Underrated Ideas Of Info About Reconciliation Of Variable And Absorption Costing Net Income On Cash Flow Statement

Question 8.11 also requires a statement of equiv alent.

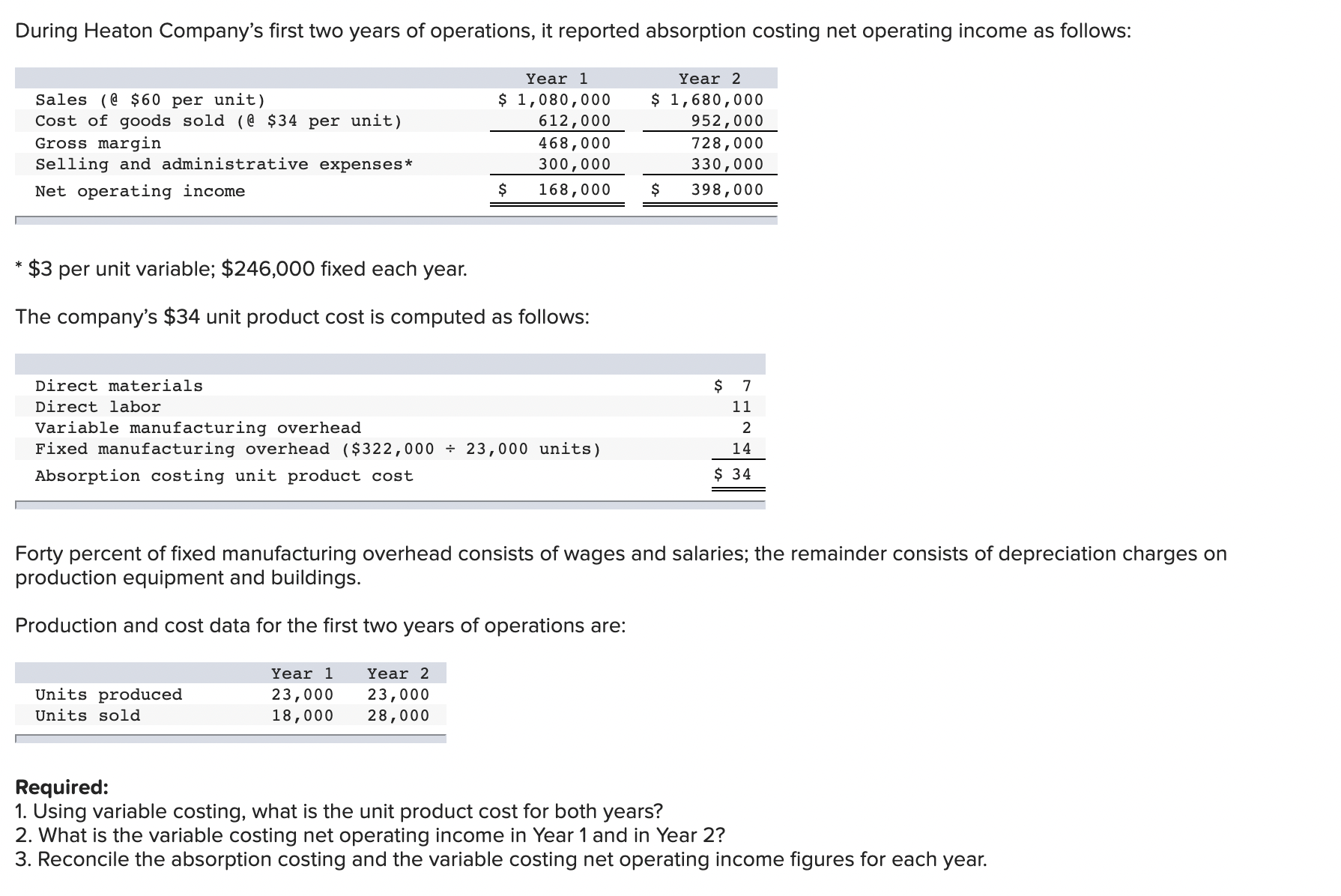

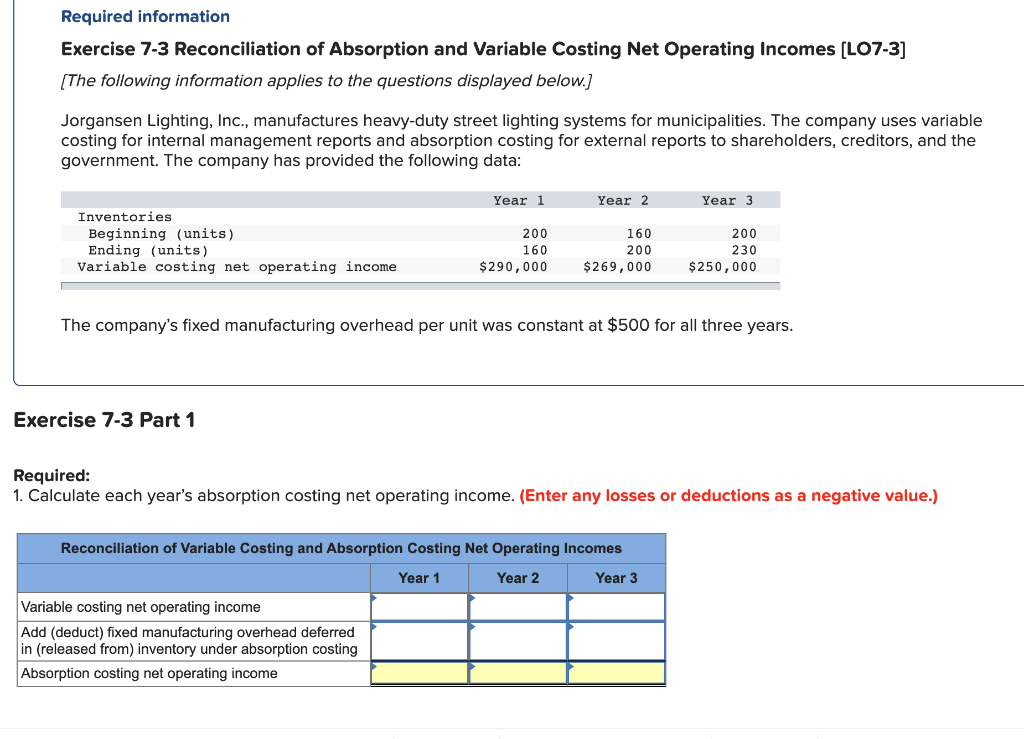

