Outrageous Tips About Purpose Of Trial Balance In Accounting What Is A Profit And Loss Budget

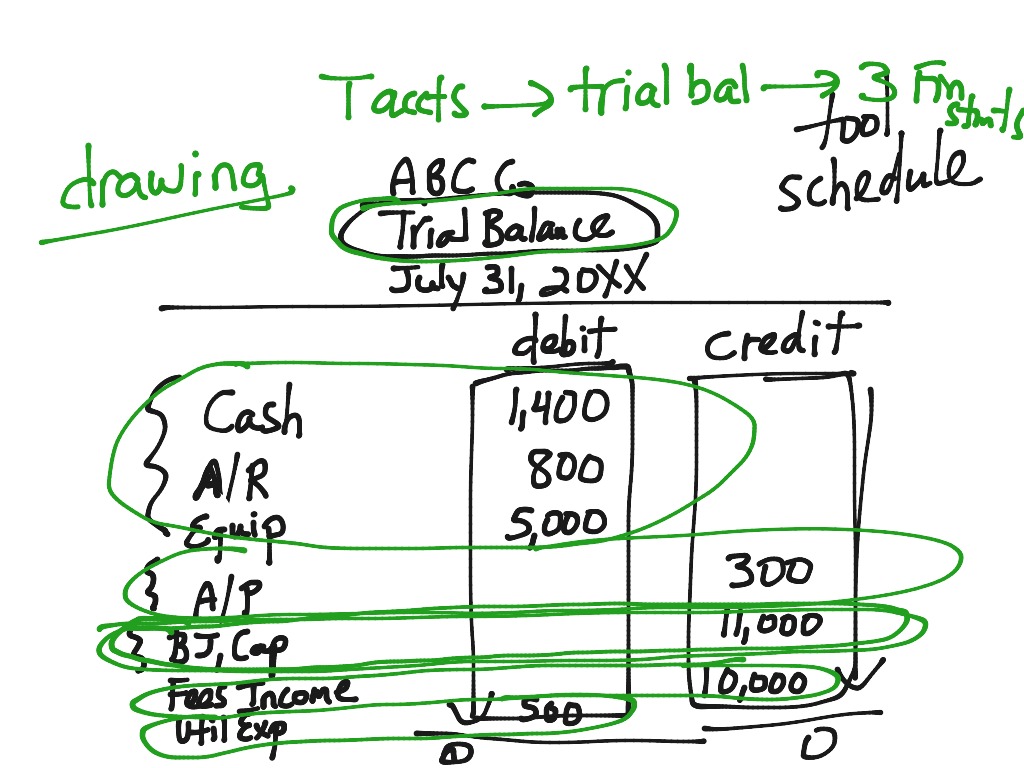

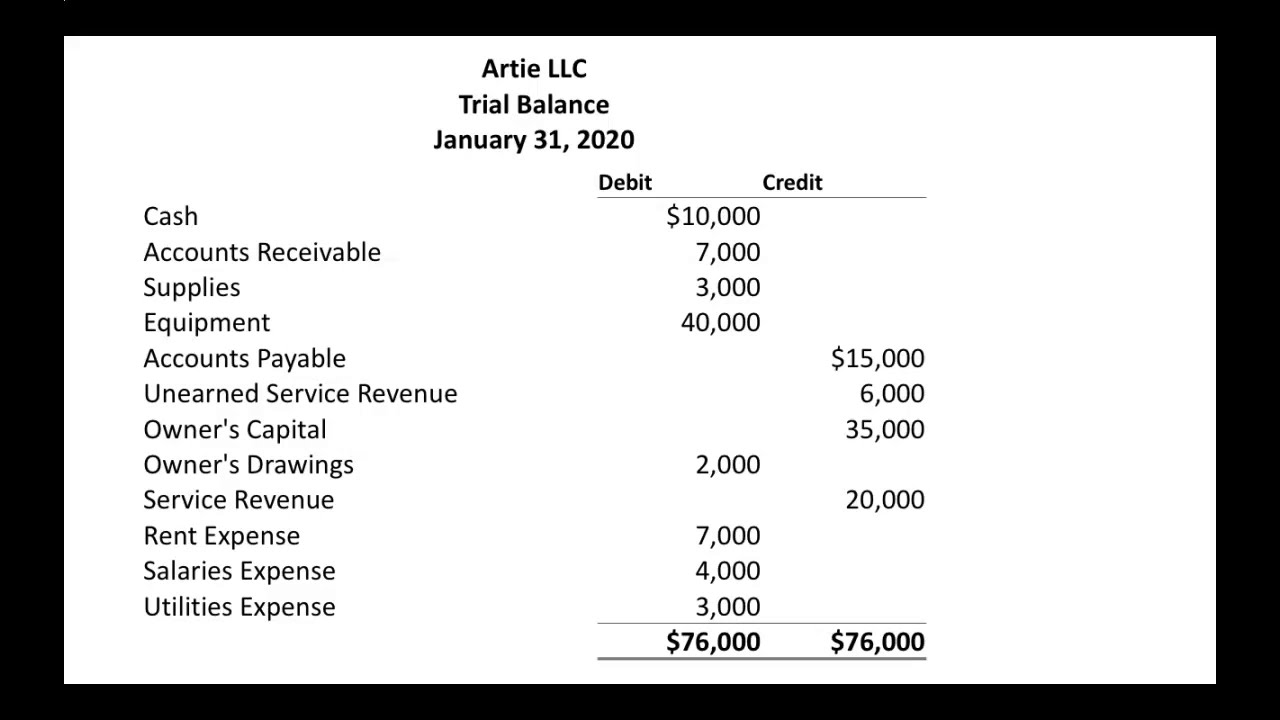

Purpose of a trial balance trial balance acts as the first step in the preparation of financial statements.

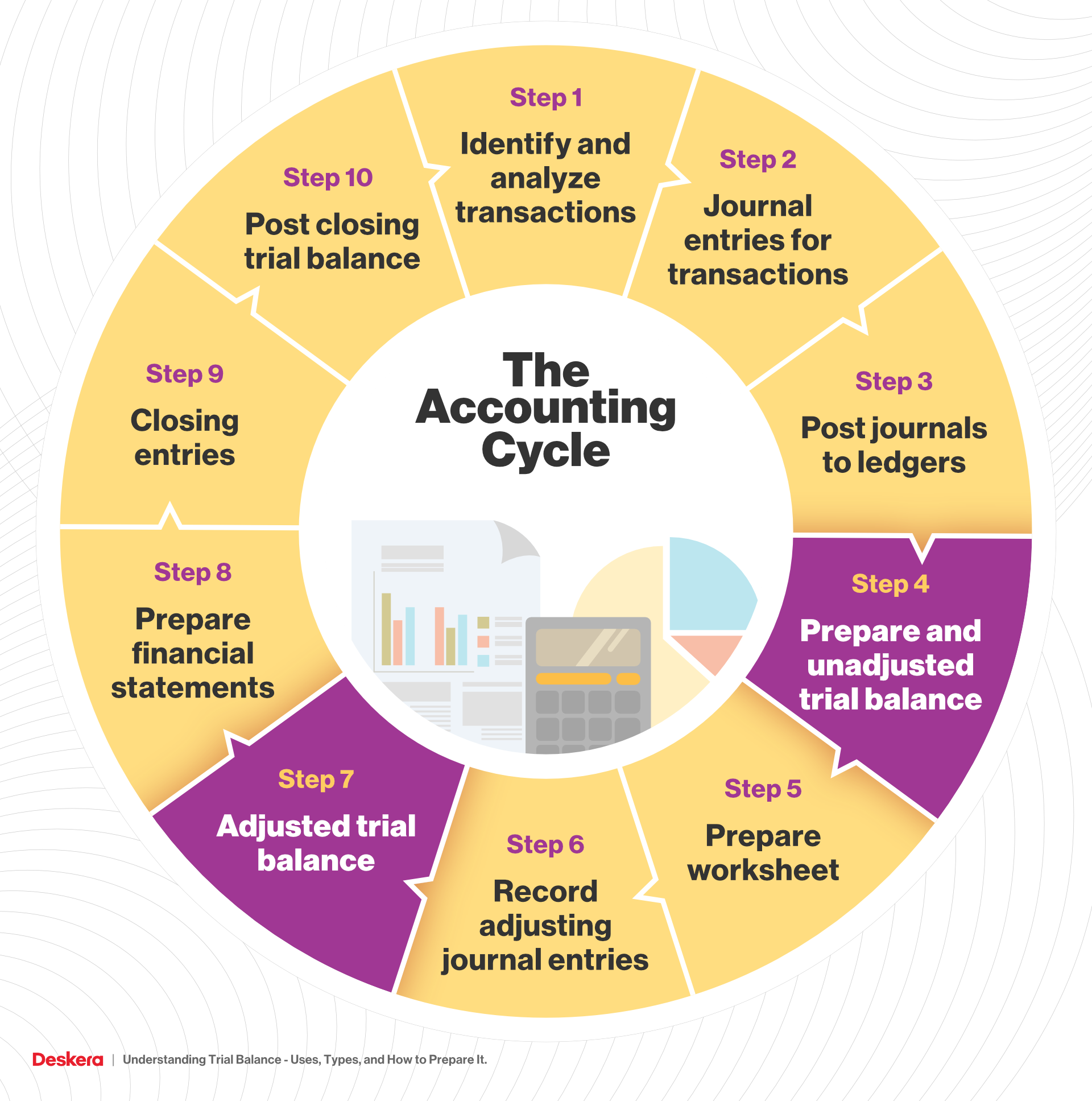

Purpose of trial balance in accounting. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. It serves several key objectives: These additional details in a general ledger reveal account activity during a certain accounting period, which makes it easier to conduct research and recognize possible.

