Lessons I Learned From Tips About Ppp Profit And Loss Statement Financial Statements Of A Merchandising Business

Plus, we’ll guide you through writing a p&l statement.

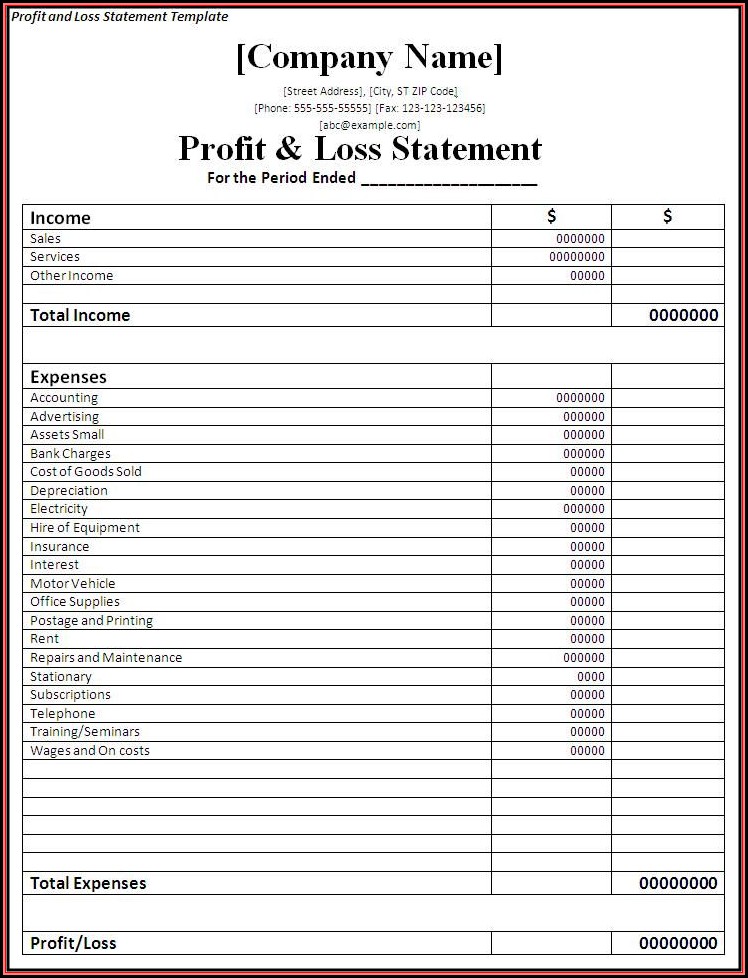

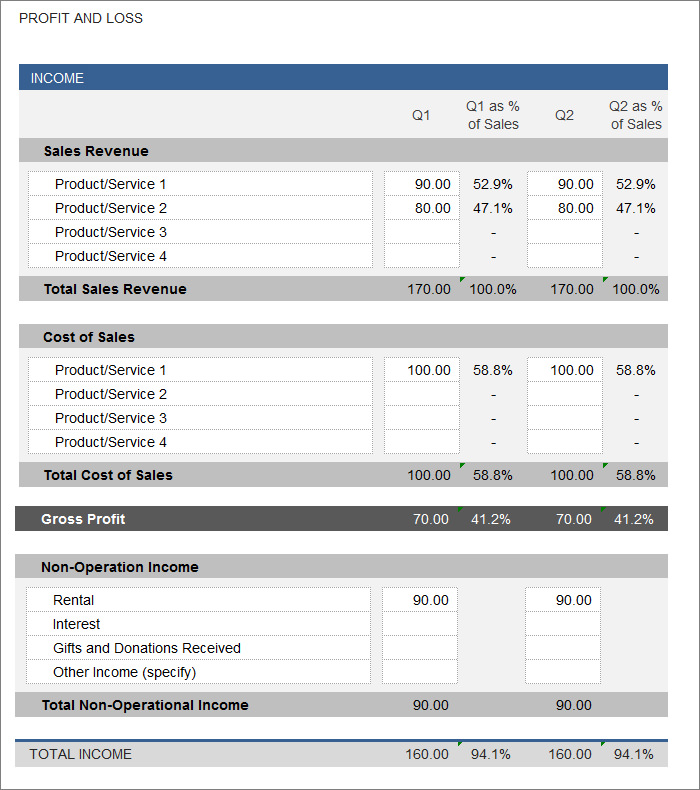

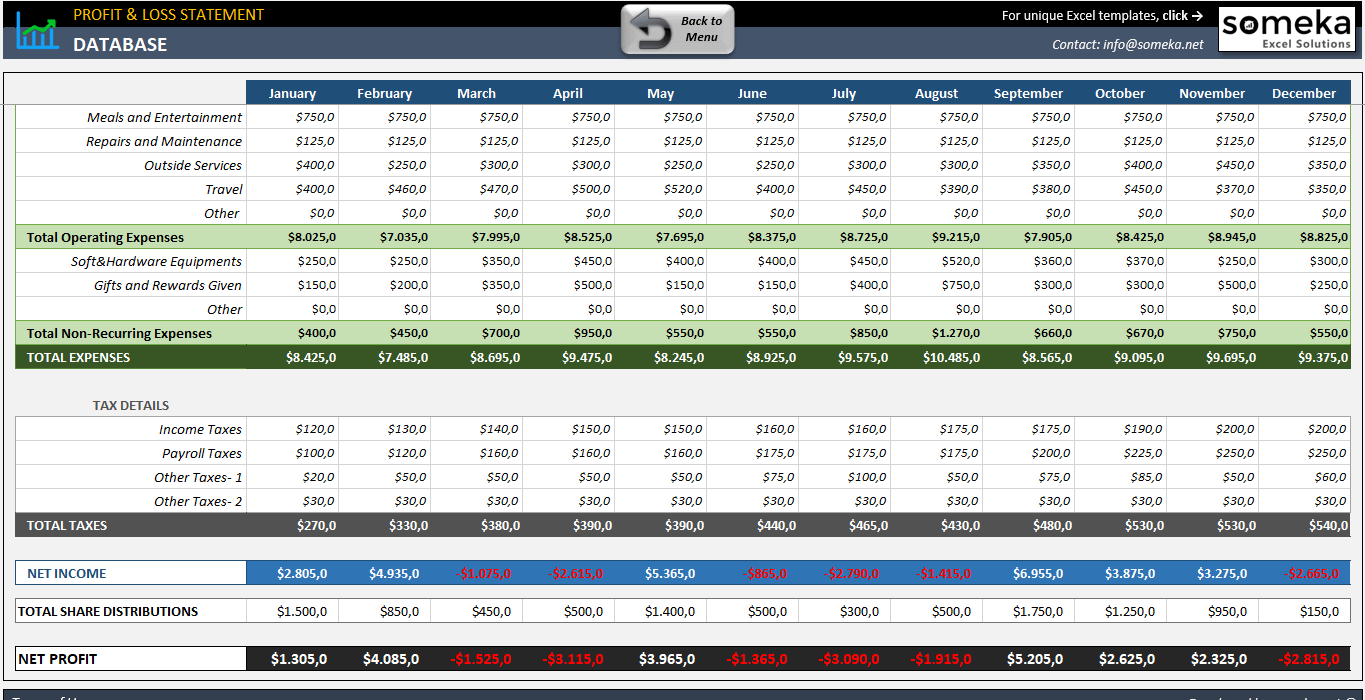

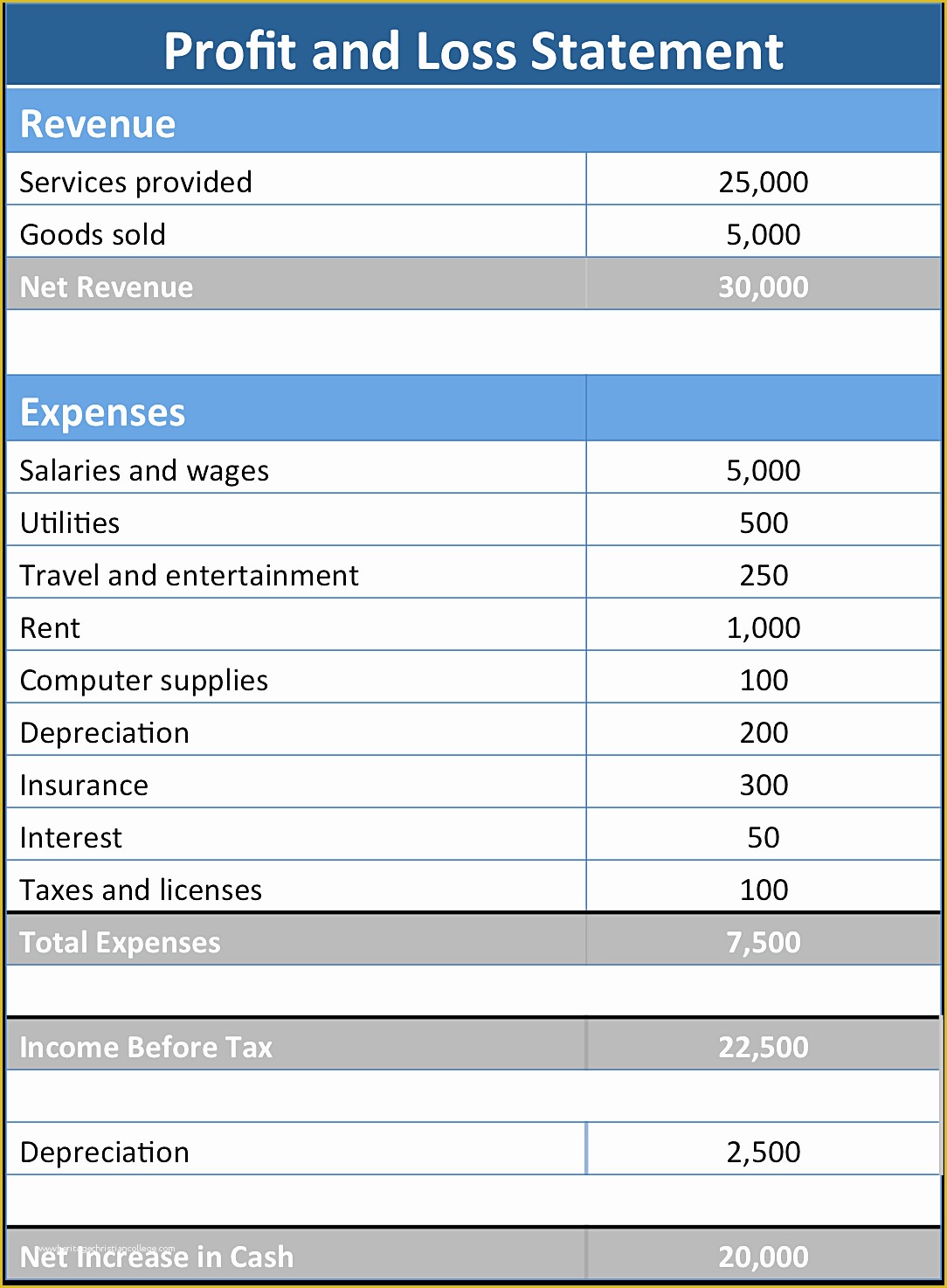

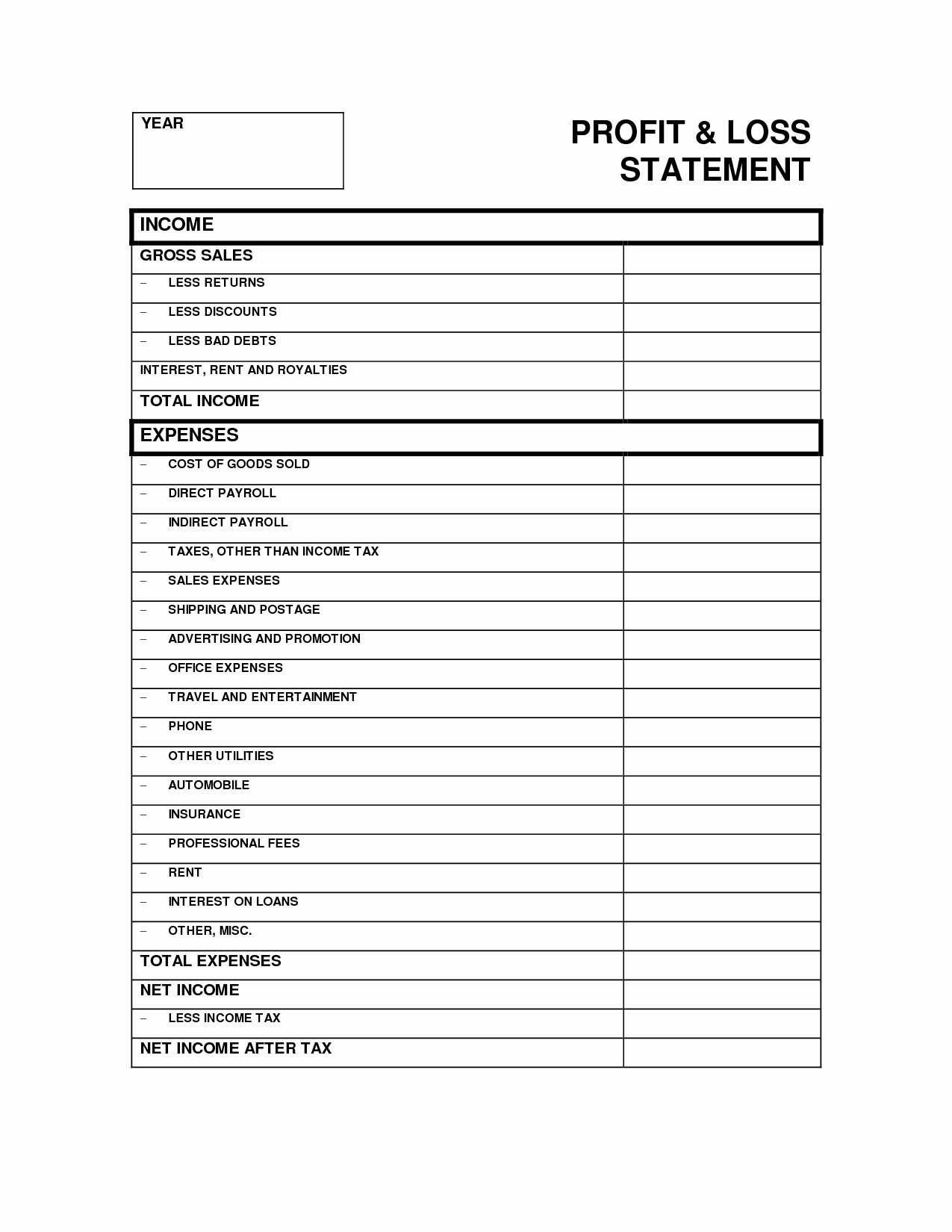

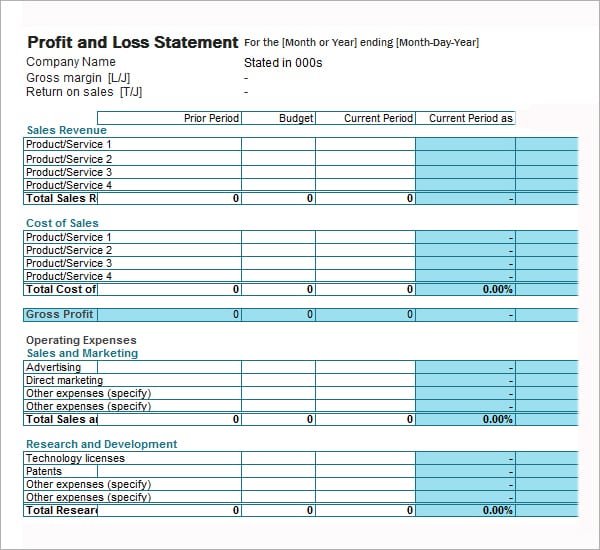

Ppp profit and loss statement. Here we discuss the top 3 examples of companies along with explanations and calculations. The income statement impact of any loan forgiveness under ias 20 may either be presented separately or be offset against the related expenses. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

