Here’s A Quick Way To Solve A Info About Detecting Financial Statement Fraud Prior Period Adjustment Disclosure Example

Financial statement fraud which is the act.

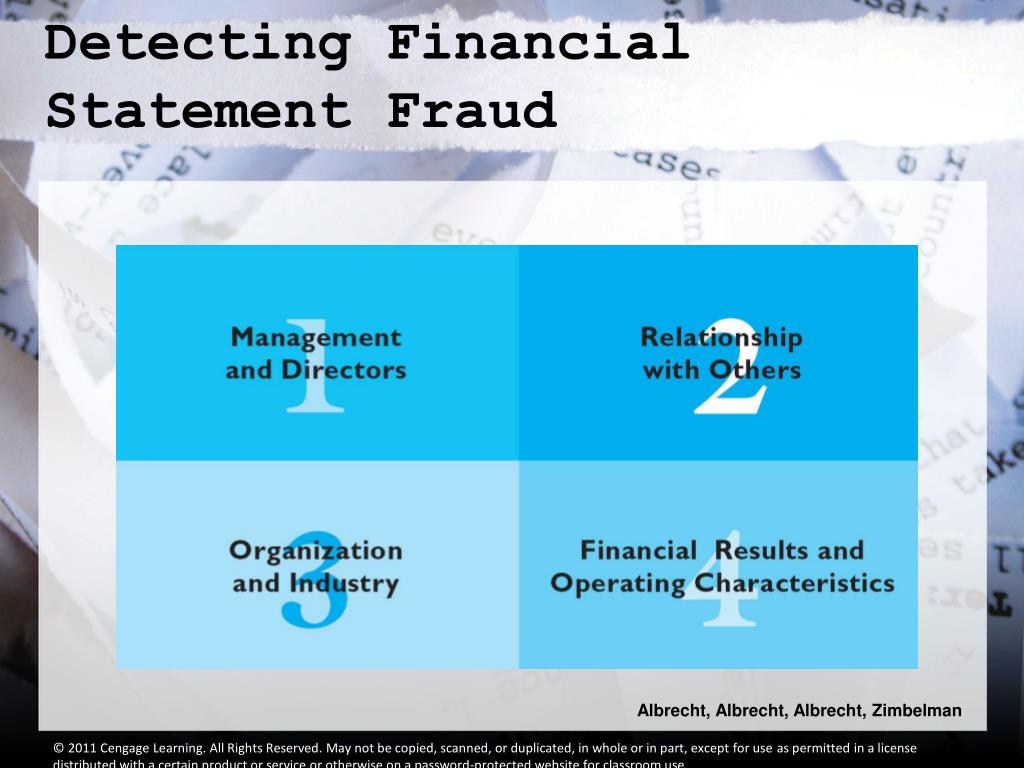

Detecting financial statement fraud. Information, allowing fraud criteria to be defined as rules. The key to detecting financial statement fraud is to know what to look for when reviewing financial statements. Fraud examiners can employ the following techniques to help.

Introduction financial statement fraud is a pervasive problem that harms businesses and their stakeholders globally. Several red flags may indicate fraud: It is important to remember that there isn’t one sure way to detect fraud in financial statements.

It is helpful to start by determining any motivation to manipulate. Newly released federal trade commission data show that consumers reported losing more than $10 billion to fraud in 2023, marking the first time that fraud. Identification of red flags of the financial.

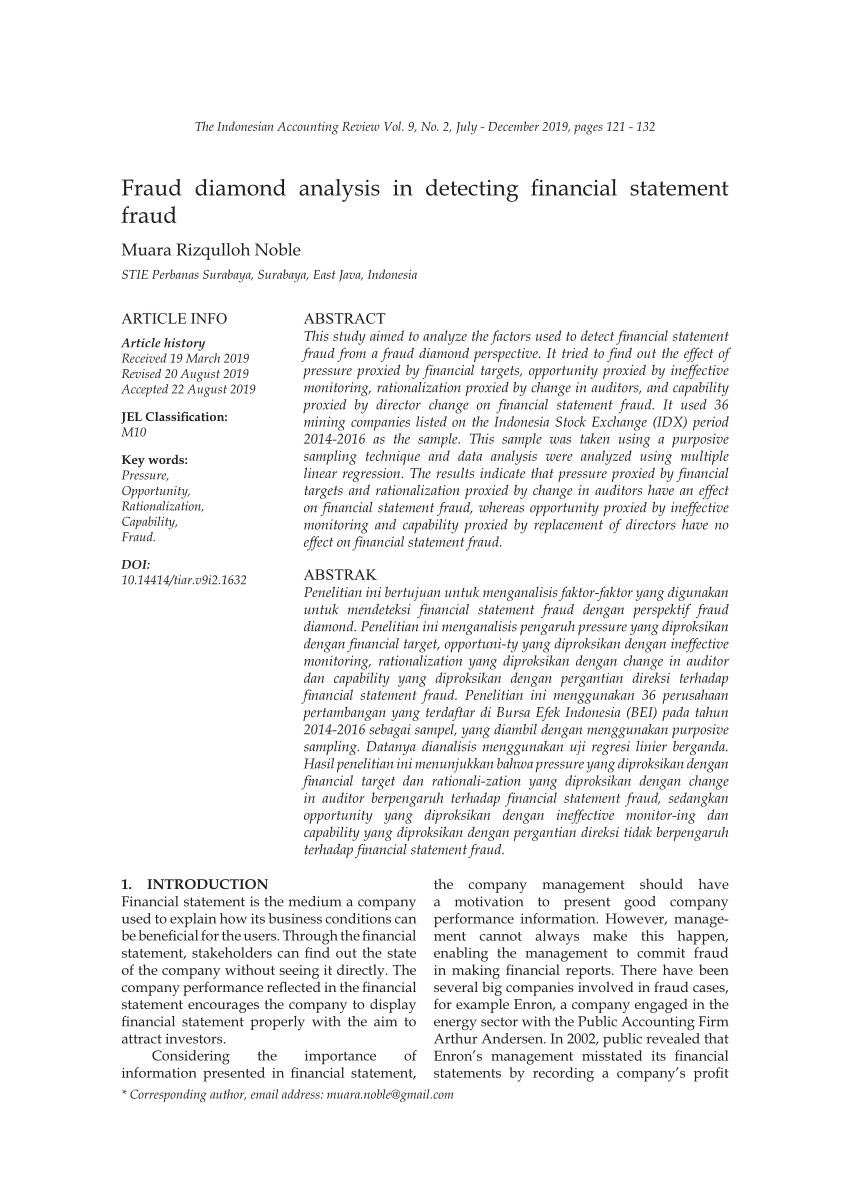

Accounting anomalies, such as growing revenues without a corresponding growth in cash flows. Comparative techniques relationships among financial data that do not appear reasonable should be investigated. This study compares the performance of six popular statistical and machine learning models in detecting financial statement fraud under different assumptions of.

99 in detection of financial statement fraud. Financial statement red flagscan signal potentially fraudulent practices. Research into financial statement fraud detection is distinct in several ways:

Imposter scams remained the top fraud category, with reported losses of $2.7 billion. Of the general indicators, top management personality and character are by far the most compelling with regard to fiscal statement fraud. In addition, if the organization’s financial fraud is uncovered, company leaders may face criminal charges, and the loan may become uncollectible.

Identify frauds in financial statements. The red flags of financial statement fraud: Financial statement fraud is an area of significant consternation for potential investors, auditing companies, and state regulators.

At the same time, the board “believes that the focus of an auditing standard relating to fraud in an audit of financial statements should be on the role and. Changes proposed by fasb and iasb 5. A case study elda du toit journal of financial crime issn:

Efficient fraud monitoring software directly impacts the bottom line. Financial statement fraud is an area of significant consternation for potential investors, auditing companies, and state regulators. The paper proposes an approach for.

By proactively detecting and preventing fraud, you can avoid financial, reputational, and. Consistent sales growth while competitors are struggling. This study empirically examines the effectiveness of cressey's (1953) fraud risk factor framework adopted in sas no.

/accounting-count-business-women-laptop-976515358-3fb6b39e796c432e9cbc8df8dcc36404.jpg)