First Class Info About Debt Ratio Balance Sheet Frs 102 Example Accounts 2019

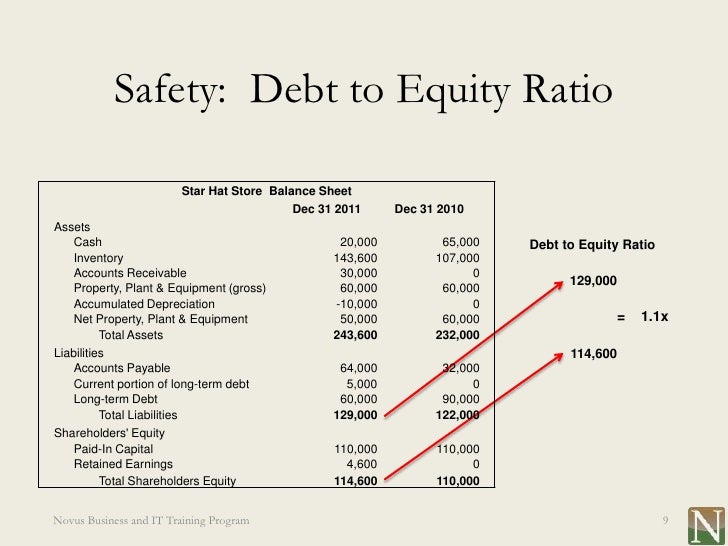

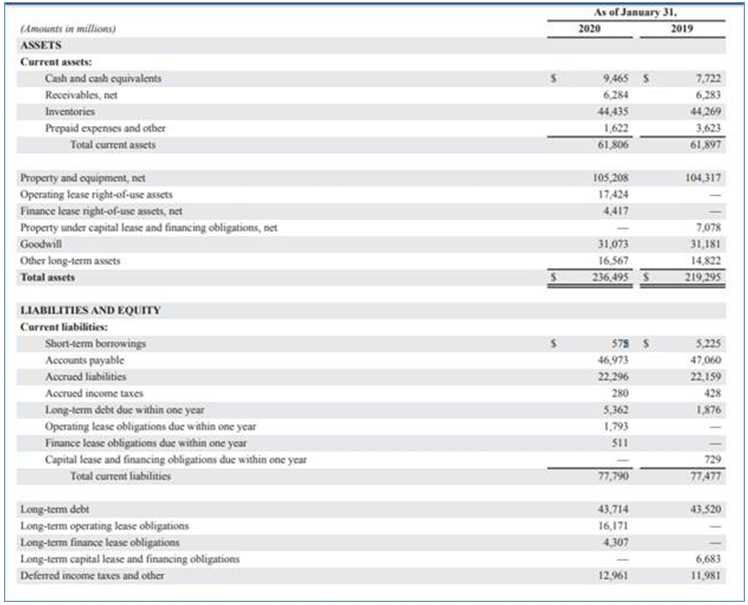

And while not all liabilities are funded debt, the equation does imply that all assets are funded either by debt or by equity.

