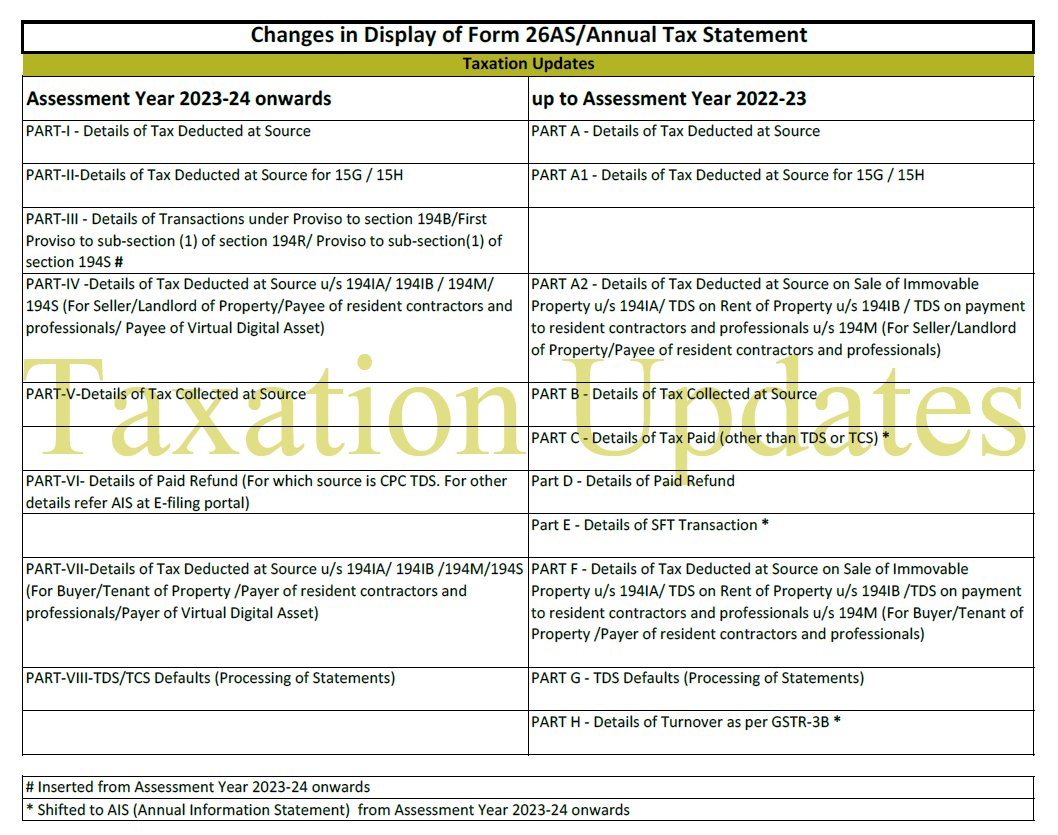

Form 26as is the comprehensive summary of income, taxes deducted at source (tds), taxes paid, and other related information of the individual or entity.

Form 26as sbi. View of form 26as is available only if the pan is mapped to that particular account. This form and its use by tax authorities/tax payers is governed by section 203aa, rule 31ab of the income tax act, 1961. The website provides access to the pan holders to view the details of tax credits in form 26as.

You can download and view form 26as via. Checking your browser before accessing incometaxindia.gov.in this process is automatic. Tax credit statement or form 26as is an important document for tax filing.

Know how to view & download form 26as online at 5paisa. There are 3 ways to view/download: Click on ' login ' and enter the 'user id' which can be either pan or aadhar number and click on ' continue '.

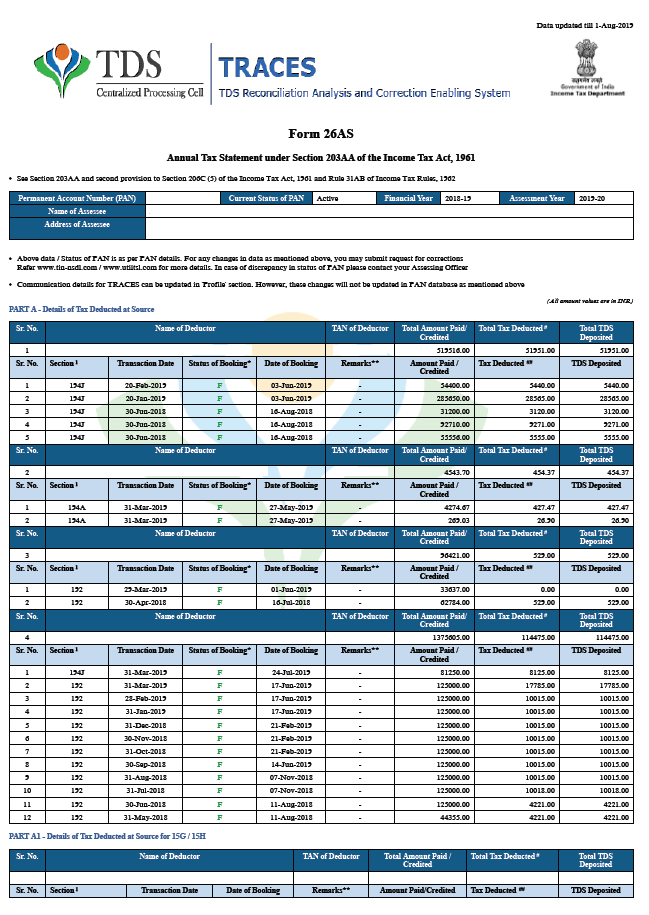

The steps for how to download form 26as from sbi are as follows. Form 26as contains of all the taxes paid and deducted at source (tds) under an individual's name. How can an nri view his form 26as?

Form 26as is a statement that shows the amount of tds or tcs deducted from a taxpayer's various sources of income. Here, you can view form 26 and press ‘confirm’. The facility is available free of cost.

Obtain form 16a and verify the same with form 26as. It typically includes the following information: Follow the steps below to download form 26as using either of the methods.

In this video tutorial i will show how to see form 26as from sbi online. Associated with a pan (permanent account number). Only a registered pan holder can view their form 26as on traces.

Sbi general insurance document download. To receive email intimations from traces, please add to the address book / contact list of your registered email id Next, click on ' income tax returns '.

This data pertains to a permanent account number (pan). It is one of the important documents required while filing the itr. How to see form 26as from sbi online (how to get/download form 26as from sbi).

Form 26as is a detailed statement that reflects details of any amount deducted against income as tax deducted at source (tds) or tax collected at source (tcs). Form 26as is an important income tax document containing all the details of taxes deducted and deposited against the pan during the financial year. Individuals can download form 26as from the new income tax portal or via an internet banking facility.