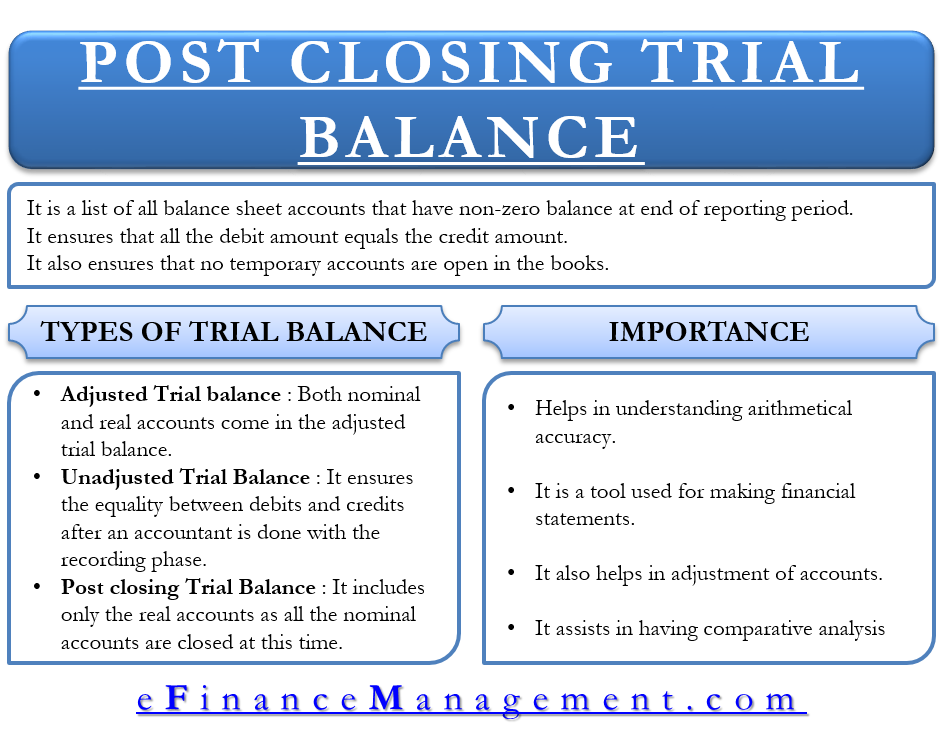

Trial balance is a crucial tool used in accounting to ensure that debits and credits are balanced, helping to detect errors in financial statements. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. The report is primarily used to ensure that the total of all.

What’s the role of a trial balance in accounting? It’s primarily used to verify that the total of all debits equals the total of all credits, which means the company’s accounts are balanced. It involves listing all the general ledger accounts and totaling the debit and credit values to ascertain if.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. It is a statement of debit and credit balances that are extracted on a specific date. The purpose of a trial balance is to ensure the accuracy and completeness of a company’s accounting records.

The purpose of a trial balance is to ensure that all entries made into an organization's general ledger are properly balanced. The trial balance is an accounting report that lists the ending balance in each general ledger account. Trial balance is the steppingstone for preparing all the financial statements such as trading and profit & loss account, balance sheet etc.

Importantly, the trial balance is not an account. The purpose of doing this is to determine the balance between credit and debit amounts on record. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

The role of a trial balance in accounting is to help accountants detect some errors when total debits don’t equal total credits for all balance sheet accounts and income statement accounts (including revenues, costs, expenses, gains, and losses). The main purpose of the trial balance is the ensure that the financial statements are correctly prepared by ensuring that all of the accounting entries that are recorded during the period are correctly recorded in accordance with the rule of debit and credit. Trial balance is the statement or the record that lists down all of the closing account ledgers of the entity for a specific period of time.

This statement comprises two columns: Those ledgers are present in debit or credit based on the nature of accounts. A trial balance is so called because it provides a.

If the trial balance is in balance (total debits equal total credits), it indicates that the company’s books are in a preliminary state of accuracy, although it doesn’t guarantee the absence of errors. The report also assists with internal auditing, which can help you compare. The total dollar amount of the debits and credits in each accounting entry are supposed to match.

Trial balance is a useful accounting tool for the accounting process of listing ledger accounts along with their respective credit or debit accounts. Essentially, a trial balance is to be used internally, and the balance sheet is to share with external shareholders. Definition of trial balance in accounting as per the accounting cycle, preparing a trial balance is the next step after posting and balancing ledger accounts.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)