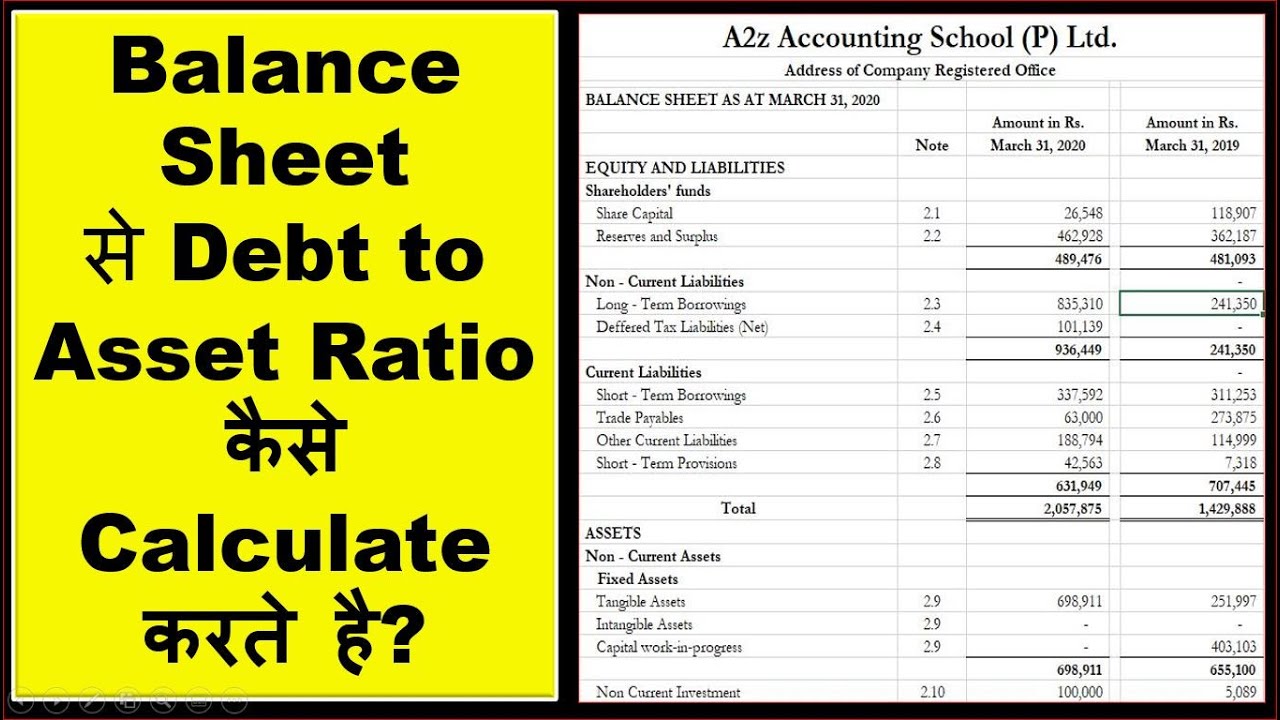

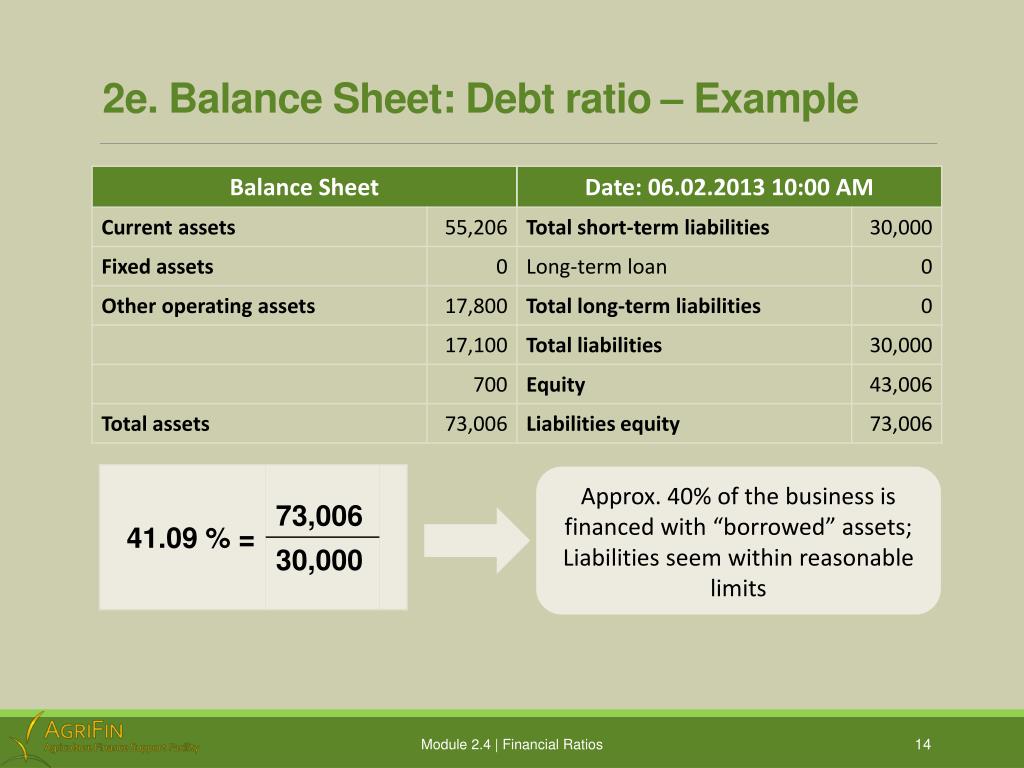

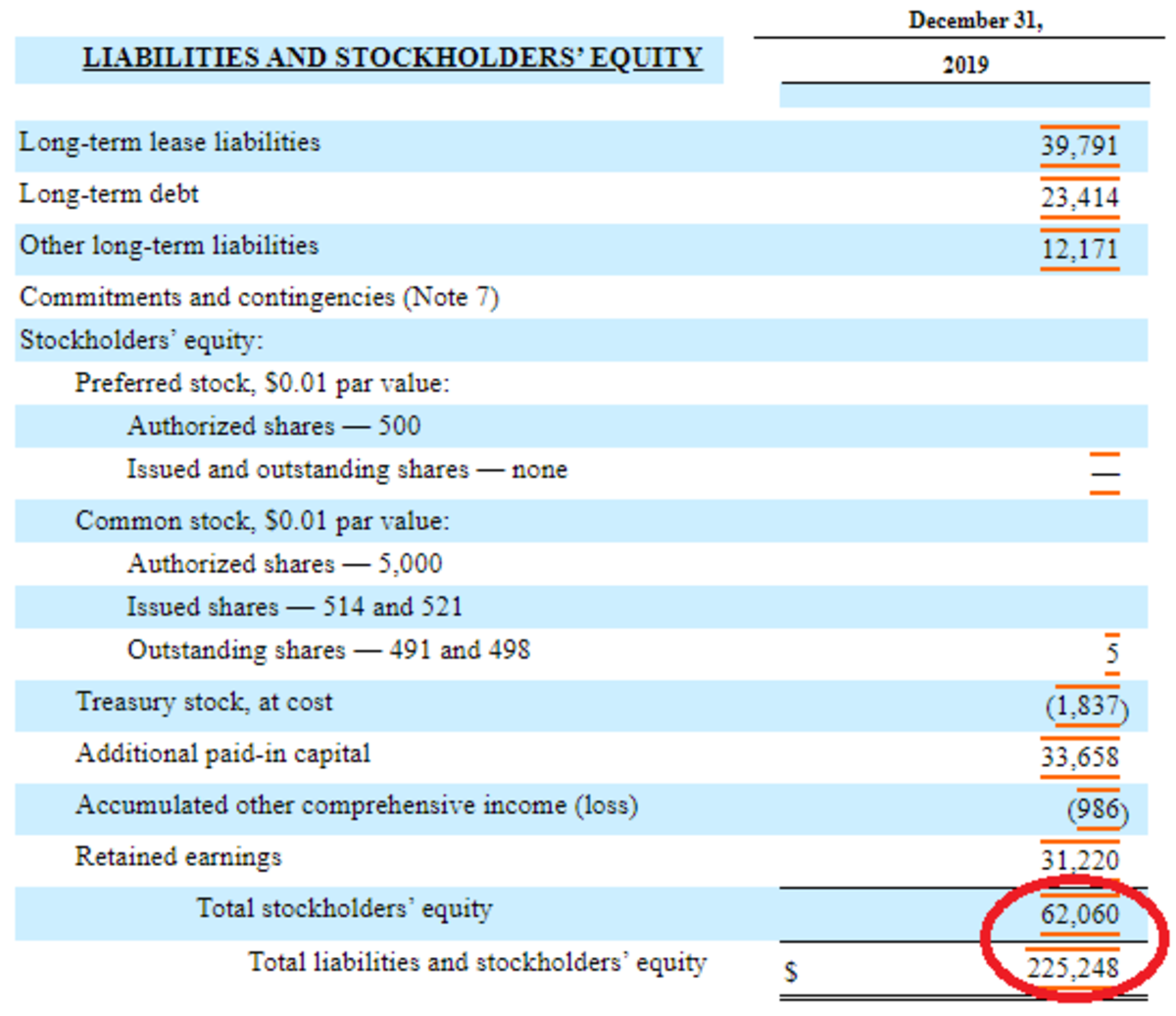

Debt ratio balance sheet. Both figures can be obtained from the balance sheet. Or you could enter the values for total liabilities. The following figures have been obtained from the balance sheet of xyl company.

