Brilliant Tips About Statement Of Trust Income Allocations And Designations Cash Overdraft Balance Sheet

Invalid tin# 3) is capital gains (box 21/a) distribution nr taxable?:

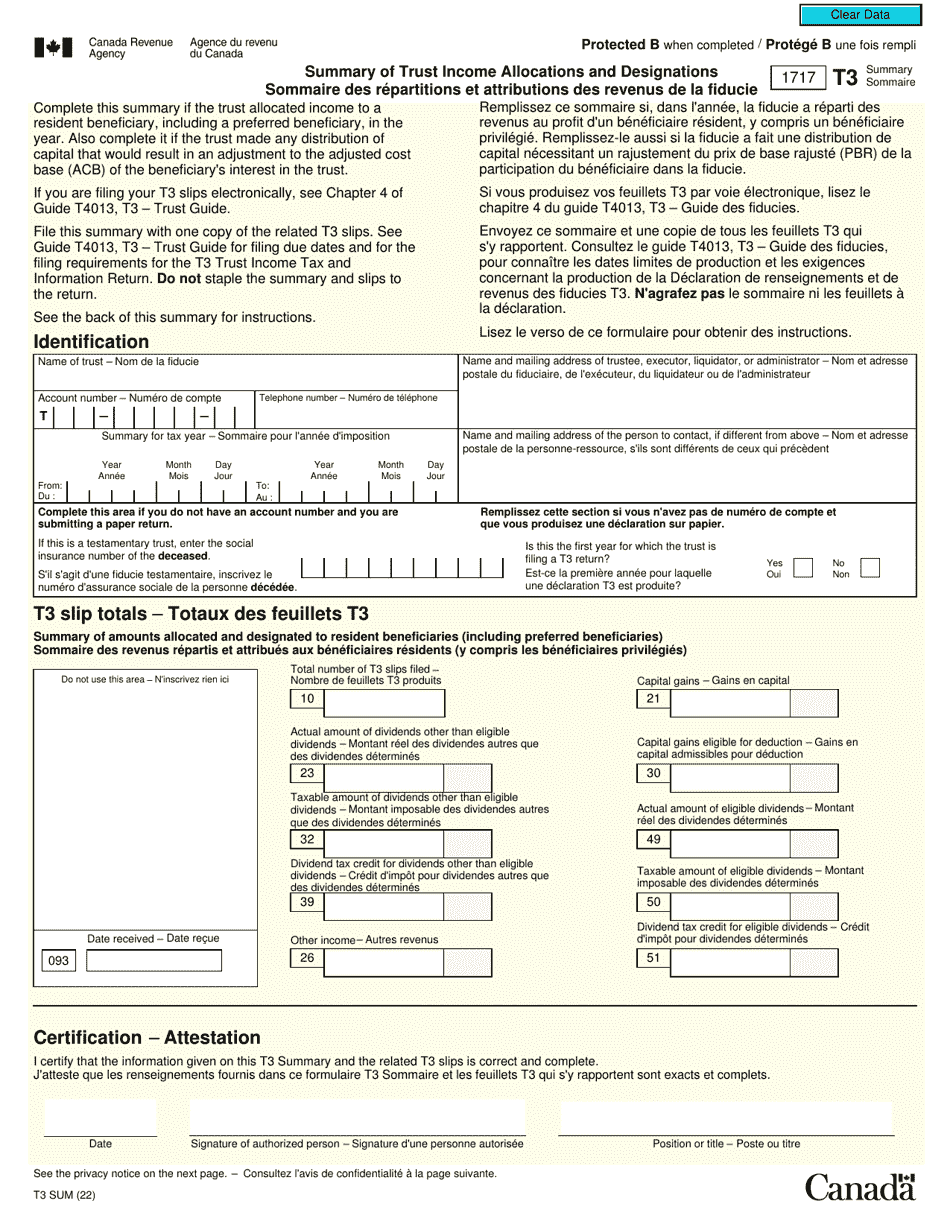

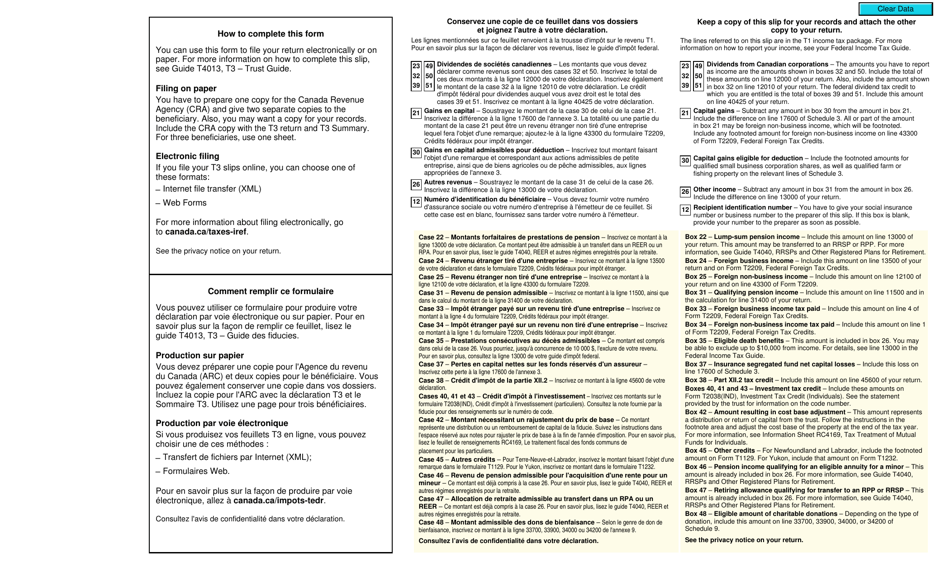