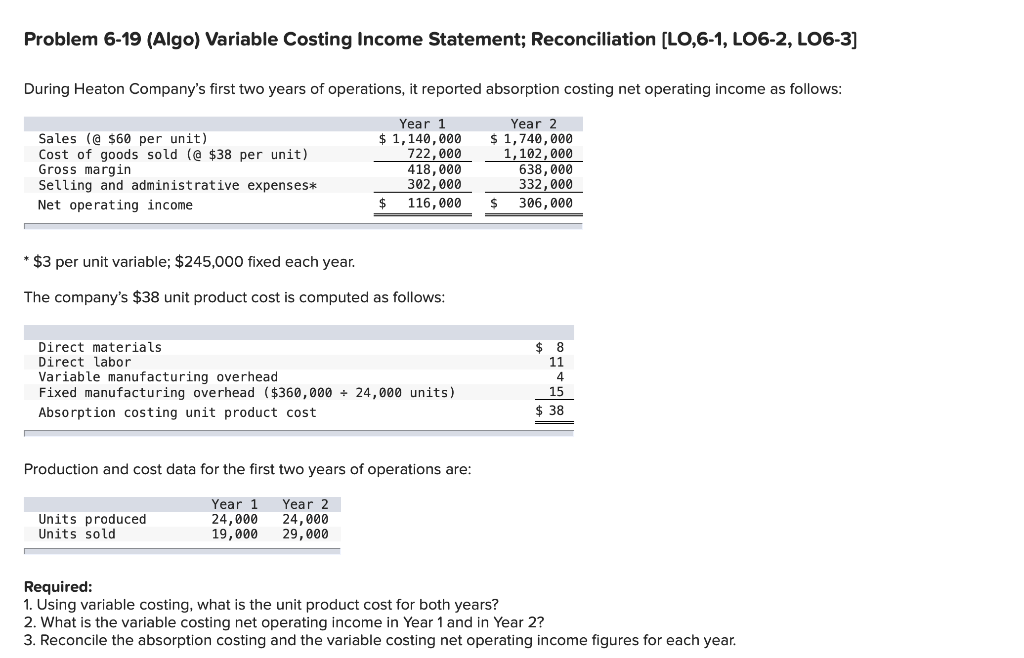

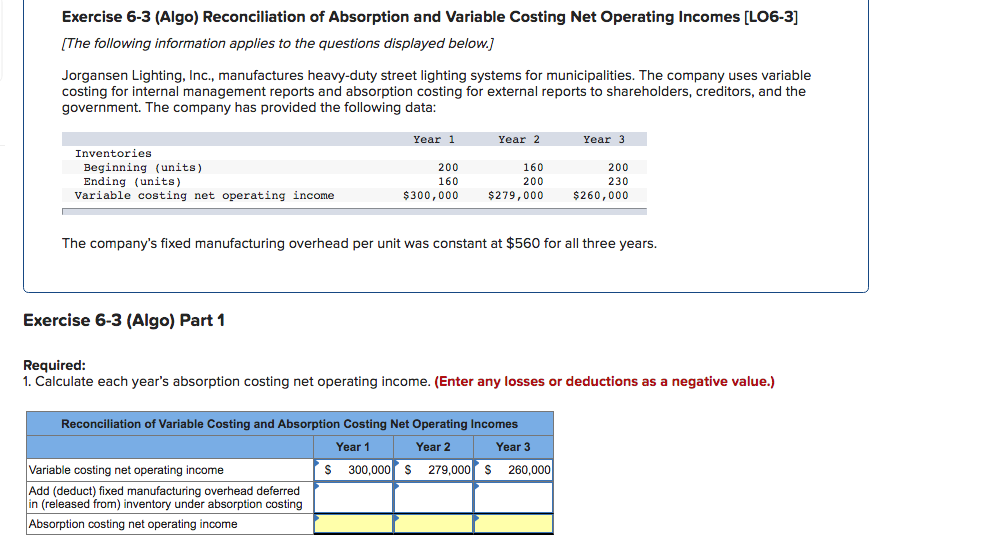

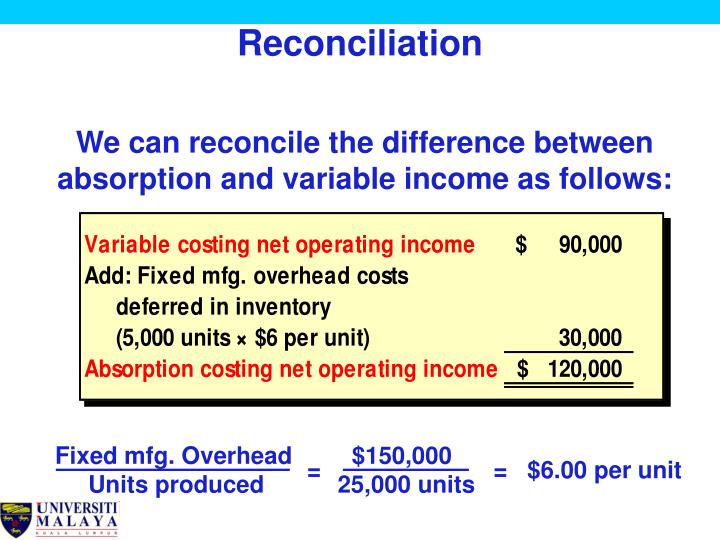

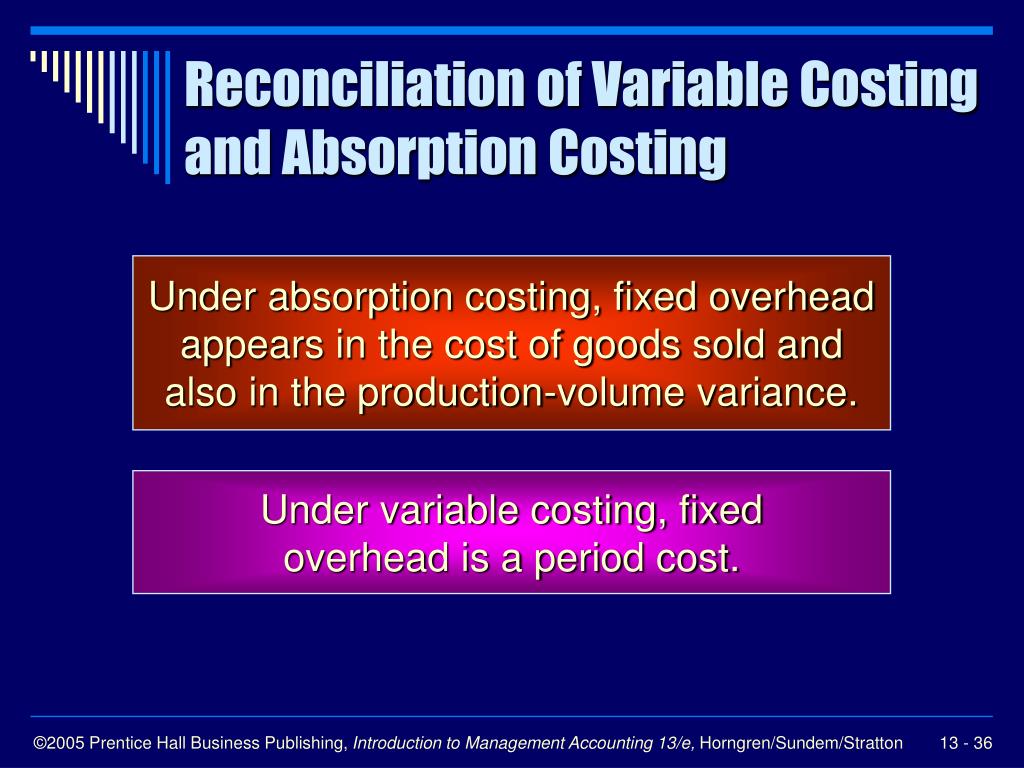

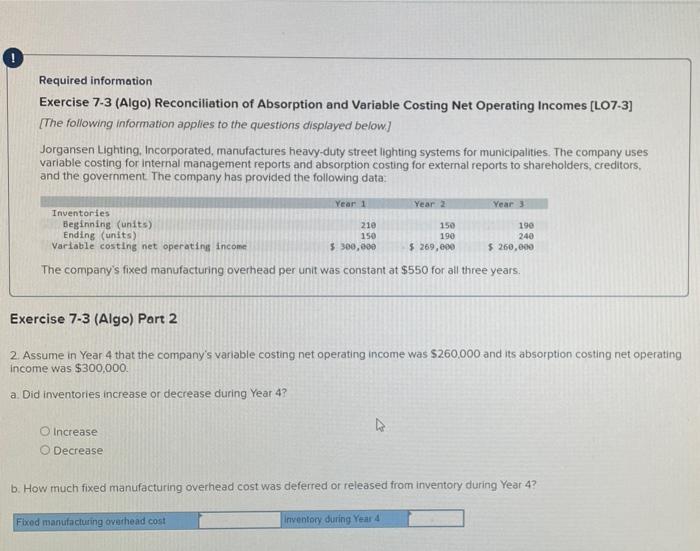

Reconciliation of variable and absorption costing. Net income under absorption costing can be reconciled with net income under variable costing by (a) subtracting the manufacturing overheads carried forward (absorbed by closing inventories) and (b) adding the manufacturing overheads brought in (absorbed by opening inventories). The reconciliation of absorption and variable costing follows: Step 1 reconciliation of variable costing and absorption costing net operating income:

View the full answer step 2 unlock step 3 unlock. Reconciliation of budgeted and actual profit. [($12+10+8) x 1,800] + $9,000 = $63,000.