Debt to capital ratio = total debt ÷ total capitalization. You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios. Policymakers said slower qt could ease shift to ample.

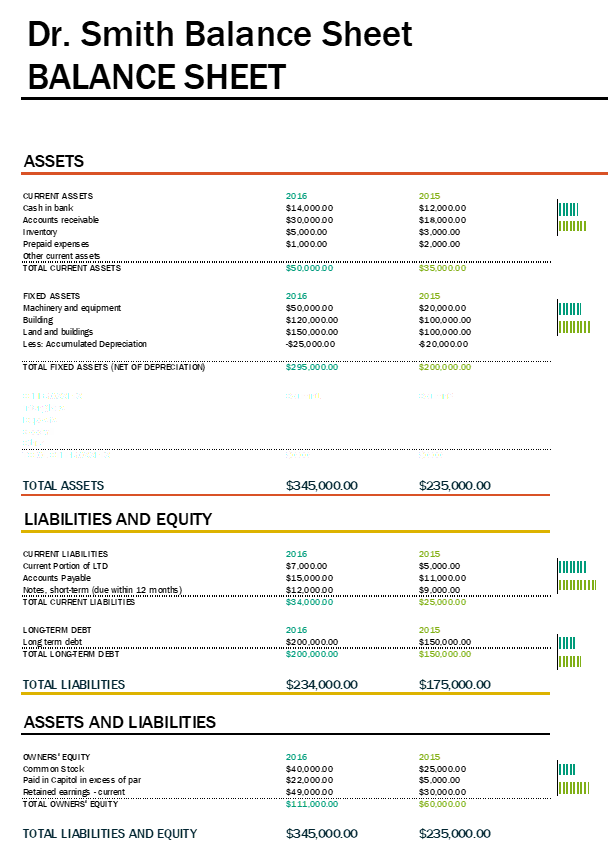

When analyzing a company's balance sheet, one of the key metrics to consider is the debt ratio.this ratio provides valuable insights into a company's financial health and its ability to manage its debt obligations. Raising capital via equity offerings allows the firm to increase net assets and thereby potentially avoid balance sheet covenant violations. Assets = liabilities + equity.

Types of balance sheet ratios; Dg debt ratio has improved over the four years from 27.03% to 23.52%. The “total capitalization” input is the sum of the company.