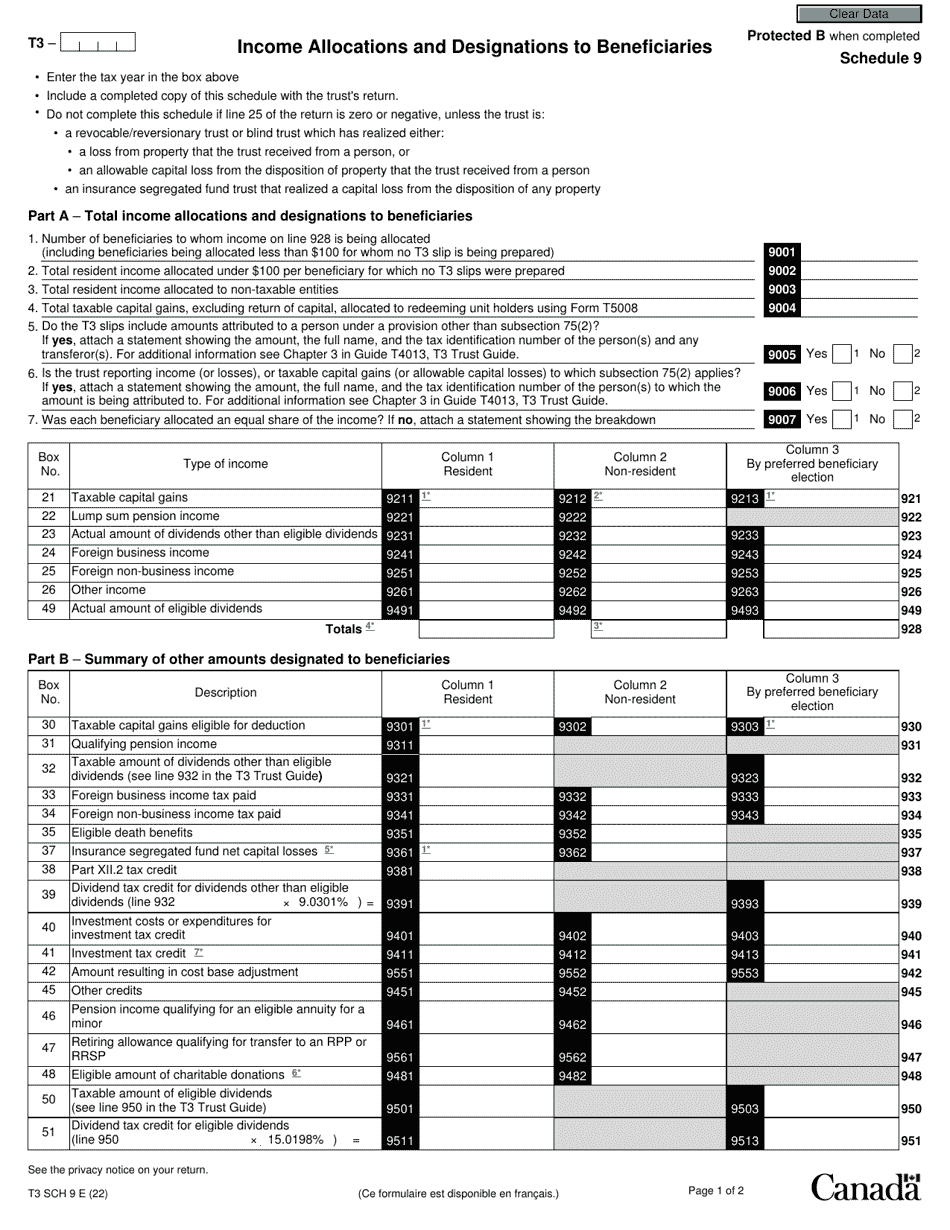

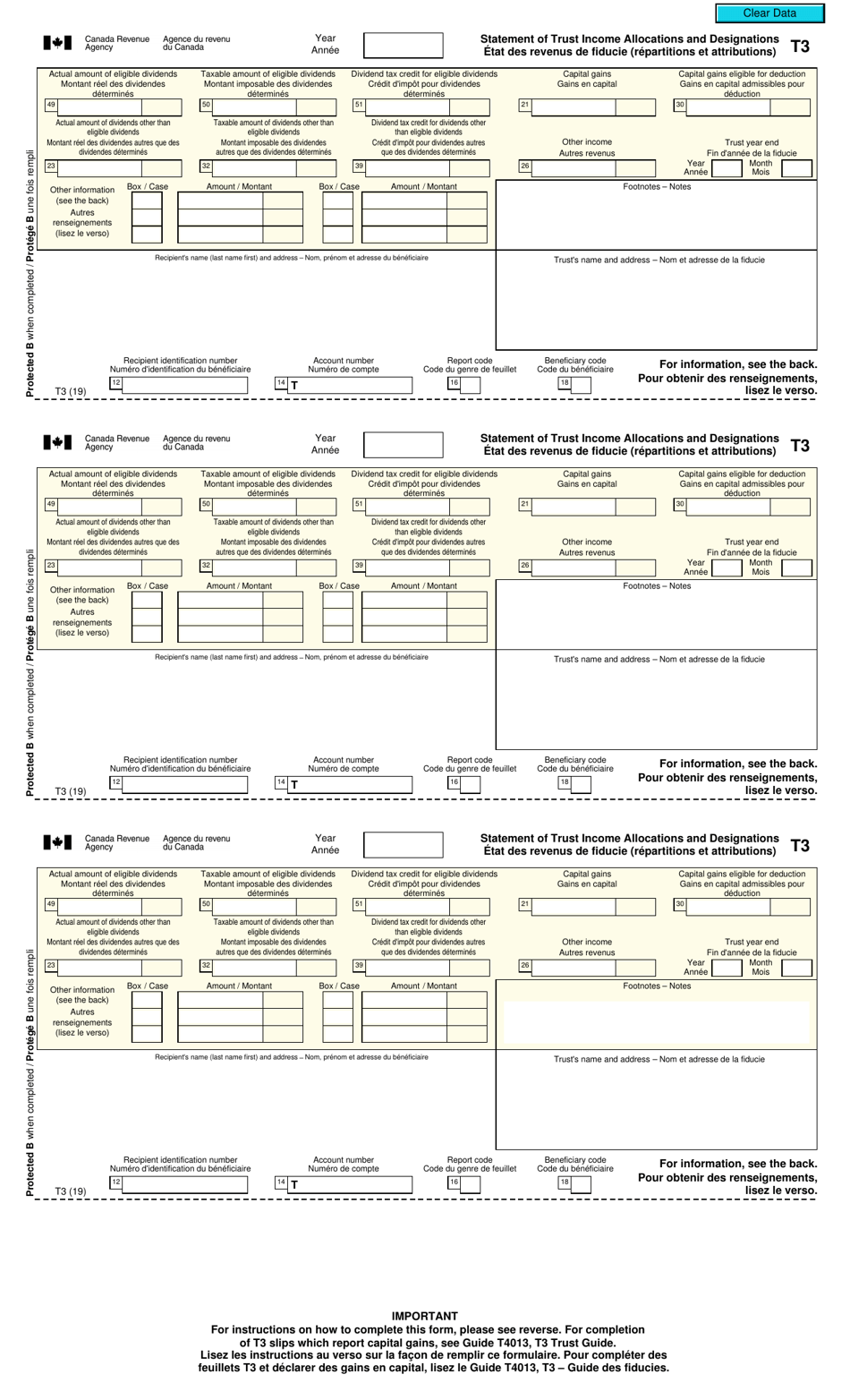

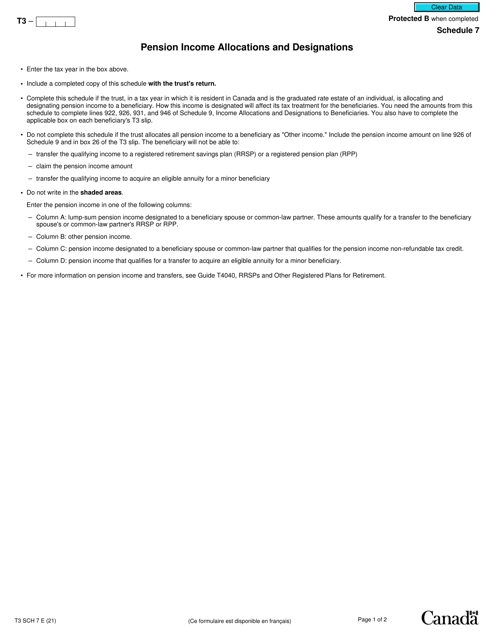

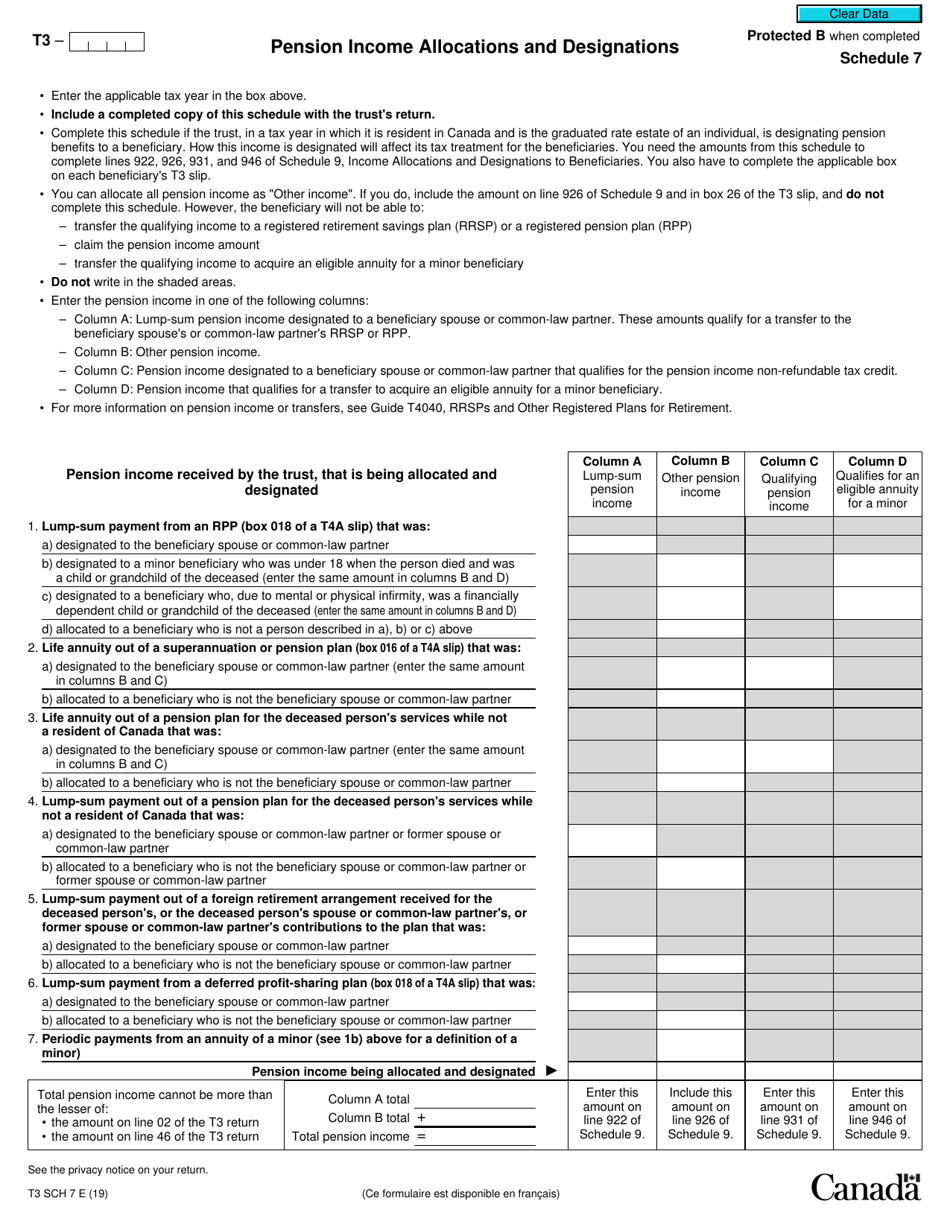

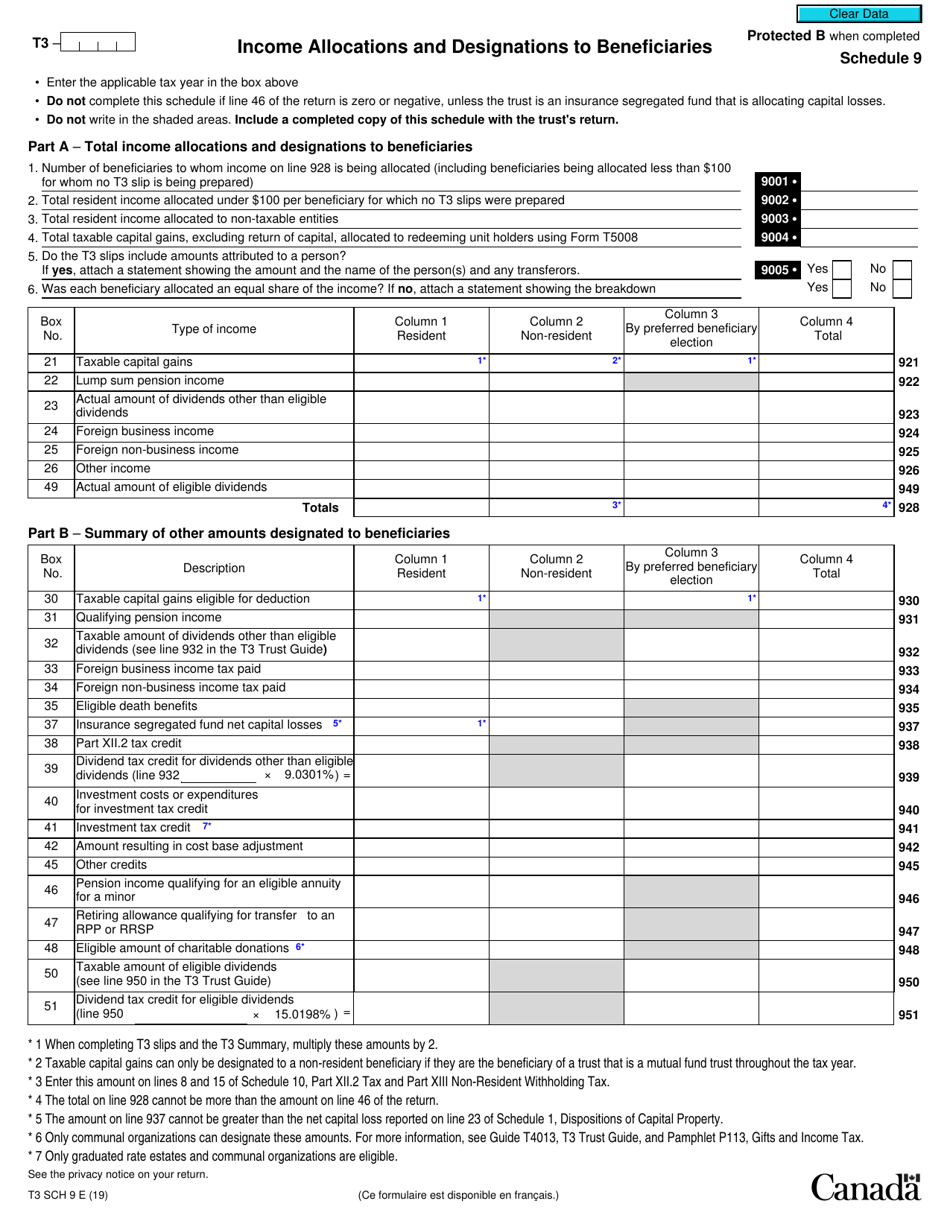

Statement of trust income allocations and designations. Was the trust involved in any corporate action(s) that could. Statement of trust income allocations and designations slip shows income allocated to you, as a beneficiary, by a trust (such as a personal or estate trust). In this guide, you will find information on how to complete the t3 trust income tax and information return, the t3 slip, statement of trust income allocations and.

Statement of trust income allocations and designations address (1): Also complete it if the trust made any distribution of capital that would result. Statement of trust income allocations and designations slip shows income allocated to you, as a beneficiary, by a trust (such as a personal or estate trust).

Was the trust involved in any corporate action(s) tha t. Statement of trust income allocations and designations address (1): This guide provides information on how to complete the t3 return, the t3 slip, statement of trust income allocations and designations, and the t3sum summary of trust.

