Beautiful Work Tips About Overdraft On Balance Sheet Fiat Financial Statements

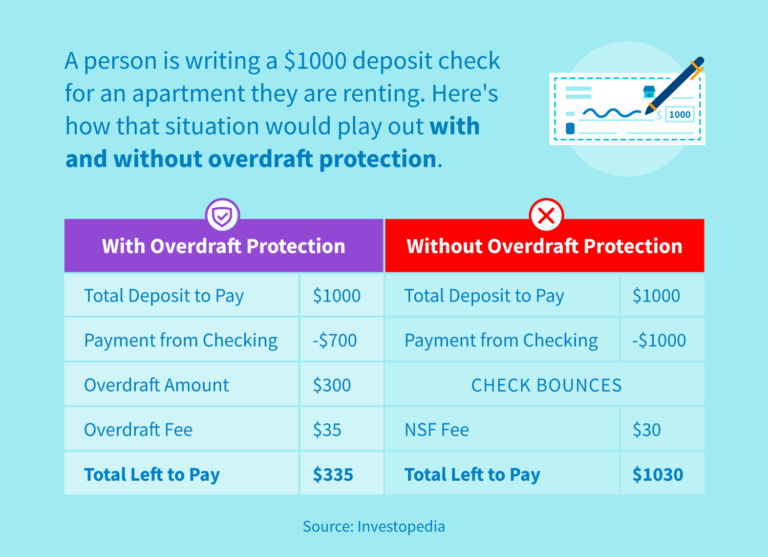

A book overdraft represents the amount of outstanding checks in excess of funds on deposit for a particular bank account, resulting in a credit cash balance reported on an entity’s balance sheet as of a reporting date.

Overdraft on balance sheet. Overdrafts and cash and cash equivalents. When overdrawn, the overdraft is. A) current assets cash at bank and in hand = £nil.

