Nice Tips About Treasury Stock Statement Of Cash Flows Annual Income Tax

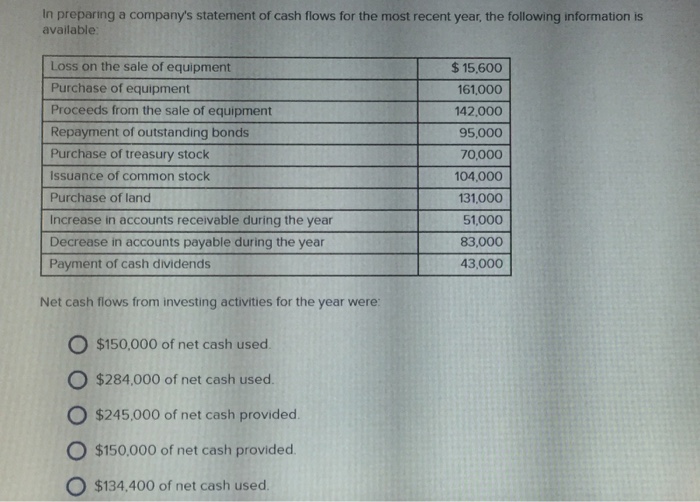

Statement of cash flows:

Treasury stock statement of cash flows. The first section of the statement of cash flows is described as cash flows from operating activities or shortened to operating activities. Cash flow from financing activities: How does treasury stock affect cash flow statement?

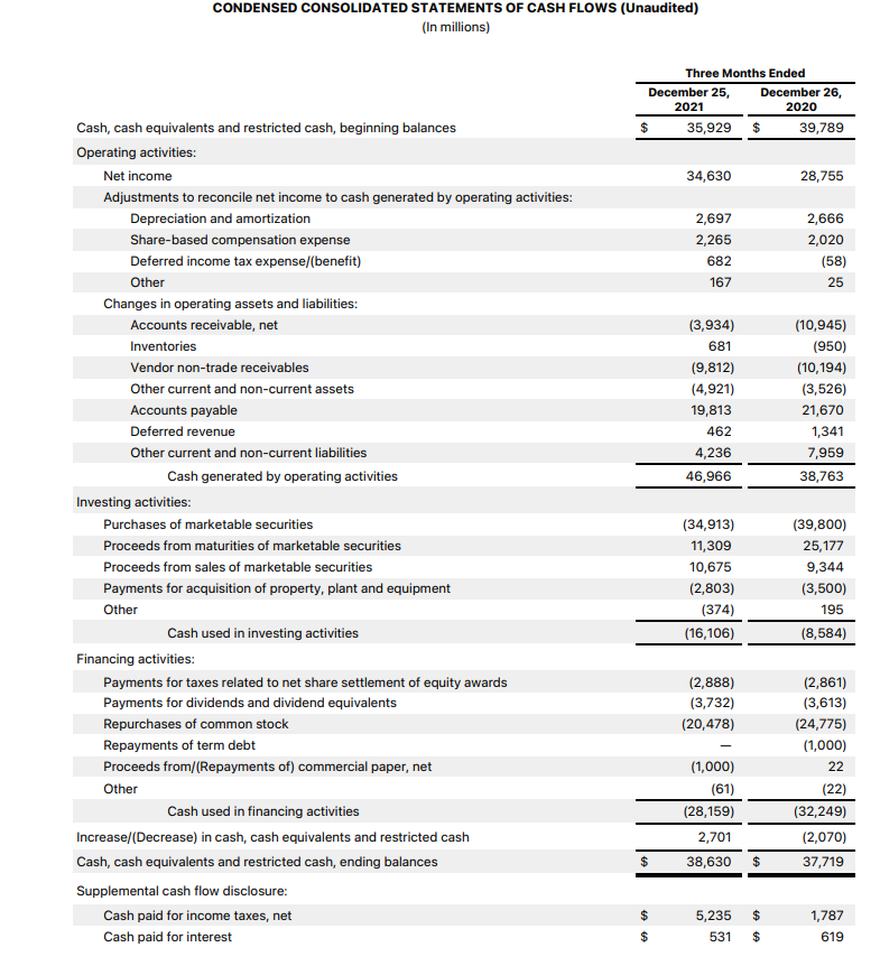

As mentioned above, treasury stock is a contra account of equity and involves the repurchase of the issued stock. The 2023 edition of this roadmap includes several new discussions that address the presentation of cash flows related to topics such as tax receivable. The statement of cash flows is a central component of an entity’s financial statements.

The monthly treasury statement (mts) is assembled from data in the central accounting system. If a company's business operations can generate positive cash flow, negative. Cash flow from financing (cff) activities is a category in a company’s cash flow statement that accounts for external.

The main purpose of the statement of cash flows is to report on the cash receipts and cash disbursements of an entity during an accounting period. The statement of cash flows is prepared by following these steps:

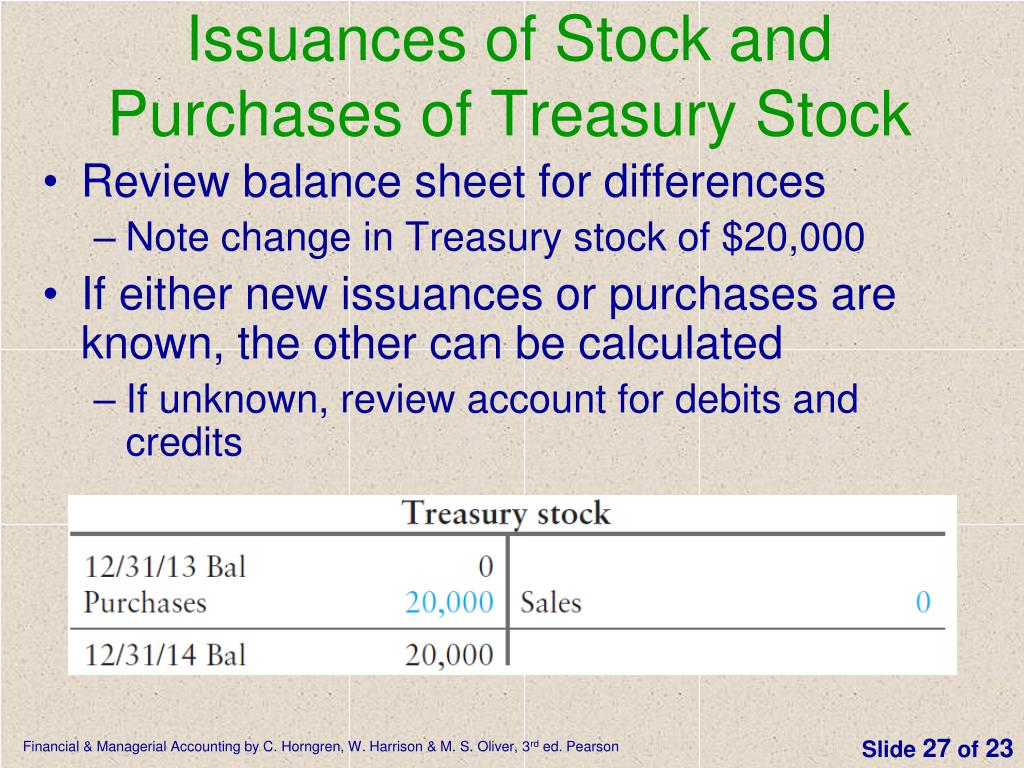

Effect of treasury stock on statement of cash flow: What is reported in the financing section of the cash flow statement? 9.3.2 accounting for reissuance of treasury stock.

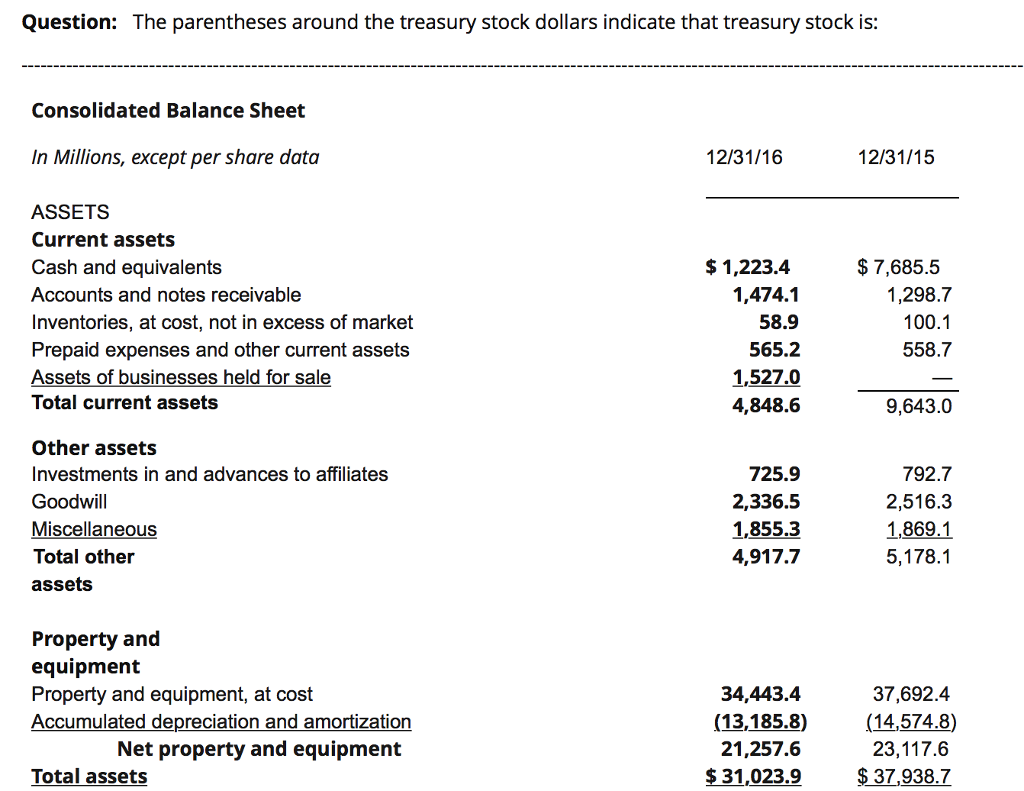

When a reporting entity reissues treasury stock at an amount greater (less) than it paid to repurchase the shares (based. Cash flows from financing activities: What is treasury stock, and where is it positioned on a balance sheet?

A consolidated subsidiary may hold an investment in its parent company's common stock. Pensions and other employee benefits. In order to repurchase stock, the company has to make payments to the existing shareholders.

The cash flow statement looks at the inflow and outflow of cash within a company. This would include issuing common. A statement of cash flows is a summary of cash inflows and cash outflows from various activities for a given accounting period.

After a repurchase, the journal entries are a debit to treasury. On the cash flow statement, the share repurchase is reflected as a cash outflow (“use” of cash). Cash flows from financing activities:

Operating activities are also referred to as. Flow of data into monthly treasury statement. It reports the cash receipts (cash inflows) and the cash disbursements (cash outflows) to explain the.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)