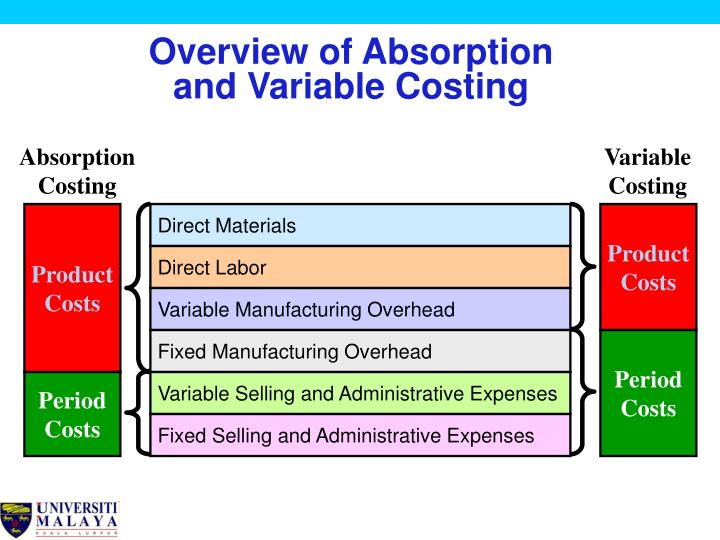

Reconcile profits under absorption as documented in the. C to both absorption costing and variable costing. The product costs under variable costing plus variable selling and administrative expenses.

B only to variable costing. Suppose we look at the example discussed above. An introduction to acca ma e3a.

February 5, 2022 variable costing | internal costing | direct costing variable costing is also known as internal costing, direct costing and marginal. Absorption costing considers both fixed and variable manufacturing costs in valuing inventory. Example let's work with the data given in example.

Since top executives are usually evaluated based on external reports to shareholders, they may feel that decisions. A only to absorption costing. Determine which of the nine statements:

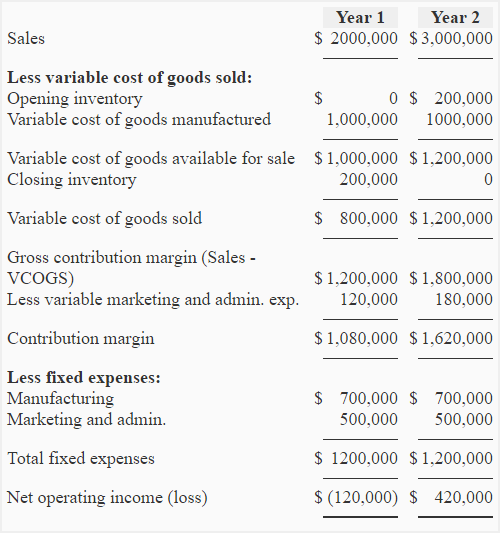

Net income under absorption costing can be reconciled with net income under variable costing as follows: Absorption costing is one approach that is used for the valuation of inventory or calculation of the cost of the product in the company where all the expenses incurred by the. Year 1 year 2 variable costing net operating income.

Both absorption and variable cost methods are based on the accrual concept of accounting. $40,000 $150, add (deduct) fixed manufacturing. Questions 8.7, 8.8, 8.10 and 8.13 require the reconciliation of absorption costing and vari able costing profits.

How much would each unit cost under both the variable method and the absorption method? *the variable costs include: When all units manufactured (15,000) are sold (15,000), operating income under absorption costing is the same as it is under variable costing, $100,000.

Variable costing separates variable and fixed manufacturing overhead, and using only variable costs allows them to make decisions based on the more reliable. Absorption costing must be used when filing income tax returns. The variable cost per unit is $22 (the total of direct material, direct.