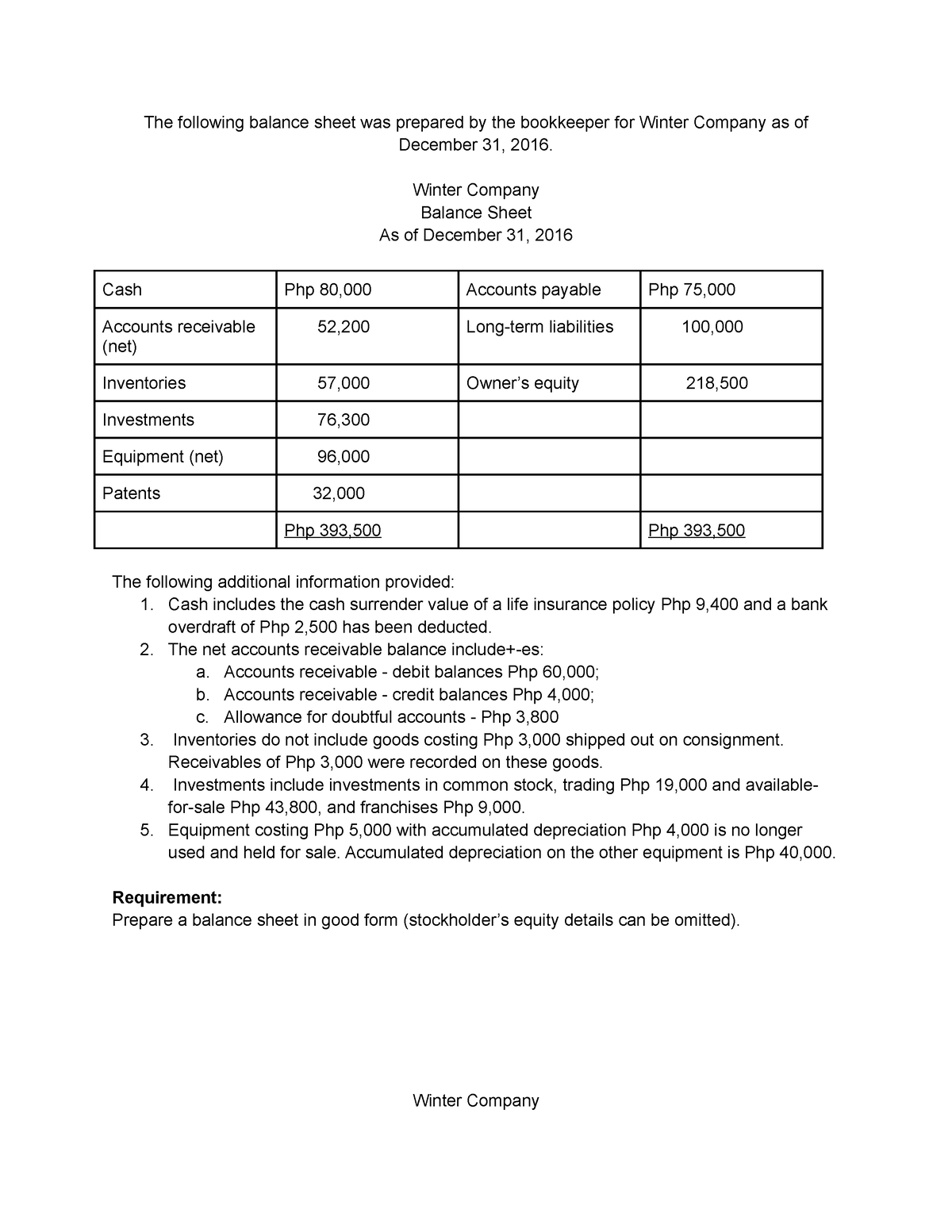

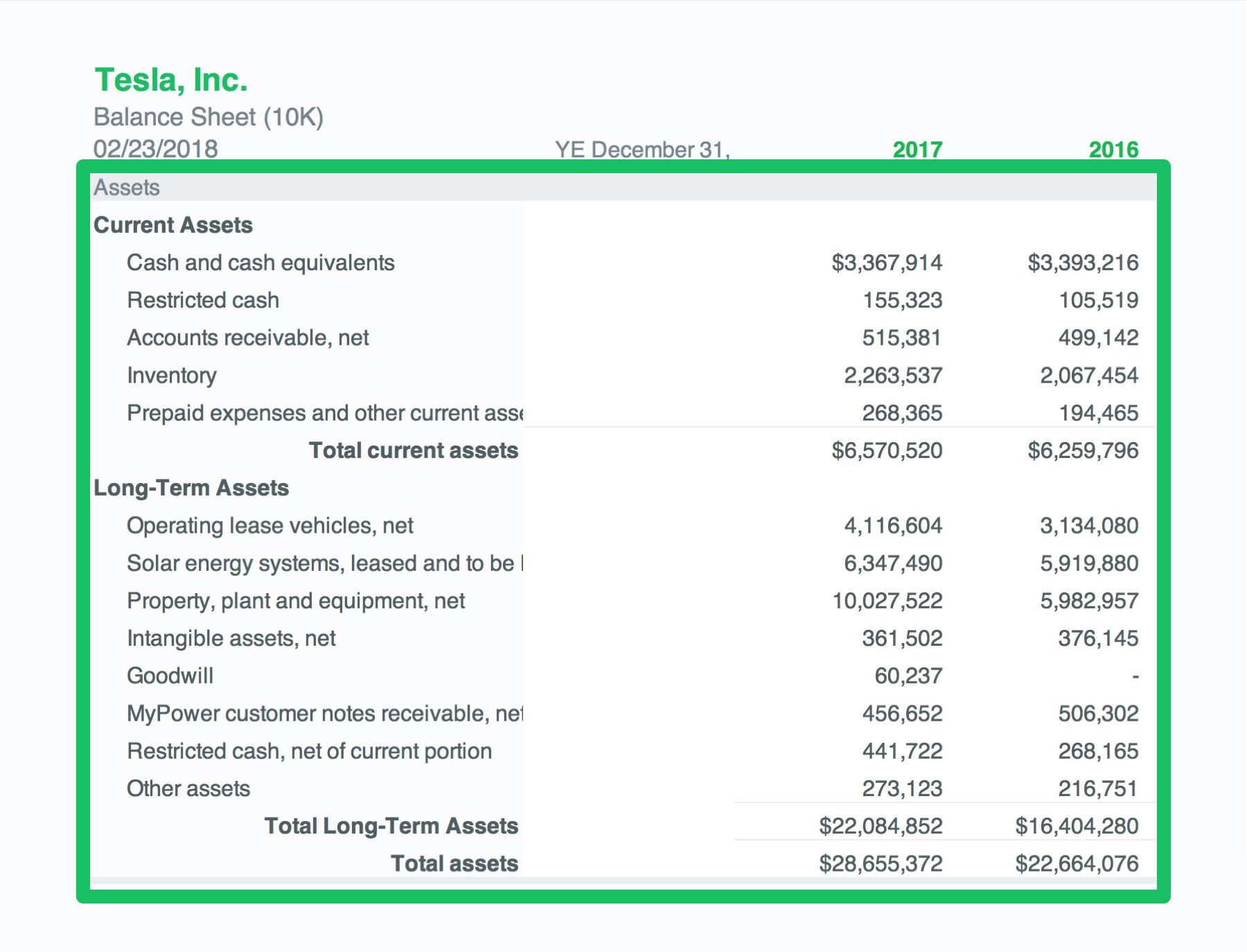

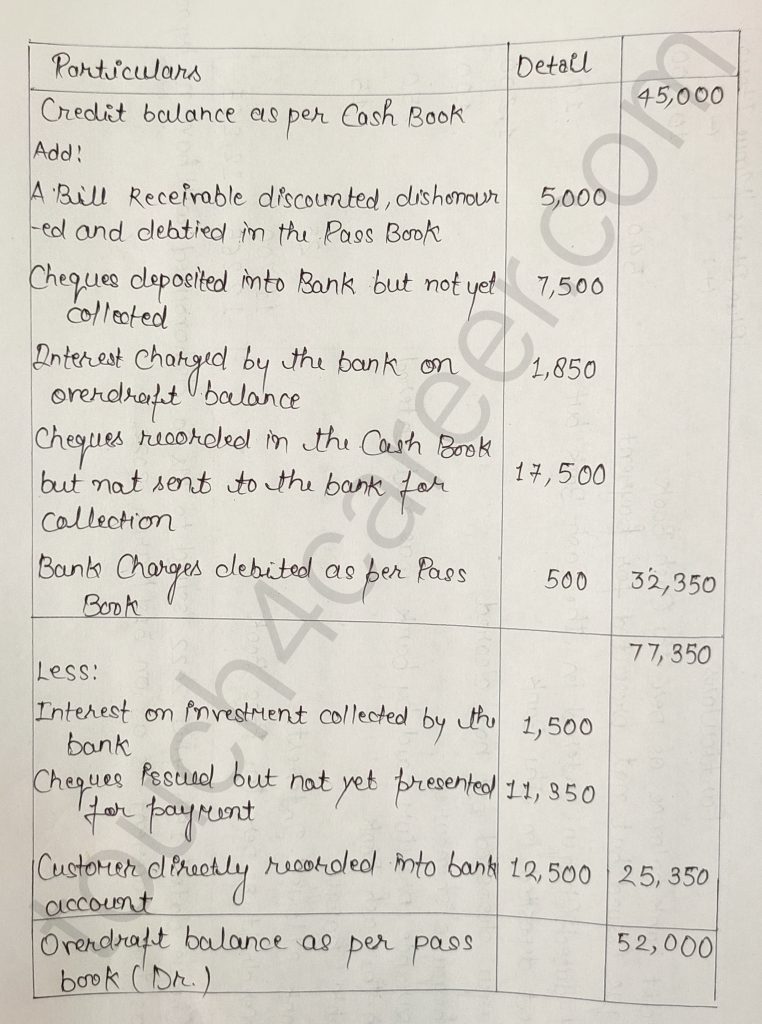

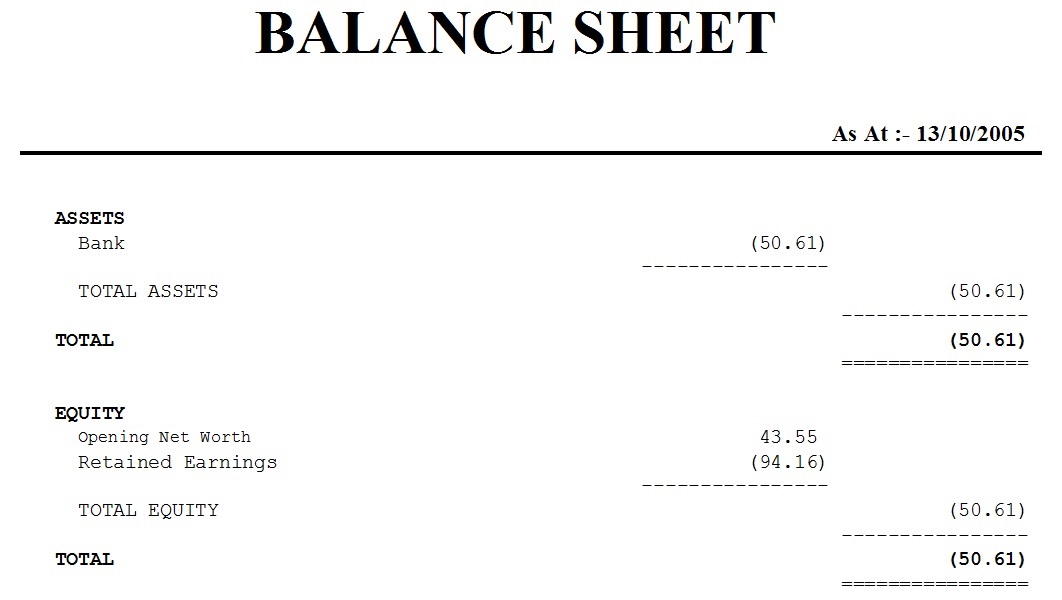

Recording bank overdrafts in a balance sheet in business accounting, an overdraft is considered a current liability which is generally expected to be payable within 12 months. Or you can also include the amount in accounts payable. Fundamental analysts use balance sheets to calculate financial ratios.