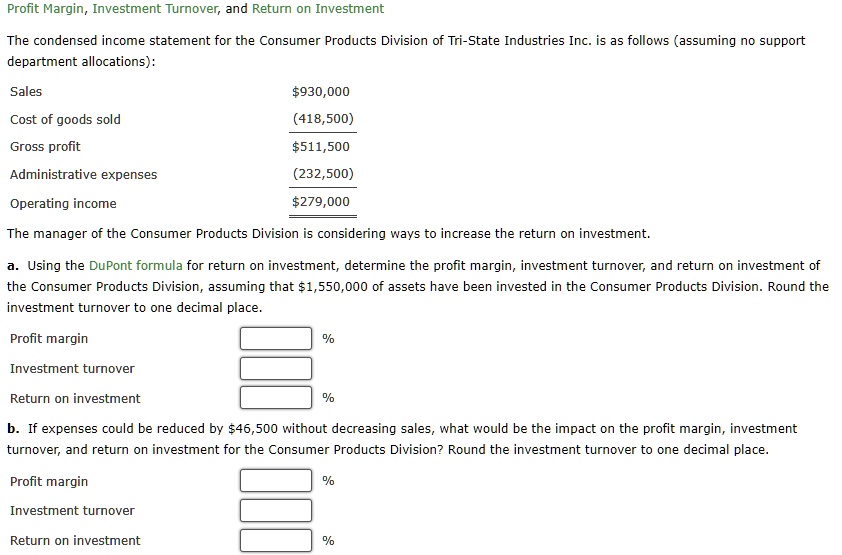

Total income ($) per unit being allocated 0.22700 0.22700 0.22700 0.22700 0.22700 0.22700. Statement of trust income allocations and designations slip will show the investment income you earned in the form of dividends, interest, and capital gains, from. Choice reit determined an income allocation of the regular distribuions and applied the allocation on an annualized basis as follows:

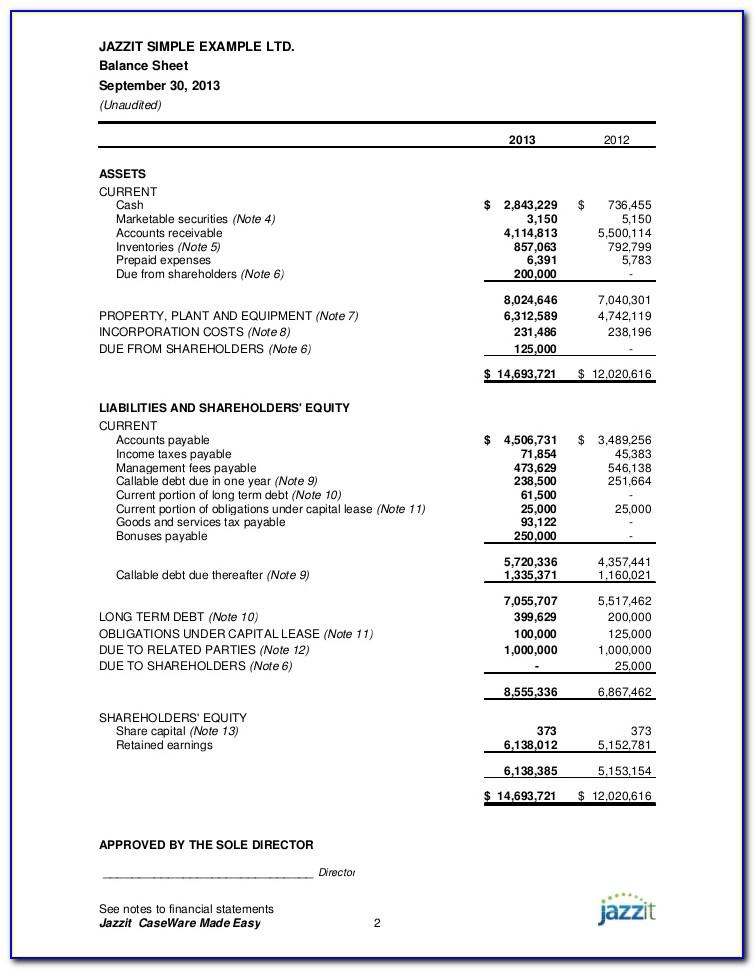

Total income ($) per unit being allocated 0.11750 0.11750 0.11750 0.11750 0.11750 0.11750 0.11750 0.11750 0.11750 0.11750 0.11750 0.11750. The t3sum provides a concise overview, while the statement and schedules offer detailed breakdowns of income and allocations. The t3 form is used by administrators for the t3 statement of trust income allocations and designations.

Po box 159, td centre, royal trust tower toronto ontario can m5k 1h1. Other income 94.78%, capital gains. Complete this summary if the trust allocated income to a resident beneficiary in the year.

Accordingly, choice reit determined an income allocation for each taxation year and applied the allocation to the respective distribution periods as follows: