Stunning Info About Different Types Of Financial Reports Define Classified Balance Sheet

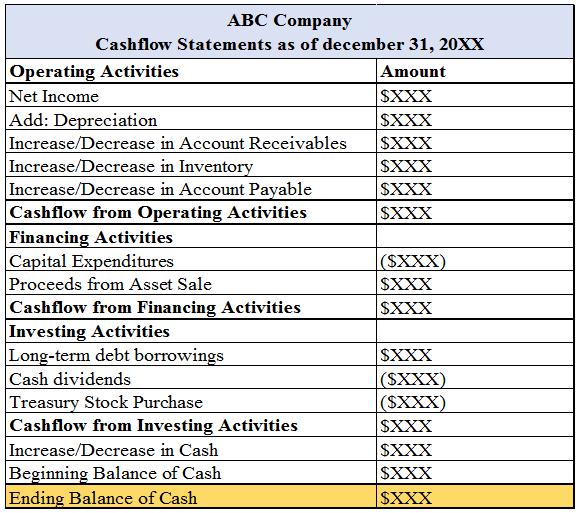

This isn’t only a matter of compliance or best practice, these reports are key for understanding the different segments of cash flow.

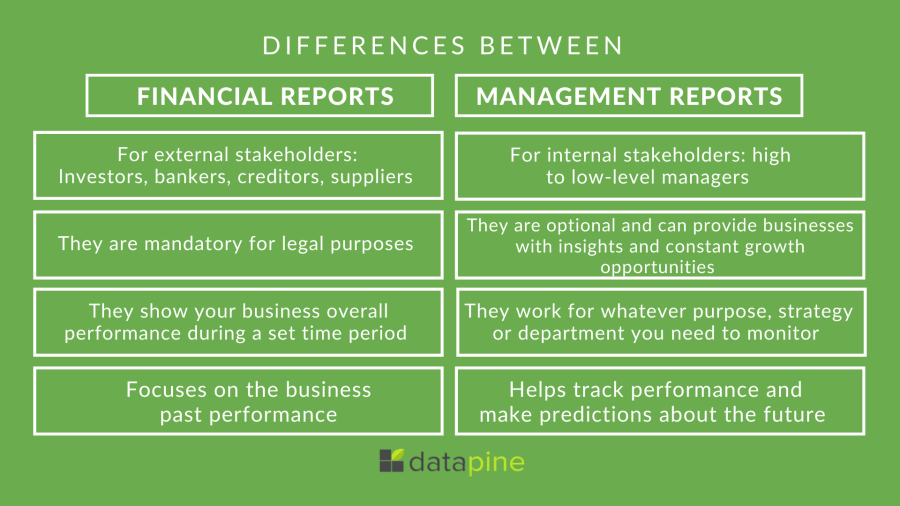

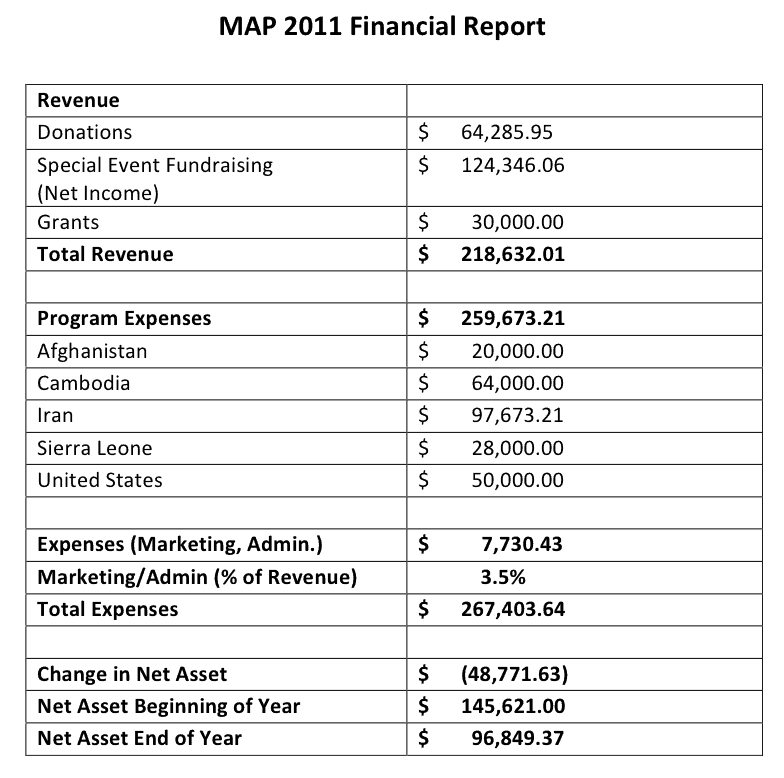

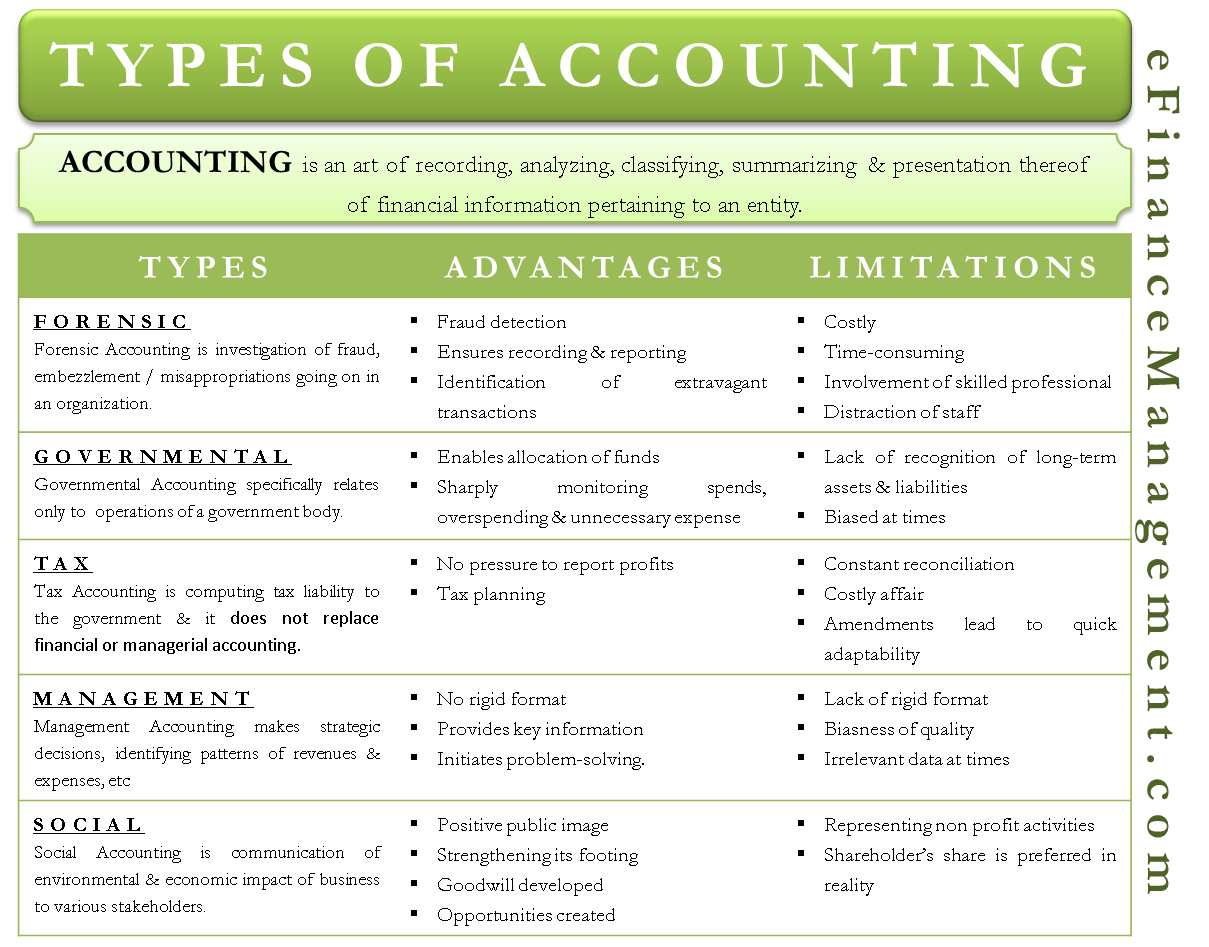

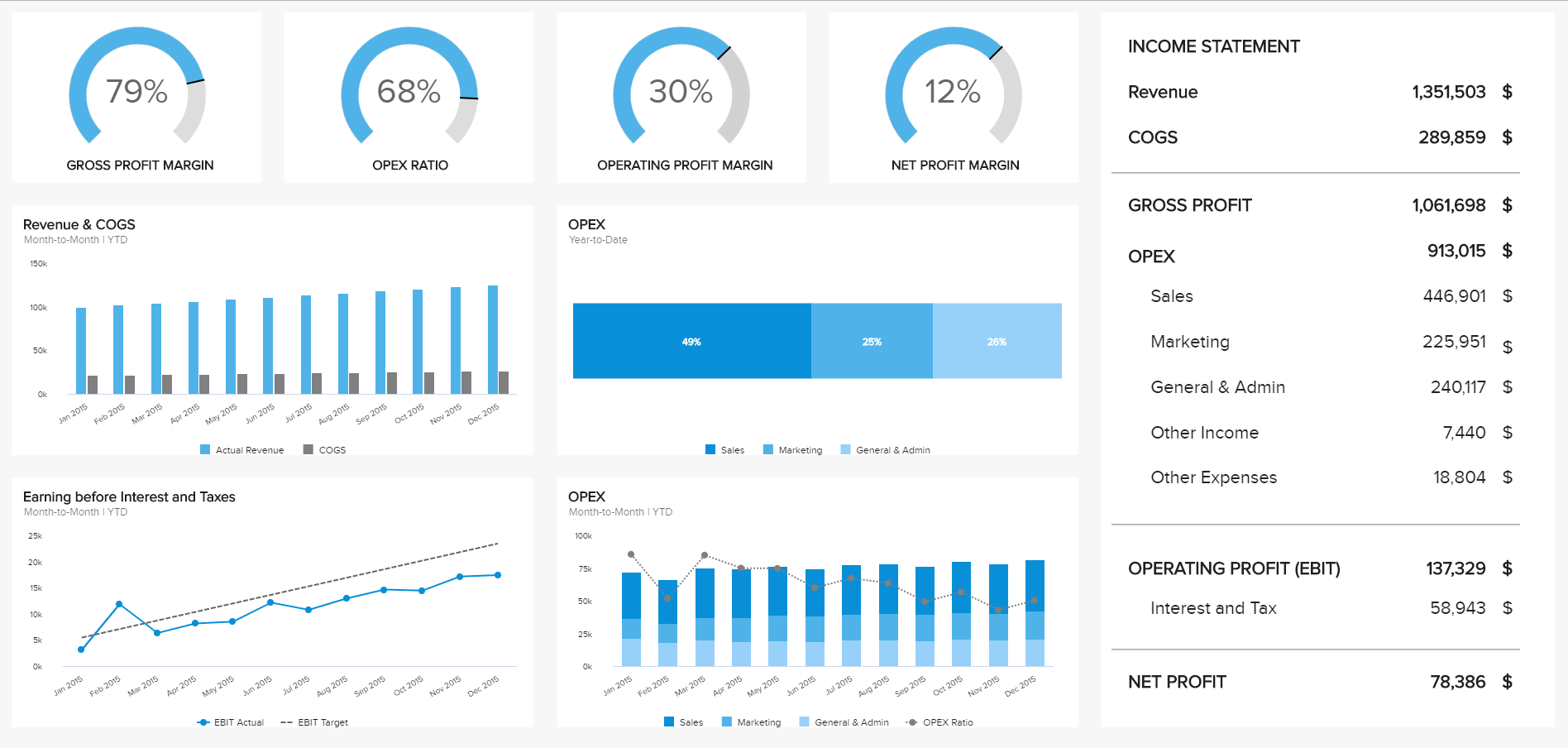

Different types of financial reports. Financial ratio analysis is often broken into six different types: The most common types of financial analysis are: Three main reports commonly used in financial reporting are balance sheets, income statements, and cash flow statements.

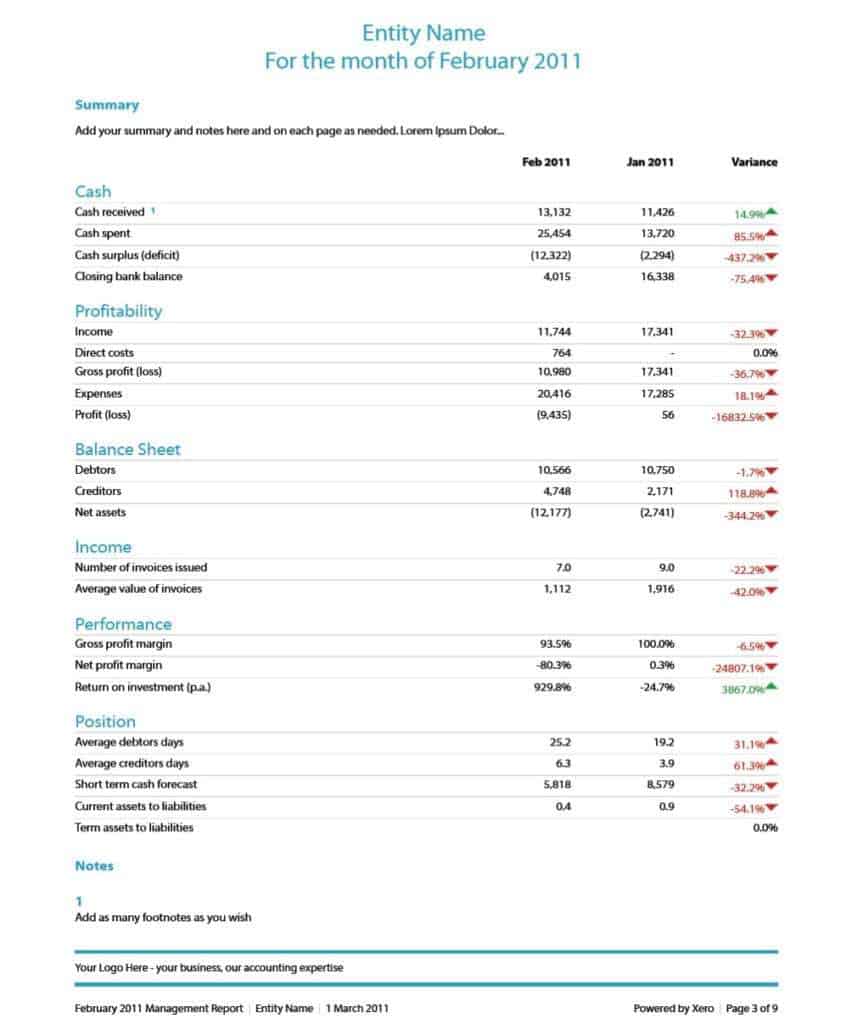

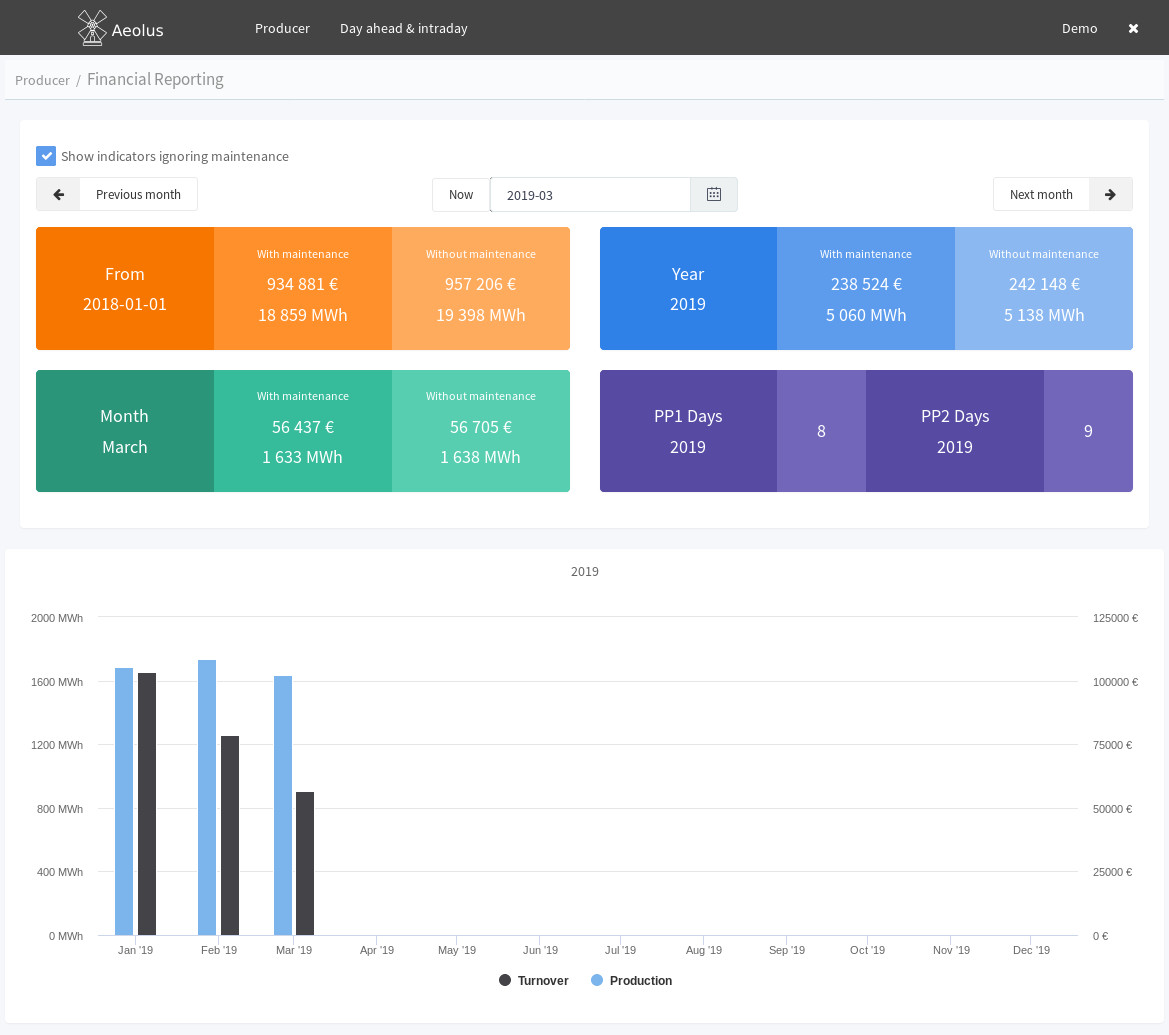

Financial reporting is the process of documenting and communicating financial activities and performance over specific time periods, typically on a quarterly or yearly basis. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. Both use the same set of data, though each analytical.

Definition of financial statements 1.1 definition of financial statements according to experts 2. What are the types of financial reporting? Financial reports include financial statements, notes to accounts, director’s reports, auditors’ reports, corporate governance reports, and prospectus.

It has two sections with three components: There are four primary types of financial statements: Vertical horizontal leverage growth profitability liquidity efficiency cash flow rates of return valuation scenario & sensitivity variance vertical analysis

Annual financial reporting happens at the end of a company's fiscal year, while interim financial reporting covers periods less than one year, typically months or quarters. Investors can use key reports, such as a balance sheet, cash flow. The most common financial statements are the balance sheet, income statement, and cash flow statement and equity change statement.

Quarterly and annual reports: Explore accounts receivable clerk jobs on indeed view more jobs what is financial reporting? Financial statements are documents that formally record a company's or organization's financial activities including expenses, income, revenue and important equity changes.

When reviewing a company's financial statements, two common types of financial analysis are horizontal analysis and vertical analysis. For example, a quarterly financial report can include a statement of change in equity, an income statement, and a balance sheet. A financial statement commonly includes information regarding a particular subject, while a financial report comprises information on multiple related topics.

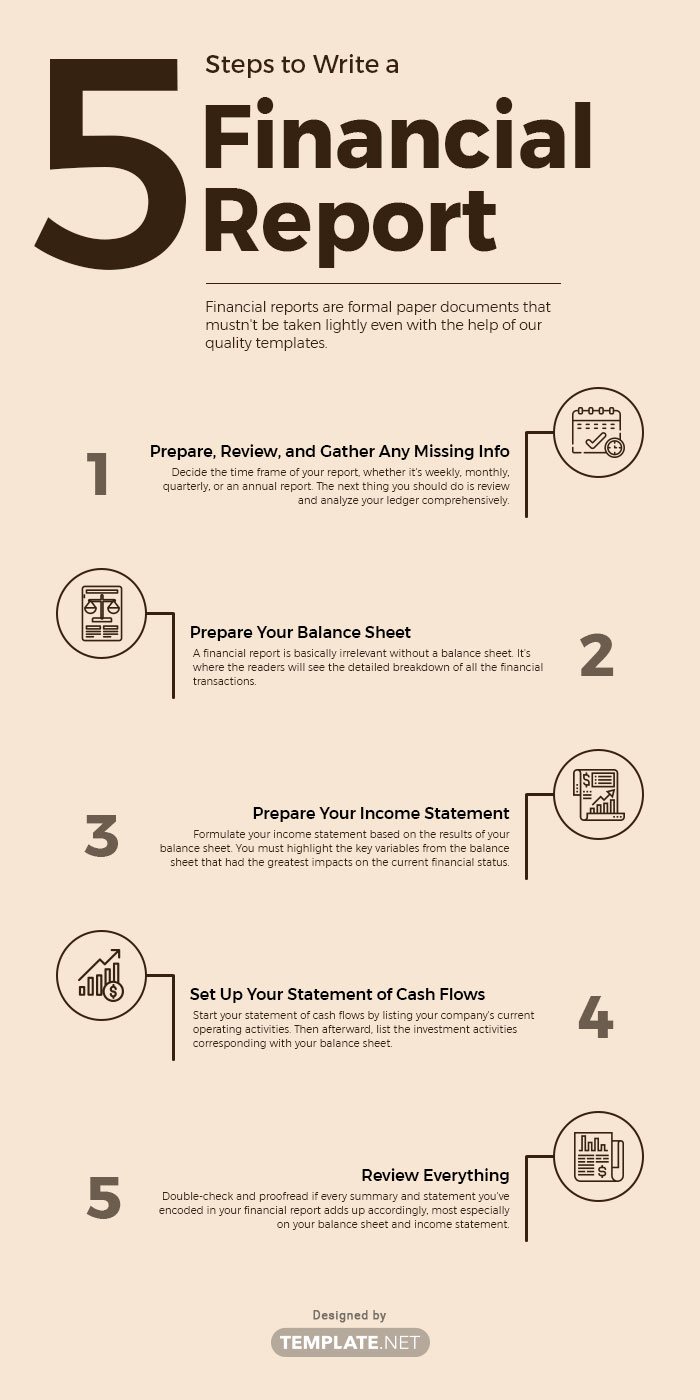

These three statements together show the assets and liabilities of a. Balance sheets show what a company owns and what it owes at a fixed point in time. In this guide, we’ll show you how to craft a great financial report, breaking it down into manageable steps.

Balance sheet a balance sheet provides a clear picture of the overall financial health of a business. Here are a few of the most common and most important types of financial statements: In a standard financial report, a company’s financial activities and performance are presented in a readable manner for people to view and analyze.

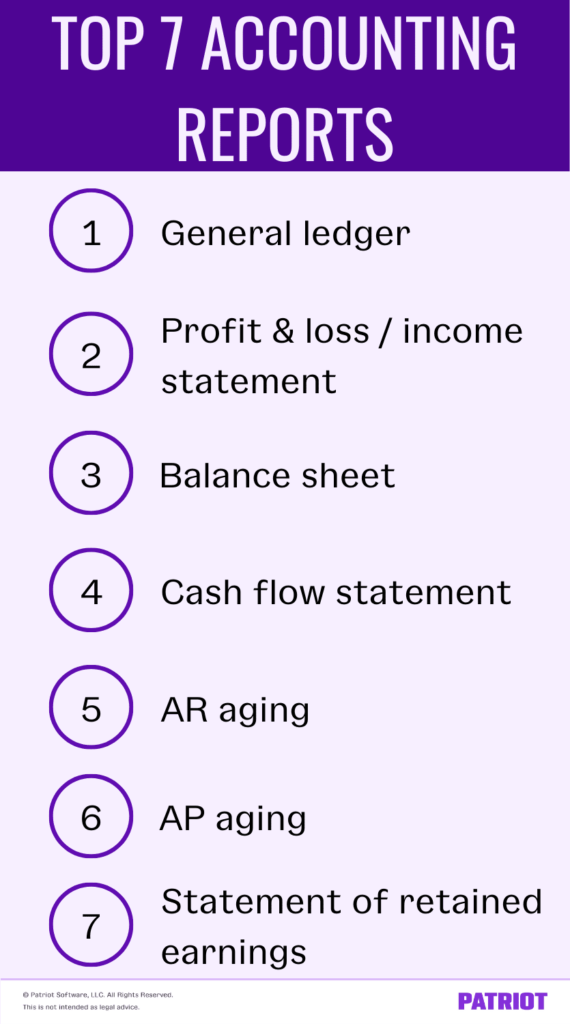

There are 5 types of financial reports that you should understand to make it easier for you to prepare and read financial reports. These reports are crucial for strategizing the future growth and sustainability of a firm. The balance sheet this provides an overview of assets, liabilities, and shareholders' equity as a snapshot in time.