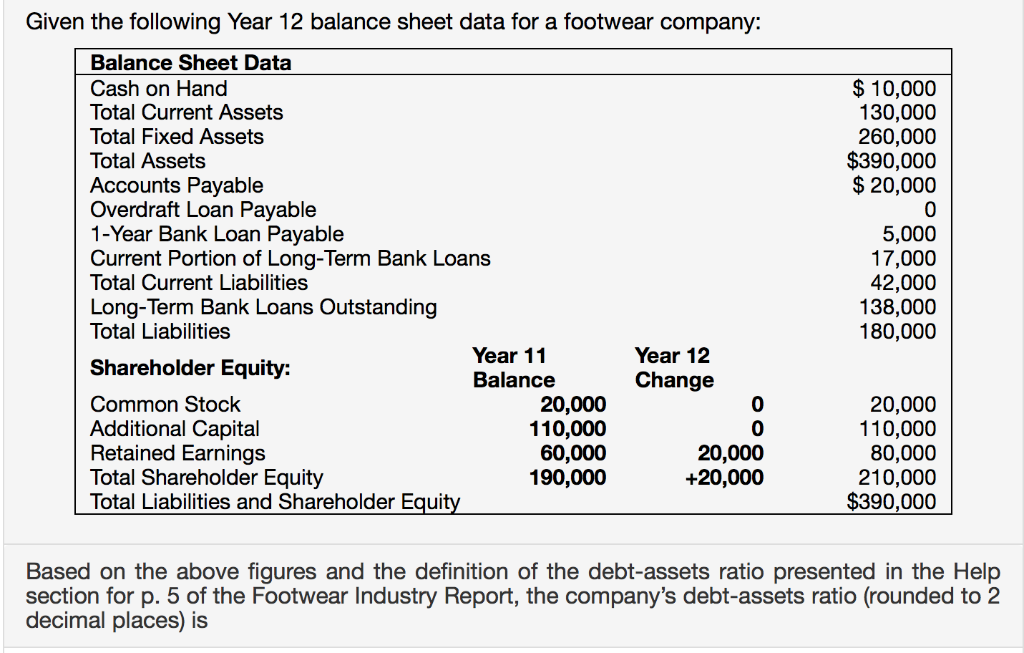

America’s three biggest consumer banks saw their overdraft fee revenues fall 25% in 2023. In that case, changes in the overdraft would be classified as financing activities in the statement of cash flows and the overdraft would be presented as debt on the balance sheet. I am a bit confused.

The overdraft allows the customer to continue. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. A cash overdraft is a bank account that contains a negative balance.

An overdraft (also known as a bank overdraft) generally means that the amount of a company's checks being presented at the bank for payment exceeded the amount on deposit. It usually happens when there are no more funds in the account in question, but an outstanding transaction is processed through the account, leading to the account holder incurring a debt. On its balance sheet, earth inc.

If the overdraft facility has a small negative balance, it can be pooled or netted against other account balances as well. Morgan chase, bank of america and wells fargo collected $2.2 billion in total in those fees last. When an individual or a business signs an agreement for an overdraft with the bank, there is no need to record any journal entry.

Overdraft facilities like this often go from being positive to overdrawn. Solution in its balance sheet, earth inc. How is this reflected in the balance sheet?

It will show a corresponding bank overdraft liability of $10 million. A bank account overdraft happens when an individual’s bank account balance goes down to below zero, resulting in a negative balance. At the agreement date there is no journal entry required at the date of signing the agreement of the overdraft with the bank.

Comment on balance sheet and statement of cash flows presentation of the overdraft. Company has a total overdraft facility of £10k and as at balance sheet date is £2k overdrawn. Find the best banks of 2024.

If you are netting the three bank accounts, consider. Shall report cash and cash equivalents of $68 million ($20 million in account a minus $2 million in account b plus $50 million in account c). Under ifrs bank overdrafts or revolvers may be deducted as negative cash.

![Solved [34 marks] Question 2 Statement of Cash Flows Set](https://media.cheggcdn.com/media/aa2/aa2fb3f8-596e-4c8e-8a90-7697dc8a1212/phpIToR6o.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)