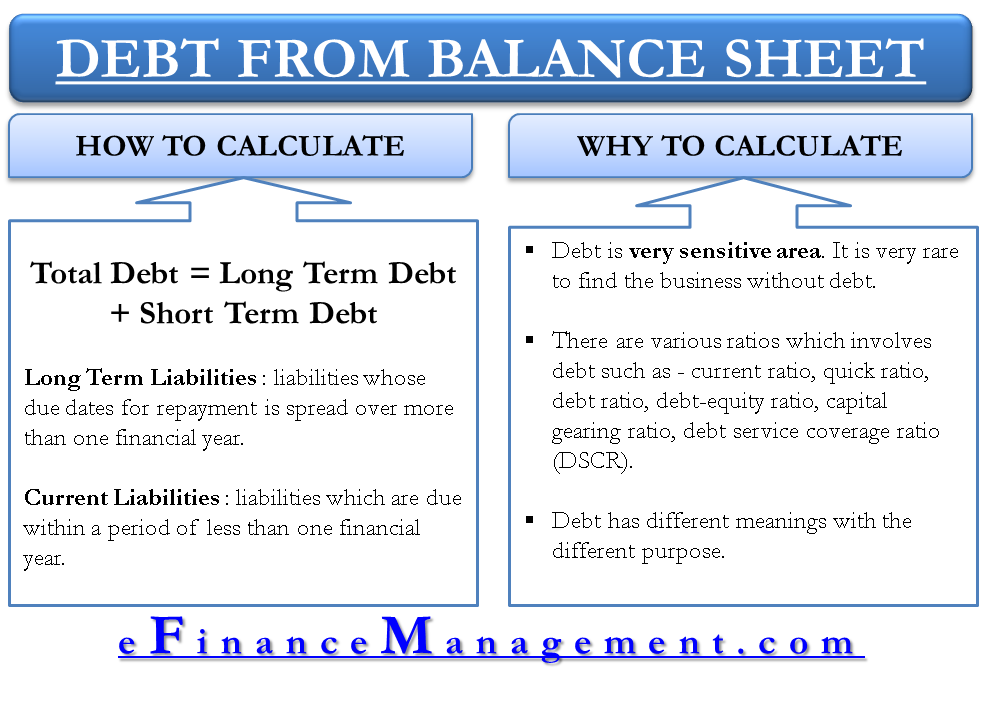

This ratio shows how much is owed compared to the company’s net worth. Fed minutes suggest officials are seeking smallest balance sheet possible. Total debt = long term liabilities (or long term debt) + current liabilities.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Assets have declined by about $1.3 trillion since june 2022. A ratio of 1 would imply that creditors and investors are on equal footing in the company’s assets.

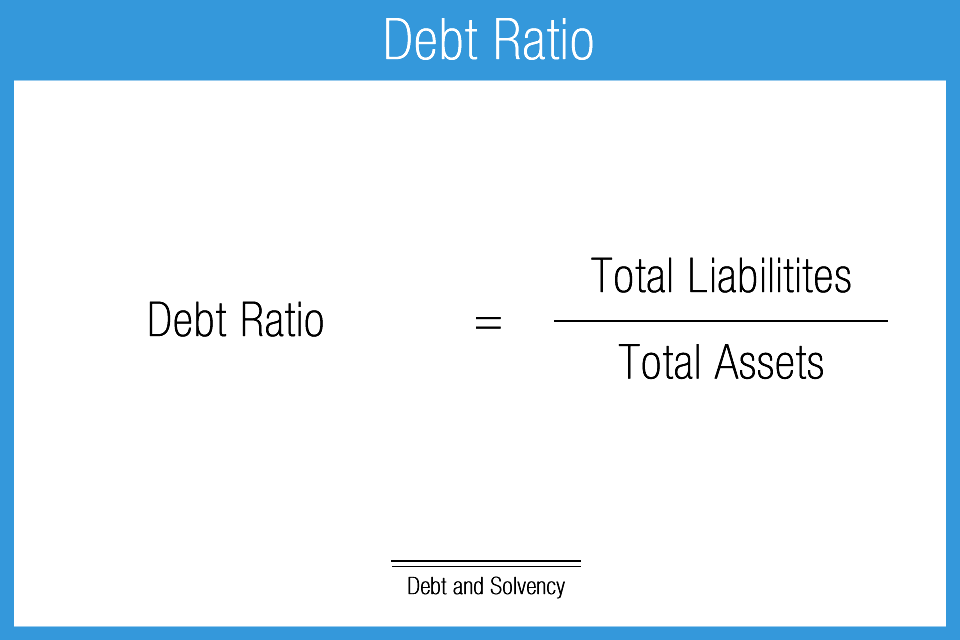

The fundamental accounting equation is assets = liabilities + equity. Debt ratio = total liabilities / total assets the debt to equity ratio calculates the weight of total debt and financial liabilities against shareholders’ equity: Debt to equity ratio (d/e) = total debt ÷ total shareholders equity.