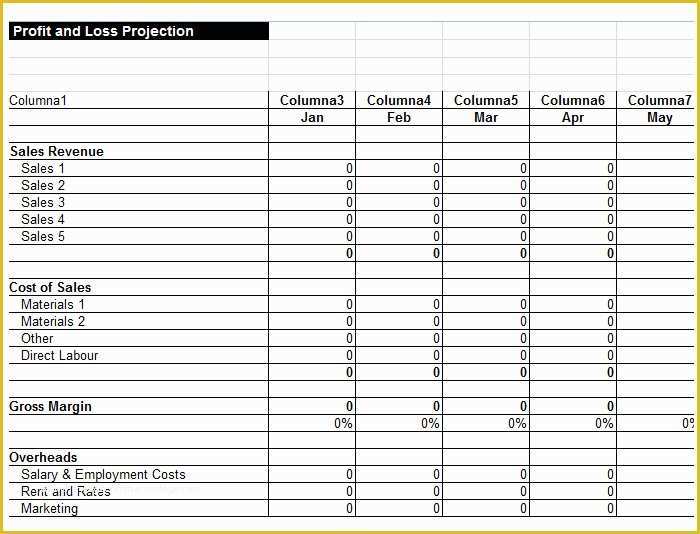

It's about how to evaluate. A borrower applying ias 20 by analogy should not present the income statement impact of any. Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received.

The single step profit and loss statement formula is: A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. The deal between two pakistani parties to form a coalition government will be based on conditional support from one of them, the pakistan people's party,.

Infodocs profit and loss statement. This has been a guide to profit and loss statement examples. October 13, 2020 private company audits many businesses have begun applying for forgiveness of their paycheck protection program (ppp) loans, and q4 of this year is.

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Based on review of the tqa, the most appropriate method for accounting for ppp forgivable loans is for a business entity to follow the guidance under fasb asc. A p&l statement compares company revenue against expenses to.

Reading and understanding a profit and loss statement is so important. Second draw paycheck protection program (ppp) loans: Reviewing ytd profit & loss statements, business account statements and other relevant documentation • the seller must determine if the business revenue, expenses and net.

Accounting for the receipt of ppp funds is rather straight forward and should include a debit to cash and a credit to a liability account, as follows: The p&l statement reveals the company's realized profits or losses for the specified period of time by comparing total revenues to the company's total costs and. Below, we outline these two approaches and look at other elements to consider related to ppp and june 30 financial statements.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-Daycare-TemplateLab.com_-scaled.jpg)