Nice Info About Loss On Disposal Account Forensic Audit Report Under Ibc

A controversial incinerator plan has been given the go ahead by the government despite hundreds of objections.

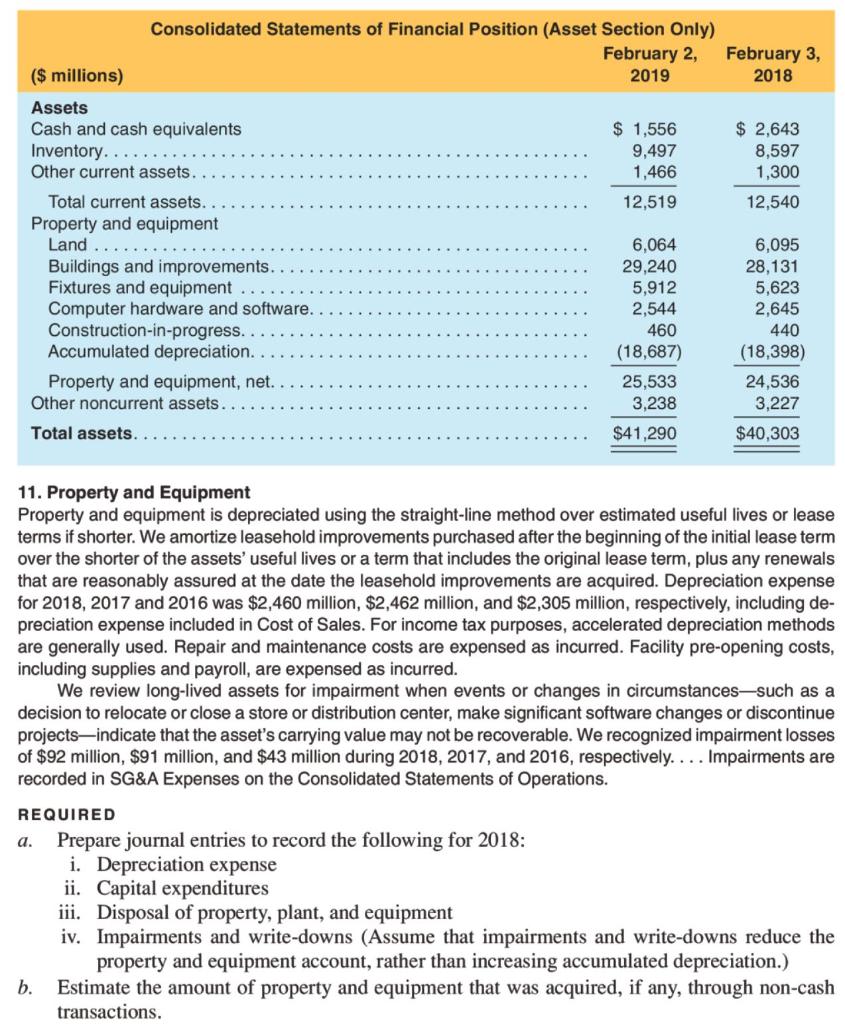

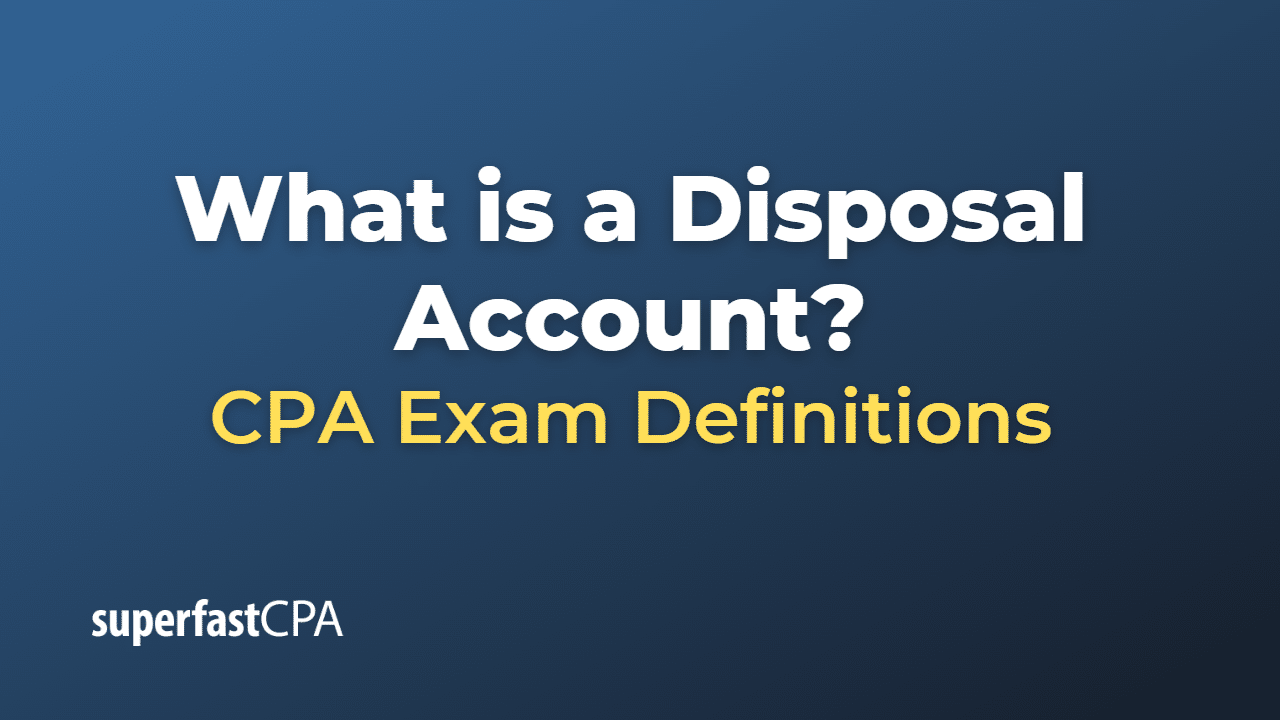

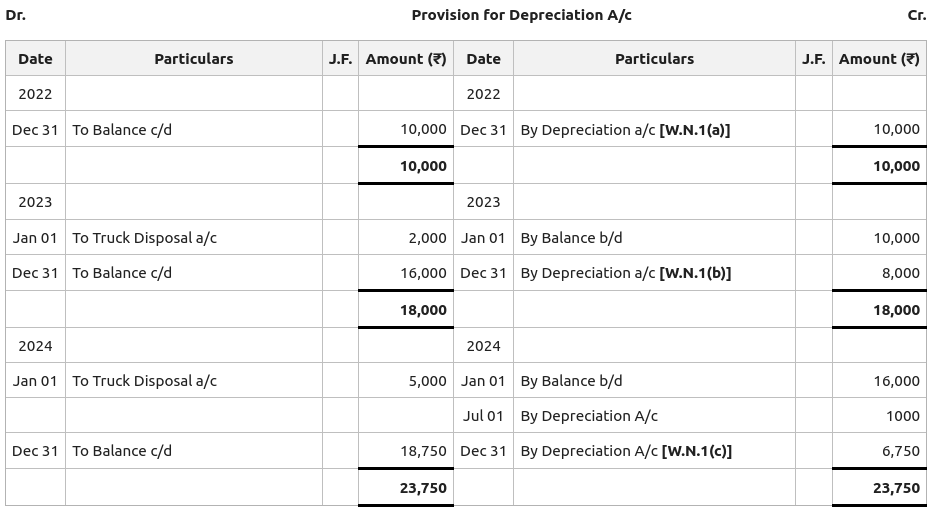

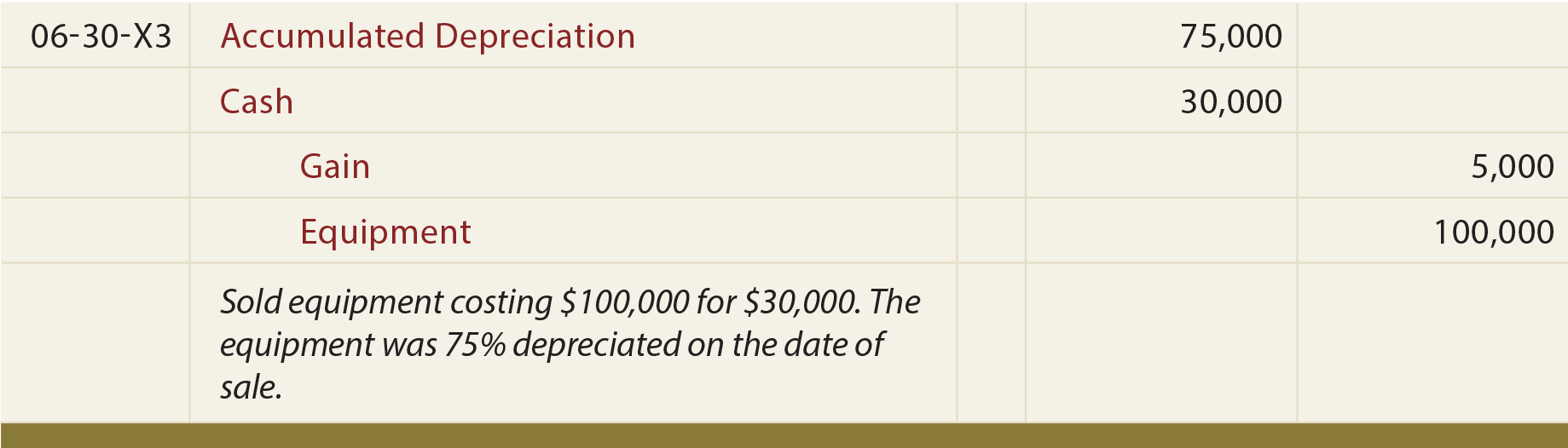

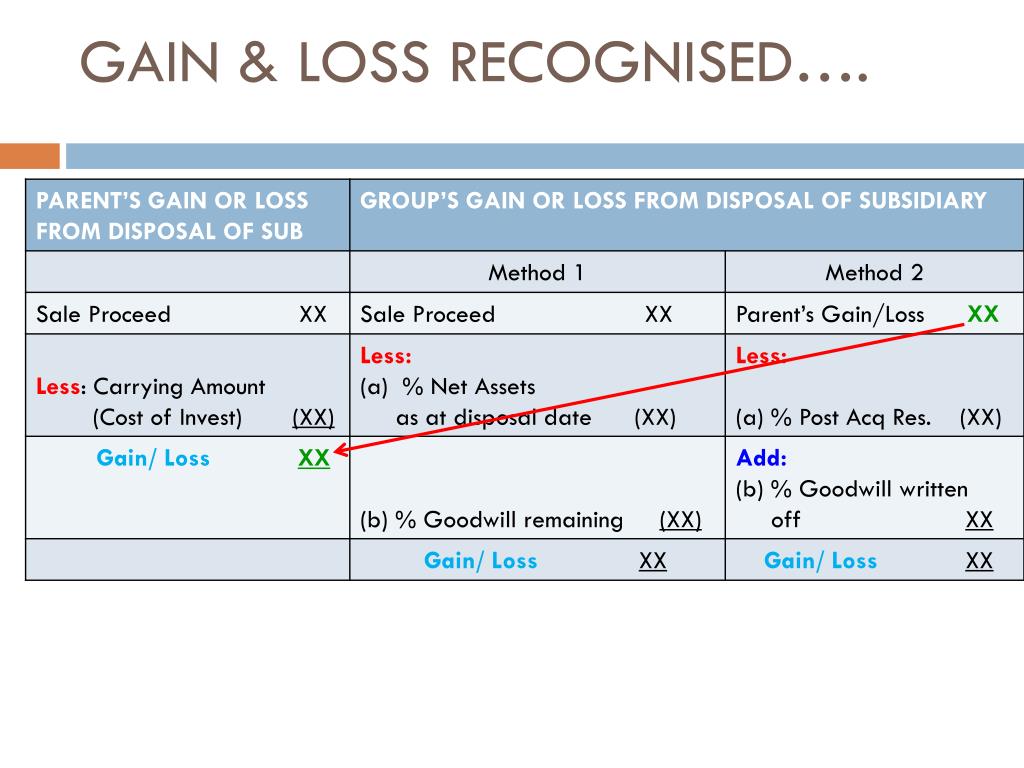

Loss on disposal account. Or a expense account or link the loss on disposal back to fixed. The options for accounting for the disposal of assets are noted. Step 2 transfer the two amounts to the disposal account.