For example, let’s say a company carries $200 million in total debt and $100 million in shareholders’ equity per its balance sheet. Debt to equity ratio is a balance sheet ratio because it is calculated by dividing total liabilities by total shareholders equity, both of which are balance sheet items. By understanding how to interpret a company's debt ratio, investors and.

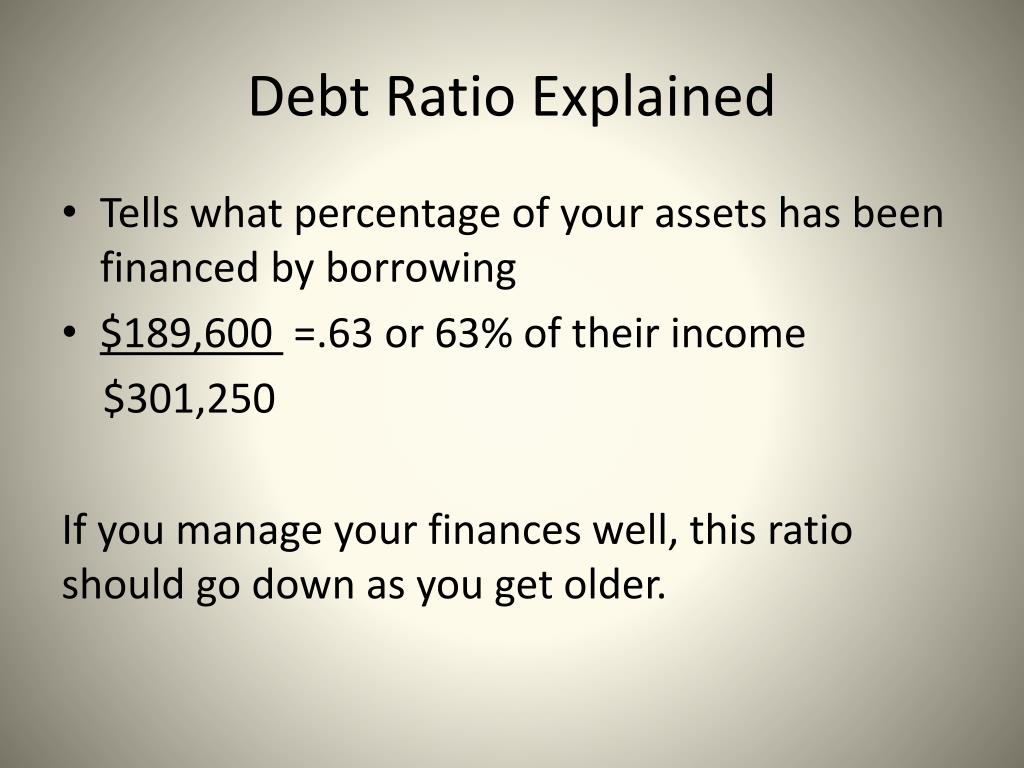

Debt ratio debt ratio formula. The debt ratio shown above is used in corporate finance and should not be confused with the debt to income ratio, sometimes shortened to debt ratio, used in consumer lending. Eramet, which has refused to inject more funds into sln, aims to reach a deal in the coming weeks with france to remove some 320 million euros ($345.82 million) of sln's debt from its own balance.

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. The simplest formula for calculating total debt is as follows: The balance sheet is based on the fundamental equation: