Heartwarming Info About Which Are Shown On A Balance Sheet Walmart Income Statement And 2018

The format of the date is:

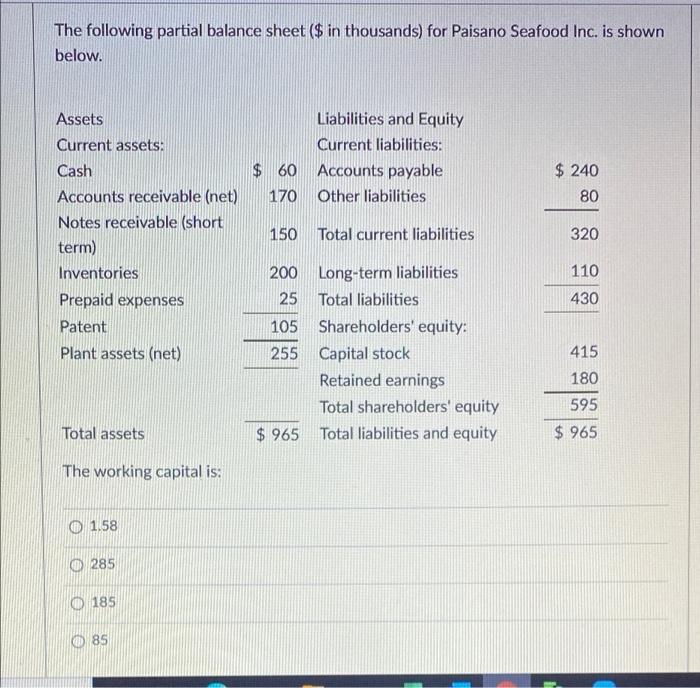

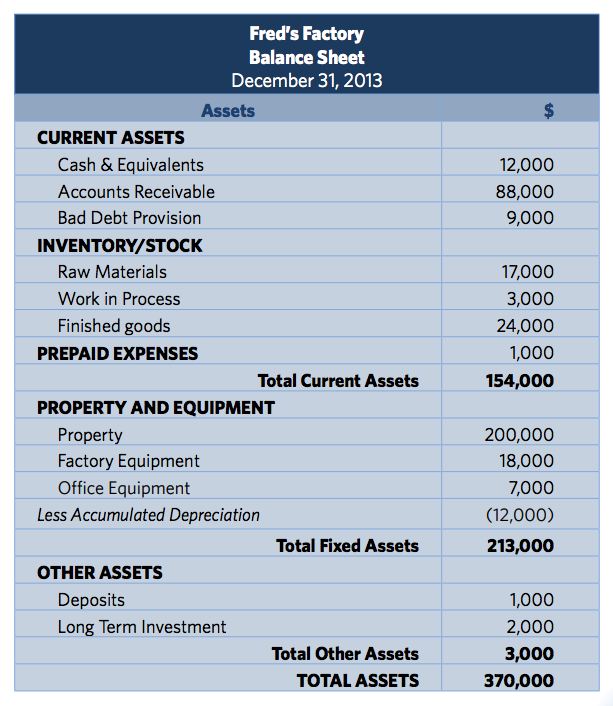

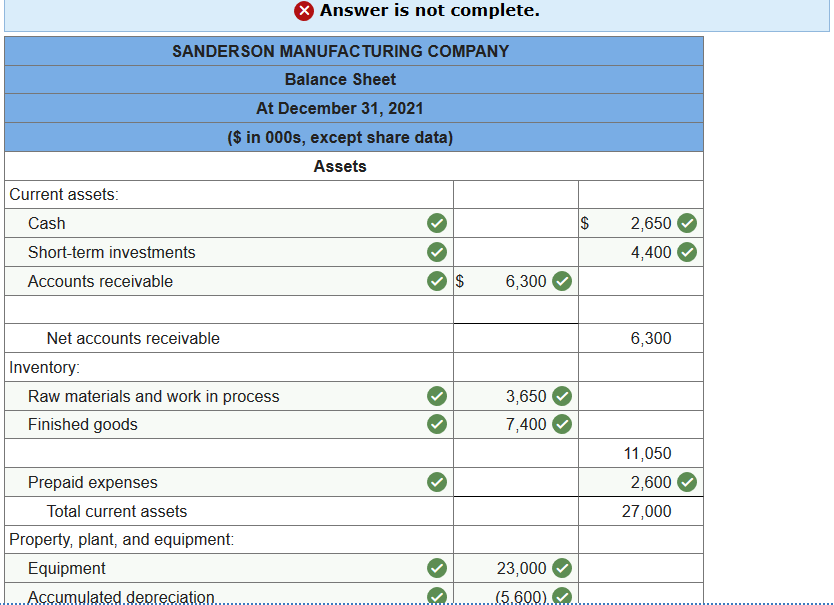

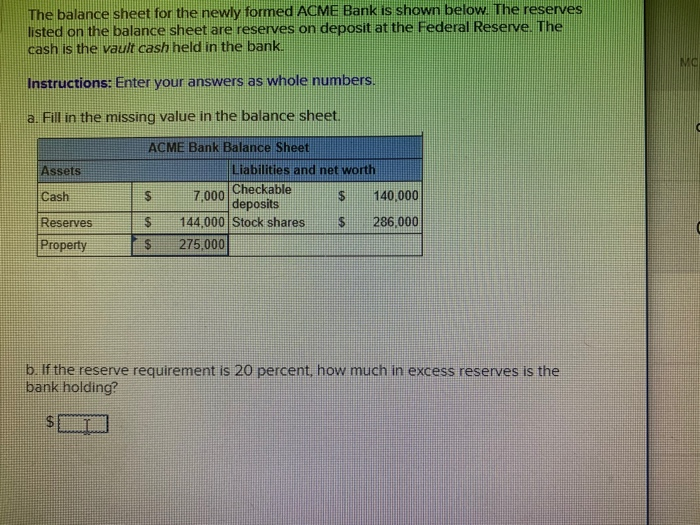

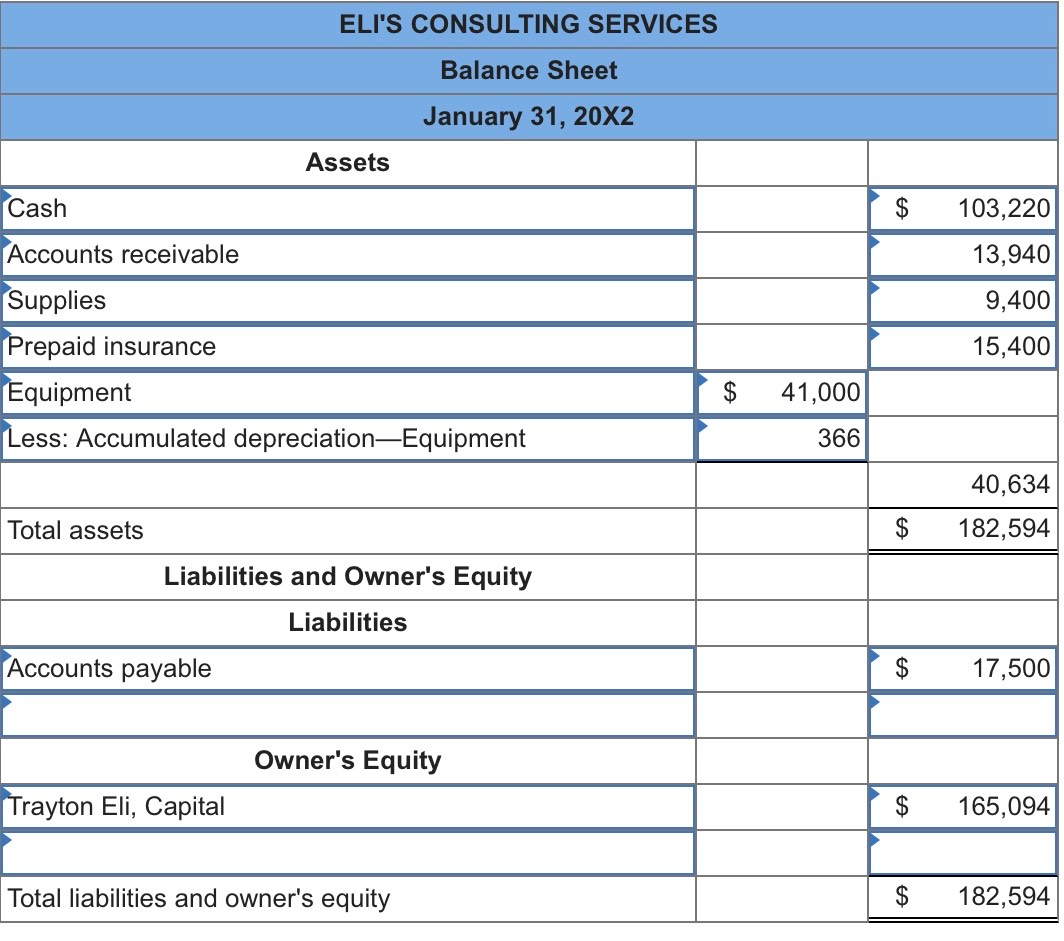

Which are shown on a balance sheet. The balance sheet is based on the fundamental equation: Current assets cash (and cash equivalents) cash includes cash in the bank, stock held and money owed to the business. The notes section contains detailed qualitative information and assumptions made during the preparation of the balance sheet.

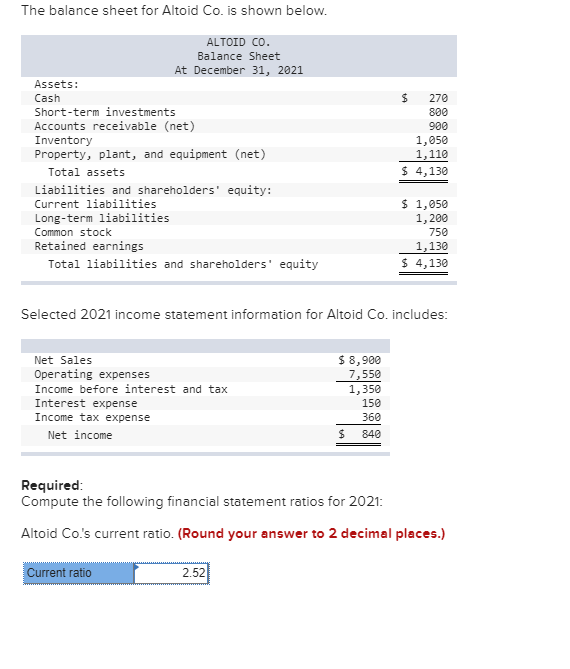

Accounts receivable (ar) accounts receivable should list any cash currently owed to the company. Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners ( owner’s equity ). Current assets are all forms of capital that the company plans to use within one year of the date shown on the balance sheet.

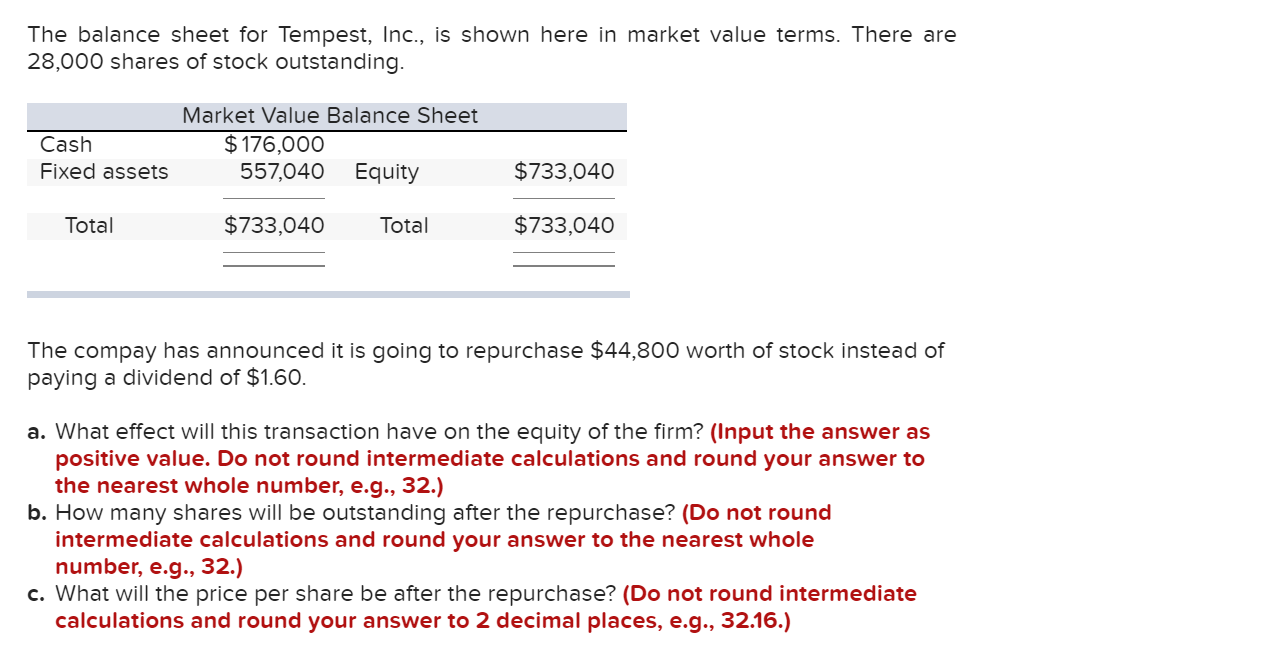

Assets must equal liabilities plus equity. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. It can also be referred to as a statement of net worth or a statement of financial position.

The balance sheet displays the company’s assets, liabilities, and shareholders’ equity at a point in time. Total assets should equal the sum of total liabilities and shareholders' equity. Figure 5.9 stockholders’ equity section of classified balance sheet.

Assets = liabilities + owners’ equity Let’s explore some of the current assets you might see on a. What is the amount of the company’s.

In a horizontal format, assets and liabilities are presented descriptively. A balance sheet only shows you a company’s financial status at one point in time. A company’s accountants generally prepare the balance sheet on the last day of an accounting year.

The balance sheet illustrates the state of these three kinds of accounts to provide a holistic view of your company’s finances at a given time. Current assets enable your business to handle expenses that occur on a. What types of assets does a balance sheet show?

The balance sheet is a statement that shows the financial position of the business. It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

It also means that the remaining 40% is financed through equity. Below, we show the balance sheet layout examples, but it shows the following information: Annual report for 2020 and locate the company’s balance sheet (the balance sheet begins on page 33).

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The balance sheet shows assets, liabilities, and shareholders' equity. This means 60% of the company’s asset generation and growth is financed through debt from creditors.