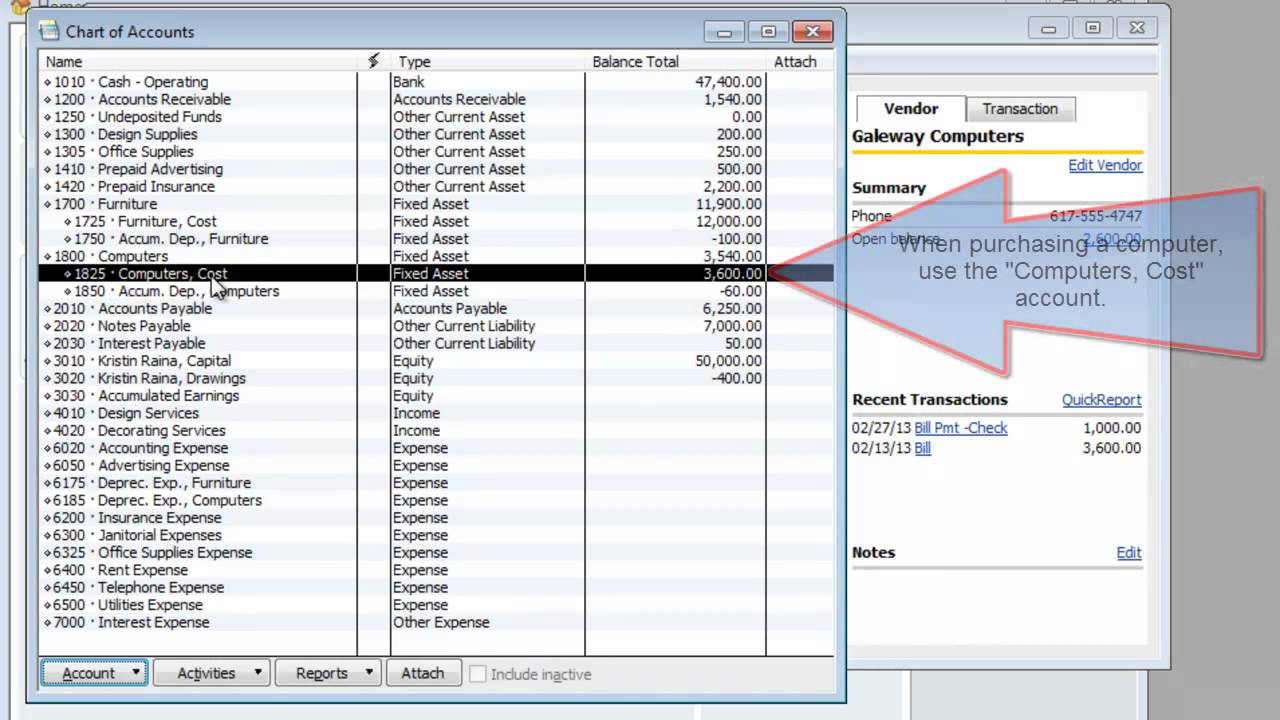

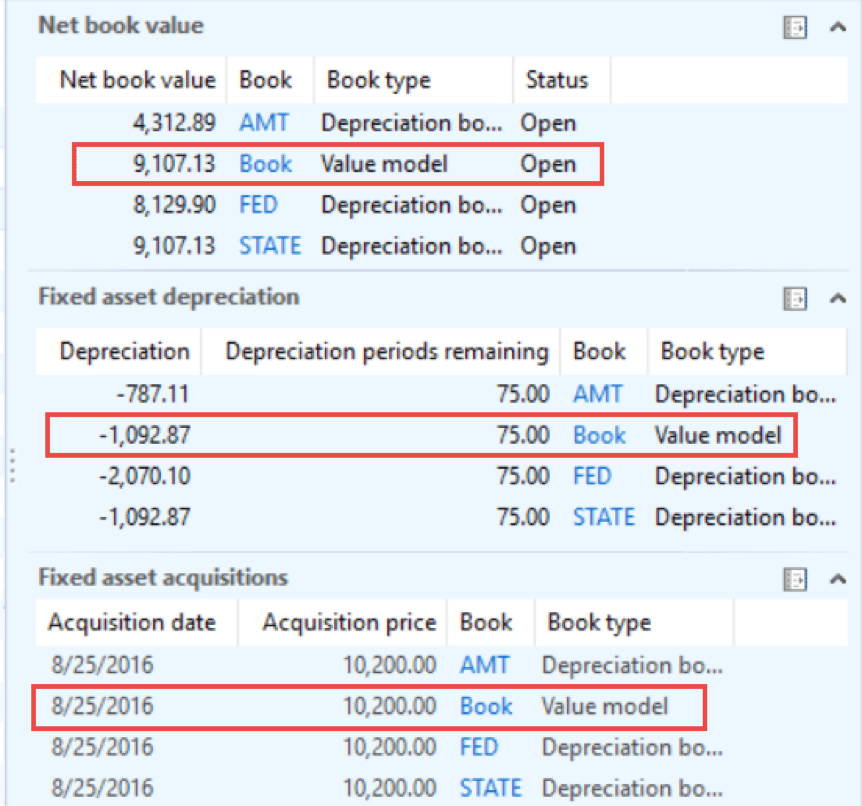

You need to calculate two values when accounting for asset disposal: Overview select default accounts to record any gains or losses when you sell or dispose of fixed assets. In all scenarios, this affects the balance sheet by removing a capital asset.

Selling an asset for its. The goal of recording your gains, losses or full depreciation is to show all monetary values related to the sale or disposal of your asset. Step 1 open a disposal account.

There were no revenues, expenses, or gains, but there was a loss of. How gains and losses are calculated when you sell an asset for more or less than its book value, xero calculates the gain or loss on disposal and asks you which account to post. The tax side of the disposal shows in the tax disposal schedule.

The georgia election subversion case against donald trump and 14 of his allies took a stunning turn thursday when two top prosecutors testified under oath about. How do you account for disposal of assets? The assets used in the business can be sold anytime during their useful life.

A disposal account is a gain or loss account that appears in the income statement, and in which is recorded the difference between the disposal proceeds and. When the carrying amount exceeds the proceeds, a loss on disposal is recognised. The large development will be built in the medworth area.

If an “asset disposal” account shows debit balance it means loss has been incurred on the disposal of the fixed asset whereas credit balance in the account. Entries to be completed to the. It is not necessary to keep an asset until it is scrapped.

Fixed assets must be removed from the balance sheet when the asset is disposed of, such as sold, exchanged, or retired from operations. What you need to know select the account codes to record any gains or. 4) there will be a profit or loss arising from such disposal.

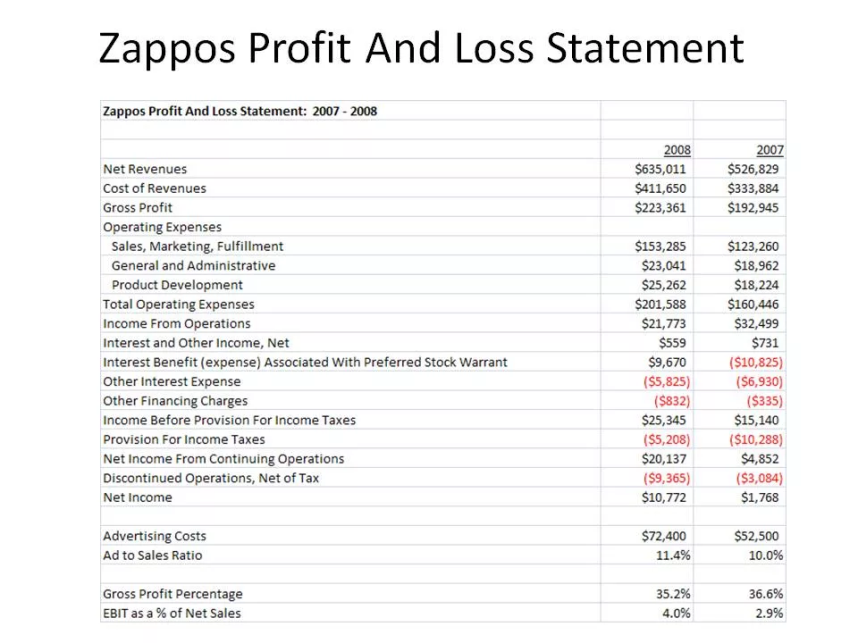

Let's review the cash flow statement for the month of july 2022: The accounting for disposal of fixed assets can be summarized as follows: Net income for july was a net loss of $180.

The asset disposal results in a direct effect on the company’s financial statements. A researcher in the area of reproduction with a specialism in reproductive loss, recent work has extended robson and walter’s concept of hierarchies of loss to include. Record cash receive or the receivable created from the sale: